Introduction: Choosing the Optimal Indian Ocean Residency for African HNWIs

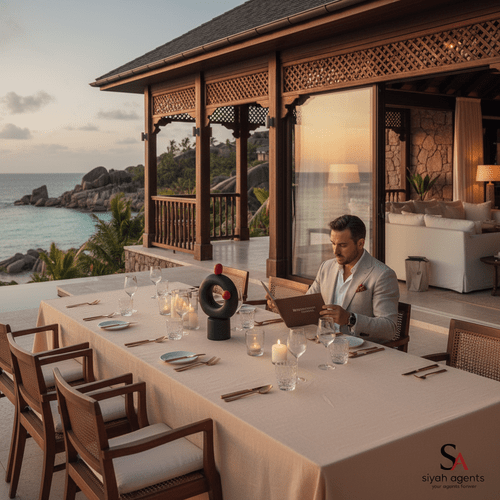

Imagine opening your eyes to turquoise waters, a sunrise over a secure, tax-efficient haven, and a passport offering enhanced global mobility. This vision captures why Indian Ocean residency appeals strongly to Africa’s high-net-worth individuals (HNWIs) seeking strategic second homes beyond mere leisure retreats. Amidst shifting geopolitical and economic currents across Africa, Mauritius and Seychelles stand out for their unique offerings in lifestyle, legal stability, and investment opportunities. But which residency truly aligns with your objectives? Let’s dissect each with clarity and candour.

Mauritius Residency: Stability Rooted in Transparency

Mauritius has long earned its place as a resilient financial centre that attracts African HNWIs desiring more than just a tropical address. Its residency programmes are investment-led, grounded in transparency, legal certainty, and a mature regulatory environment.

Key Mauritius Residency Routes

- Residency by Investment (Property Schemes): Investments must be made in government-approved real estate projects such as the Property Development Scheme (PDS), Integrated Resort Scheme (IRS), or Smart City Scheme.

- Occupation Permit: Available to investors, professionals, and retirees ready to live, work, or conduct business in Mauritius.

The typical minimum investment for property-based residency is approximately USD 375,000 in qualifying residential real estate. A renewable 10-year residency permit is granted to investors and their immediate family, contingent on maintaining this investment. There may be additional provisions for extended family under specific schemes.

Applicants may pursue permanent residency after fulfilling initial residency conditions, bolstering continuity and legacy security.

Insight: Mauritius’s structured residence-by-investment platform offers African investors robust legal safeguards and a clear path to securing residence in a politically stable environment.

Seychelles Residency: Selective, Exclusive, and Discreet

Known for pristine beaches and exclusivity, Seychelles offers residency on a more selective and less formulaic basis than Mauritius. Its residency avenues are discretionary, aimed at individuals bringing substantial economic or social contributions.

Seychelles Residency Pathways

Unlike Mauritius, Seychelles does not maintain a formal residence-by-investment programme. Options include:

- Permanent Residence Permit: Awarded at presidential discretion, often for those making significant investment or social impact.

- Business Investment: Participation in sizable local enterprises may lead to long-term residency rights.

Official investment thresholds are undisclosed, highlighting a case-by-case, relationship-driven approach typically accessible to high-calibre investors or entrepreneurs.

Insight: Seychelles favours applicants who contribute exceptional value to the nation, making this pathway exclusive and less predictable.

Investment & Eligibility: Open Access vs Premium Gatekeeping

Mauritius: Offers transparent, rule-based entry with defined minimums and processes:

- USD 375,000 minimum real estate investment.

- Occupation permits require financial proof or business activity.

- Eligibility extends broadly to spouses and dependent children.

Seychelles: Lacks codified financial thresholds; each application undergoes thorough scrutiny, favouring significant investors with direct government engagement and entrepreneurial involvement.

Comparison: Mauritius’s clarity and accessibility contrast with Seychelles’s exclusivity and discretion, affecting ease of planning and predictability.

Tax & Legal Frameworks: Structured Efficiency vs Adaptive Privacy

Mauritius:

- No capital gains or inheritance taxes.

- Flat 15% corporate and personal income tax rate.

- Extensive double taxation treaty network aids global tax planning.

- Non-residents enjoy exemptions under many conditions.

- Property ownership and estate succession are straightforward for foreigners.

Seychelles:

- Known for financial privacy and offshore company advantages.

- Local personal and corporate tax treatment varies and can be case-specific.

- No capital gains tax on most domestic assets.

- Regulations subject to international scrutiny and potential change.

Lifestyle Considerations: Cosmopolitan Comfort vs Exclusive Tranquillity

Mauritius: Boasts modern healthcare, international schools with French and English curricula, a democratic and multicultural society, and well-developed luxury amenities including championship golf courses and five-star resorts. Excellent air connectivity supports effortless travel.

Seychelles: Offers unparalleled natural beauty and privacy with limited infrastructure. Educational and healthcare options are fewer and less internationalised. Its remoteness is viewed as a luxury by some, while others may find it restrictive.

Risk & Regulatory Environment: Predictability Meets Professionalism vs Discretionary Flexibility

Mauritius: Renowned for rule of law, transparent regulatory agencies, and investor protections. Residency permits are codified and safeguarded.

Seychelles: Residency depends heavily on discretionary approvals with potential policy shifts posing risks. It is suitable for investors comfortable with this uncertainty.

Risk Summary: Mauritius provides predictable legal security; Seychelles rewards influence and capital but with higher regulatory risk.

Comparative Overview: Mauritius and Seychelles at a Glance

| Aspect | Mauritius | Seychelles |

|———————-|——————————————-|———————————————|

| Residency | Defined investment schemes & permits | Discretionary, case-by-case approval |

| Minimum Investment | USD 375,000 in government-approved property | Not publicly codified; high entrepreneurial bar |

| Taxation | 15% flat tax, no CGT/inheritance | Flexible offshore tax; subject to change |

| Lifestyle | Family-friendly, cosmopolitan, modern | Private, exclusive, limited infrastructure |

| Predictability | High due to legal certainty | Lower; discretion and policy risks |

| Ideal For | HNWIs prioritising legacy, stability, tax efficiency | Entrepreneurs, privacy-conscious ultra-HNWIs |

Decision Guidance for African HNWIs

Mauritius emerges as the preferred choice for those seeking predictable, scalable residency with strong legal frameworks, family integration, and tax efficiency. Conversely, Seychelles suits visionary entrepreneurs and ultra-HNWIs who prize exclusivity and personal engagement with government.

For those exploring beyond the Indian Ocean, emerging possibilities like Turkey residency offer investment flexibility and lifestyle benefits. Similarly, the UAE Golden Visa remains a strong contender for business-friendly policies and strategic global connections.

Final Thoughts: Secure Your Future with Confidence

Choosing a residency is a pivotal decision shaping wealth preservation, mobility, and family security. Mauritius and Seychelles each open distinct pathways—clear and stable versus exclusive and discreet. Ultimately, your choice should reflect personal priorities and long-term vision.

For bespoke guidance that transcends generic advice, explore Siyah Agents programmes for tailored residency solutions. Begin your tailored journey today with a free assessment to identify the best Indian Ocean or global residency suited to your ambitions. In international mobility, clarity is an essential asset, not a luxury.