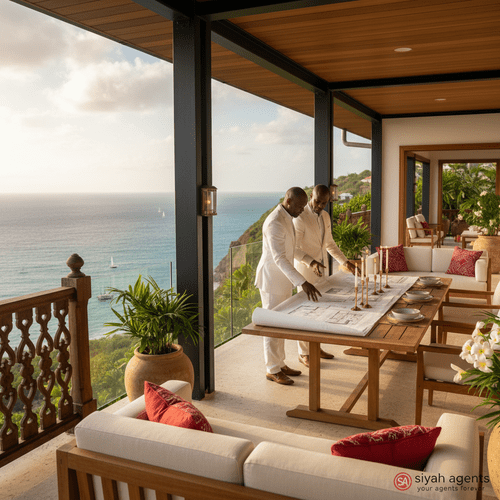

Introduction: Rethinking Caribbean Real Estate Investment

Caribbean real estate investment often conjures images of luxury beachfront condos in St. Barts or sprawling mega-resorts in Barbados and the Bahamas. While these iconic hotspots attract many, an increasing number of Nigerian investors and global citizens are steering their focus towards lesser-known markets that promise untapped growth, diversity, and lifestyle appeal.

Emerging Caribbean markets like Dominica, Grenada, St. Lucia, and Belize are revealing new avenues beyond mass tourism, supported by government incentives and infrastructure upgrades. This article explores these promising destinations and compares them with European residency investment options, providing strategic guidance for sophisticated investors.

Emerging Caribbean Markets: Hidden Gems

The Caribbean’s underexplored territories are gaining momentum through targeted development and foreign investment. Dominica, Grenada, St. Lucia, and Belize exemplify islands fostering sustainable urban projects, eco-resorts, and mixed-use developments that cater to modern investors and residents.

Dominica’s Sustainable Revolution

Known as the ‘Nature Island,’ Dominica actively promotes climate-resilient real estate projects linked with its Citizenship by Investment (CBI) programme. Sustainable eco-villas and community infrastructure receive significant investment, appealing to remote workers and families seeking a green lifestyle.

Grenada and St. Lucia: Flexible Ownership and Secure Legal Frameworks

Grenada and St. Lucia offer fractional ownership opportunities and property-linked citizenship routes, attracting investors interested in residency or asset diversification. St. Lucia is especially notable for its transparent title system and strong legal protections, easing concerns for international buyers.

Belize: Investor-Friendly and English-Speaking

Belize stands out due to its English language, British Common Law-based legal system, and affordability compared to other Caribbean markets. Areas such as Placencia and Hopkins provide quieter, well-serviced communities ideal for investors from Nigeria and the Commonwealth.

Insight:

Emerging Caribbean markets combine government-backed incentives with attractive entry prices, offering growth prospects beyond traditional resorts.

Drivers of Growth: Infrastructure, Economy, and Government Support

Contributing to these markets’ attractiveness are strategic infrastructure projects, economic diversification efforts, and investor incentives.

Infrastructure Enhancements

Dominica, St. Lucia, and Grenada are investing heavily in roads, ports, medical facilities, and fibre optic connectivity to reduce dependency on tourism alone. For example, Dominica’s new international airport and climate-resilient housing projects signify broader development ambitions.

Economic Diversification and Foreign Investment

These nations aim to attract foreign direct investment in sectors like medical education (Grenada), agritech (Dominica), and fintech incubation (Barbados), diversifying their economic foundations.

Property-Linked Citizenship Incentives

Dominica and Grenada’s CBI programmes facilitate property investment with minimum thresholds between $200,000 and $350,000. St. Lucia also offers a property purchase route with thorough due diligence and legal safeguards; however, holding periods may apply.

Insight:

Infrastructure and citizenship programs drive value, but investors must navigate legal nuances and holding requirements carefully.

Lifestyle and Community Appeal

Investment returns are only part of the picture; quality of life is equally vital.

Peaceful Living with Connectivity

Emerging markets offer tranquil environments less saturated by tourists, with family-friendly communities and strong access to North America via direct flights. Belize’s English-speaking environment further eases integration.

Authentic Cultural Experiences

Islands such as Dominica and Grenada provide rich cultural festivals and cuisine, fostering genuine community engagement attractive to entrepreneurs and families.

Key Points:

- Authentic, peaceful neighbourhoods contrast with typical tourist resorts.

- Language compatibility and legal clarity, especially in Belize, reduce barriers for Nigerian and Commonwealth investors.

Recognising Risks

No real estate investment is risk-free.

- Secondary markets may be less liquid, complicating resale and price discovery.

- The Caribbean faces hurricane exposure; new developments claim enhanced resilience, but long-term data is limited.

- Ownership laws and resale restrictions vary across territories.

- Currency fluctuations may affect returns, typically denominated in US dollars or local currency.

Historical property appreciation in these emerging markets varies between 2–6% annually, depending on economic cycles and development quality.

Comparing with European Residency Investment Routes

Investors often compare Caribbean options with European programmes such as the Spain Golden Visa and the Portugal Golden Visa.

Spain’s Golden Visa offers EU mobility and urban property appreciation but at higher entry costs (typically €500,000) and complex tax regimes. Recent reforms have altered investor pathways, requiring close attention.

Portugal’s scheme allows diversified asset choices but has tightened qualifying zones, excluding many coastal and major city areas. Both programmes involve higher costs and regulatory complexity compared to the Caribbean’s generally faster, lower-cost citizenship-by-investment property routes, which do not grant EU mobility.

Strategic Advice for Nigerian and Global Investors

Success lies in three fundamentals:

- Clarify your goal: lifestyle, second citizenship, financial yield, or a blend.

- Choose markets with strong legal frameworks and clear exit options—Belize and St. Lucia excel here.

- Seek expert consultancy to navigate evolving policies and market conditions, such as Siyah Agents programmes, which provide up-to-date real estate advisory.

Summary

- Caribbean real estate is diversifying beyond traditional hotspots, driven by infrastructure growth and policy incentives.

- Returns vary by market and project; typical yields range from 2–6% annually.

- European residency investment routes demand higher capital and carry regulatory flux; Caribbean programmes offer speed and affordability without EU access.

- Rigorous market selection and regulatory diligence are essential for Nigerian high-net-worth investors.

Conclusion: Begin Your Caribbean Investment Journey

The evolving Caribbean real estate landscape offers unprecedented opportunities for the cautious, curious, and globally minded. Nigerian investors and international buyers can benefit from a broader set of markets with unique lifestyle, investment, and citizenship advantages.

Start your journey confidently with a free assessment from Siyah Agents, leveraging their expertise to identify your optimal investment strategy and navigate complexities with integrity.