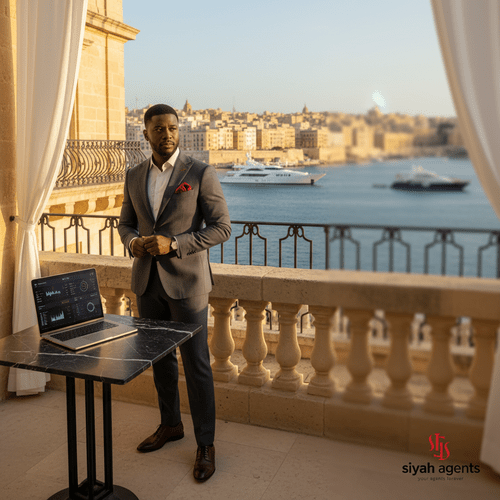

Introduction: Malta’s Rising Appeal for High-Net-Worth African Investors

For many high-net-worth (HNW) Africans, Malta is no longer just a picturesque island but a strategic gateway to Europe. If you have built significant wealth in Africa and seek a stable, tax-efficient base with excellent connectivity to European markets, Malta emerges as a pragmatic choice. It offers a robust financial system, political stability, and tailored relocation opportunities that combine lifestyle advantages with serious business credentials.

This case study follows Mr. K, a Lagos-based tech entrepreneur with a net worth exceeding $45 million, who selected Malta to diversify his operations and safeguard his family’s future. We explore how Malta’s unique combination of economic strengths and regulatory frameworks met his strategic objectives.

Investor Profile and Strategic Goals

Mr. K’s business success spans multiple West African countries. Realising the importance of international diversification, he sought:

- A stable operational hub within the European Union

- Personal and corporate tax optimisation compliant with EU laws

- Enhanced mobility and education prospects for his family

- Protection against African market fluctuations and currency risks

Malta’s balanced offerings aligned perfectly with these aims, extending beyond simple incentives to a grounded business environment.

Malta’s Economic and Business Environment

The Maltese economy boasts robust growth, outperforming several larger EU countries, thanks to thriving sectors such as fintech, iGaming, and financial services.

Key advantages include:

- Sustained GDP growth: Averaging over 4% recently, reflecting strong economic dynamism.

- Competitive tax framework: Effective corporate tax rates can range from 5% to 10% after Malta’s unique refund mechanisms, providing international companies with fiscal efficiency.

- Strategic position: Serving as a bridge between Africa and Europe, Malta simplifies cross-continental business.

Malta’s well-educated English-speaking workforce and EU passport rights add legal certainty crucial for non-EU investors.

Insight: Malta’s tax refund system can reduce the effective corporate tax rate significantly, although specific results depend on compliance and structure.

Structuring the Investment: Legal and Operational Steps

Mr. K undertook detailed due diligence with expert advisors focusing on regulatory compliance and structuring benefits. His approach included:

- Setting up a Malta-registered holding company to centralise revenues and utilise double taxation treaties covering over 70 countries.

- Securing residency through the Malta Permanent Residence Programme (MPRP), involving designated property investment and government contributions totalling approximately €370,000–€420,000.

- Engaging local fiduciary and compliance professionals to meet anti-money laundering (AML), substance requirements, and VAT regulations.

Anticipating banking onboarding challenges and adapting to evolving EU rules were integral parts of this strategy.

Important: Strong compliance frameworks are essential due to Malta’s rigorous AML and economic substance laws.

Residency and Citizenship Pathways

Malta offers transparent residency programmes prioritising compliance. The MPRP provides rights to live, work, and study in Malta with visa-free Schengen travel but does not guarantee citizenship or an EU passport by default.

Citizenship-by-investment schemes have faced stricter EU scrutiny and regulatory changes, making outcomes less predictable.

Mr. K valued the MPRP for enabling his family’s educational mobility and served as a contingency plan against African geopolitical uncertainties.

Process essentials included strict background checks, tax compliance, and ongoing advisory engagement regarding citizenship options.

Insight: Malta’s residency programmes grant EU resident benefits, though citizenship routes are increasingly restricted.

Potential Risks and Mitigation

No relocation is without challenges. Investors should consider:

- Regulatory shifts: EU policies on residency and taxation can change rapidly, demanding flexible planning.

- Banking onboarding delays: Malta’s tightened AML standards complicate bank account openings, mitigated but not eliminated by expert support.

- Public scrutiny: Wealth migration attracts attention; transparency is vital.

- No guaranteed returns: Real estate and corporate sectors have shown strength but investors should maintain realistic expectations.

Mitigation requires multi-jurisdictional advisors, layered corporate structures, and conservative financial modelling, as demonstrated by Mr. K.

Comparative Analysis: Portugal and UAE Golden Visa Programmes

African investors often compare Malta’s offerings with:

-

Portugal Golden Visa: Focused on property investment and eventual citizenship, it appeals to those prioritising long-term EU residency and passport access, though recent policy updates affect investment thresholds.

-

UAE Golden Visa: Provides long-term residence in a zero-income tax environment with rapid business setups but lacks EU market access.

Each programme suits different goals: Portugal for EU citizenship, Malta for tax-efficient EU operations, and UAE for Middle Eastern regional business agility.

Results and Reflections from Mr. K’s Journey

Eighteen months post-relocation:

- His Malta holding company facilitated seamless EU transactions and partnerships.

- Family access to EU healthcare and education proved invaluable amid African political uncertainties.

- Corporate tax efficiency improved, though ongoing compliance was required.

- Operational challenges like KYC bottlenecks remained but were manageable with local alliances.

Mr. K stresses that relocation is a strategic investment in resilience rather than a guaranteed shortcut.

Conclusion and Next Steps

For HNW African investors, Malta offers a compelling option combining EU access, regulatory stability, and fiscal benefits. Success depends on rigorous preparation and expert guidance.

Explore specialist support, tailored solutions, and ongoing relocation assistance through Siyah Agents programmes. Begin your journey confidently with a free assessment to identify your optimal route. Your global future deserves a foundation built with insight and expertise.