Introduction: The Crucial Role of Government Policy in CBI

Every investor deeply values certainty, especially when significant life decisions hinge on policies set afar. For Nigerian investors and global citizens interested in Citizenship by Investment (CBI) programmes, understanding how government policy steers these schemes is essential. Government policy shapes eligibility rules, investment requirements, and the ultimate value of new citizenship. Those who comprehend these dynamics gain an edge in a rapidly shifting environment.

Navigating CBI begins with recognising that these programmes are governanced by deliberate policy choices aiming to meet national priorities. This article explores how such policies influence CBI design and function, illustrated through Turkey’s evolving citizenship and residency landscapes, and offers practical insight for Nigerian investors.

The Policy Foundation Underpinning Every CBI Programme

CBI programmes are not accidental; they are strategic instruments crafted by governments pursuing key national goals, such as attracting foreign capital, enhancing economic development, or reinforcing diplomatic ties. Policy levers shaping programmes include:

- Economic imperatives (e.g., supporting infrastructure or real estate sectors)

- National security safeguards (rigorous due diligence helps protect integrity)

- International relations considerations (adapting to EU and OECD oversight)

- Domestic political environment (balancing public opinion and political will)

Policy volatility is a fundamental risk in CBI. Changes owing to new administrations, regulatory amendments, or diplomatic pressures can transform market conditions swiftly.

How Government Policy Moulds CBI Programmes: Four Key Elements

1. Eligibility Criteria

Policy guides who qualifies, often raising standards in response to security concerns or international scrutiny. This includes background checks, minimum applicant age, and clean criminal records.

2. Investment Thresholds

Governments adjust minimum investment amounts to reflect economic needs or competitive pressures, directly shaping the profile and impact of investors. For instance, increasing real estate investment minimums modifies both the investor base and local market effects.

3. Acceptable Investment Types

Policies determine which investments qualify—ranging from real estate and government bonds to entrepreneurship or direct contributions—each reflecting precise economic goals like job creation or swift capital inflows.

4. Rights and Benefits Attached

The policy also decides accompanying benefits such as visa-free travel, work rights, and family reunification, which strongly influence a programme’s attractiveness. These rights may shift to align with international norms or domestic pressures.

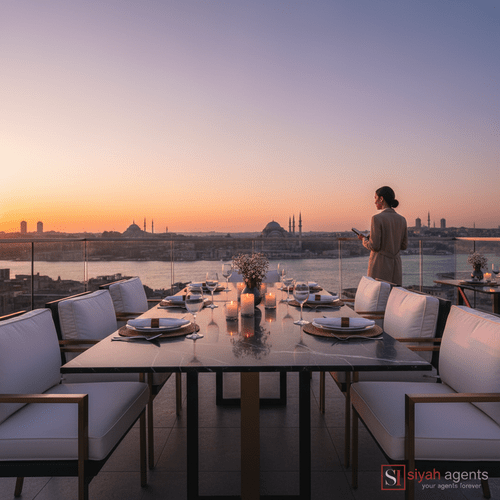

Turkey: A Case Study of Policy’s Impact on CBI

Turkey’s citizenship and residency programmes vividly demonstrate government policy’s influence.

Changes in Turkish Citizenship Policy

In 2017, Turkey reduced its real estate investment requirement for citizenship from $1 million to $250,000 to stimulate property markets and attract investment. This policy move boosted interest notably among investors from Nigeria and the Middle East. This link between government objectives and investor behaviour is striking. Later, by mid-2022, the threshold was raised to $400,000 to manage demand and broaden oversight. Learn more about Turkey citizenship.

Turkish Residency Policy Adaptations

Likewise, Turkey’s investment residency schemes have evolved with shifting economic cycles and political priorities. Changes in eligibility, processing time, and investment options require investors to stay informed. Those seeking a strategic gateway to Europe and Asia’s junction should understand these nuances. Details are available on Turkey residency.

Note: Policy changes can reshape opportunities rapidly—success demands current insights.

Policy-Driven Shifts: Investment and Eligibility Trends

Governments worldwide frequently adjust CBI parameters. Key trends include:

- Rising minimum investment requirements to manage demand or enhance programme quality.

- Altering eligibility lists as geopolitical alliances shift.

- Strengthening background checks to meet international standards, affecting approval times.

These are practical realities requiring vigilance and expert advice.

Navigating Risks: Uncertainty and Investor Protection

CBI is inherently uncertain, impacted by political shifts and regulatory changes. Risks involve:

- Sudden programme suspensions or cancellations.

- Increased investment thresholds partway through applications.

- Retroactive rules affecting prior approvals.

- Political changes altering visa-free benefits.

Precise risk probabilities vary across countries and timeframes; no guarantees exist.

Insight: Every CBI investment carries risk. Past success does not ensure future benefit stability. Professional risk management and guidance are critical.

Preparing for the Future: An Evolving Policy Landscape

Global politics, alliances, and scrutiny from entities like the EU and OECD keep CBI policy fluid. Discussions increasingly factor in programme sustainability, economic, social, and reputational impacts, signalling complex reforms ahead.

Strategic Advice for Nigerian Investors

Given CBI’s complexities, Nigerian investors should:

- Stay informed through specialised sources tracking policy shifts.

- Assess diverse CBI options beyond Turkey for balanced risk exposure.

- Select providers offering robust aftercare post-approval.

- Budget for flexibility to adapt to evolving rules.

CBI holds transformative potential, but successful navigation requires treating policy as a dynamic factor, not a fixed given. Quick judgement and expert support are invaluable.

If this feels challenging, you can rely on Siyah Agents programmes crafted to bring clarity and strategy, guiding you through each step.

Summary: Core Takeaways for Confident CBI Choices

- Government policy shapes all CBI aspects—from applicants’ eligibility to investment criteria and benefits, as illustrated by Turkey citizenship policy impact and Turkey residency investment policy.

- Policy shifts are frequent and unpredictable; constant vigilance is essential.

- CBI offers opportunity but no guarantees; risk-aware strategies and expert advice ensure better outcomes.

- Nigerian investors gain advantage by collaborating with experts monitoring daily global policy changes.

Your Next Step: Explore with Confidence

When securing global access through CBI, do not leave your journey to chance. The policy terrain constantly evolves, but partnering with leading experts helps you stay ahead. Discover tailored Siyah Agents programmes and take 15 minutes for a free assessment to chart your optimal path—supported by decades of CBI advisory experience. With Siyah Agents, remain a step ahead as policy moves.