Introduction: Navigating Europe’s Dynamic Tech Landscape

For US investors and international expats looking to expand their portfolios while gaining residency rights, Europe’s evolving technology hubs offer compelling opportunities. Once seen merely as a follower behind Silicon Valley, European cities like Lisbon and Athens have become beacons of innovation, driven by growing start-up ecosystems, venture capital influx, and supportive government policies. Accessing these sectors through golden visa programmes allows investors to marry financial growth with European residency or potentially citizenship.

What Are Golden Visas and How Do They Relate to Tech Investments?

Golden visas grant residency in exchange for investment, typically involving significant contributions to real estate, funds, or businesses. Recently, several European countries have shifted focus, channeling investments specifically into technological and innovation-driven enterprises. This trend supports regional tech development, job creation, and research.

- Investment Options: Encompassing real estate, venture capital, private equity, and direct tech business investments.

- Residency Advantages: Holders enjoy mobility within the EU zone including Schengen travel, with options to pursue permanent residency or citizenship, depending on local laws.

For US investors, these programmes offer not only a lifestyle upgrade but a strategic way to diversify globally and engage with booming tech markets.

Spotlight on Leading Technology Hubs: Lisbon and Athens

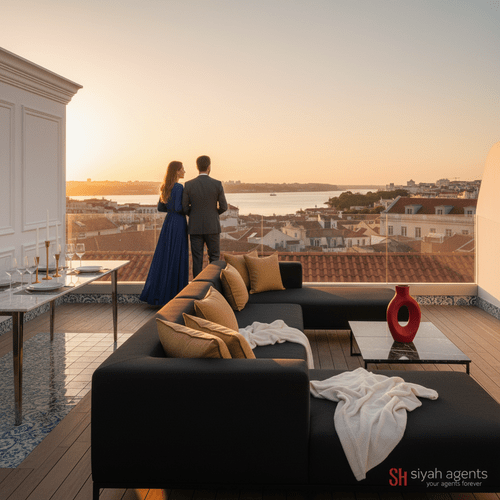

Lisbon: Western Europe’s Technology Beacon

Lisbon is no longer a hidden gem but a leading tech city known for robust government incentives, a multicultural talent pool, and marquee events like Web Summit. Investments here tap into a vibrant ecosystem where start-ups thrive and venture capital flows are increasing steadily (according to verified government and investment reports).

- High Start-up Density: One of Europe’s highest ratios of founders to population.

- Growing Venture Capital: Consistent year-on-year funding growth from 2021 to 2023.

- Global Investor Interest: Numerous US and international investors access golden visa-linked funds focused on scaling tech ventures here.

Athens: The Innovation Gateway of Southern Europe

Athens has transformed from a traditional commerce hub into a digital innovation centre. The Greek government actively promotes tech through innovation programmes and start-up incubators, attracting golden visa investments directed to technology sectors.

- State Support: Incentives targeting research, development, and digital infrastructure.

- Departure Towards Growth: A steadily growing start-up economy with increasing local tech employment (verified investment data).

Insight: Beyond Lisbon and Athens, other emerging European tech hubs include Barcelona, Tallinn, and Warsaw. Nevertheless, Portugal and Greece stand out for aligning golden visa schemes with burgeoning tech industries.

Why Invest in Technology through Golden Visas?

Clear Benefits for Investors

- Diversification: Reduces reliance on domestic markets by tapping robust European tech ecosystems.

- EU Market Access: Provides strategic positioning towards a consumer base nearing 450 million.

- Quality Infrastructure & Talent: Extensive access to multilingual, well-educated workforces with competitive costs.

- Direct Capital Deployment: Increasing channeling of golden visa funds into early and growth-stage tech firms enhances return potential (per Siyah Agents’ expertise).

Market Highlights

- Portugal: Issued over 10,000 golden visas since inception, infusing upwards of €6 billion, with a growing share targeted at tech-driven investment funds (government data).

- Greece: Multi-billion euro investments via golden visas with dedicated efforts towards innovation sector funding.

Insight: Expected yields from tech-focused golden visa funds in Portugal and Greece range between 3–7% annually. Risks persist, and results will depend on investment selection (verified reports). No investment guarantees.

Assessing Risks and Market Volatility

Technology investments, especially early-stage, carry risks:

- Project Viability: Some ventures may not achieve profitability. Rigorous due diligence is essential.

- Regulatory Changes: Golden visa requirements and policies may be revised, impacting residency paths.

- Liquidity Considerations: Longer horizons may be needed before exit and return realisation.

- Citizenship Not Guaranteed: Permanent residency is common, but naturalisation depends on evolving legal conditions.

Reminder: Local political and geopolitical factors should be accounted for when considering such investments. Although offering diversification and mobility, outcomes vary by country.

In-Depth Look: Portugal and Greece’s Golden Visa Programmes for Tech Investments

Portugal Golden Visa: A Pioneer in Tech Fund Investments

Portugal’s golden visa stands out for technology-focused investors. US investors can participate via regulated investment funds targeting innovation with minimum investments often around €500,000 (Portugal Golden Visa).

- Fund Participation: Capital is directed into European scale-ups and emerging tech ventures.

- Residency Perks: Residency in a modern, well-connected EU country with strong intellectual property protection.

Greece Golden Visa: Fast and Innovation-Focused

Greece offers swift residency, usually within months, and a lower entry point—€250,000—with evolving legislative support channeling investments into technology businesses (Greece Golden Visa).

- Speed and Ease: Investor-friendly processes enhance accessibility.

- Growing Innovation Ecosystem: Athens’ incubators and accelerators drive digital growth and new business launches.

Comparing the Two

Both schemes grant EU mobility and potential paths to permanent residency, with Portugal further advanced in tech fund deployment and Greece offering lower investment thresholds and rapid approval. Legal frameworks evolve, so current guidance should be reviewed before investment.

Strategic Takeaways for Investors

For those seeking to combine capital growth with residency options, European tech hubs offer substantial opportunities:

- Diversify geographically and across sectors to reduce risk.

- Focus on regulated funds managed by experienced teams.

- Keep abreast of government policy changes and incentives.

- Engage professional advice to evaluate economic impact and returns.

Conclusion: Seize the Moment in Europe’s Tech Renaissance

Europe’s technology sector is flourishing, and golden visa programmes provide a gateway for US investors and expats to join this growth story. Investing in hubs like Lisbon and Athens offers not just capital appreciation but enhanced global mobility and stable residency options. To explore your tailored investment and residency pathways, consider the expert guidance available through Siyah Agents programmes. Book your free assessment today to begin crafting your European investment journey.

For those focused on tax efficiency, the Non-Habitual Resident scheme offers distinct advantages, but understanding entry routes is crucial. The Portugal Golden Visa remains a leading option for assured capital entry, while the Greece Golden Visa provides a fast track to innovation-focused residency.

Now is the time to unlock Europe’s technology hubs, combining your capital ambitions with new horizons for your family.