Introduction: Why Alentejo Demands Your Attention

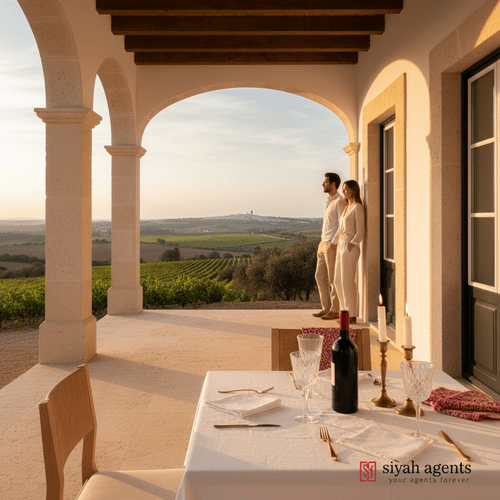

Imagine discovering a real estate market primed for growth before it hits the mainstream—a region where tranquillity meets opportunity, and authentic charm is abundant. For US investors and expatriates, Portugal’s Alentejo offers this rare combination. While Lisbon and the Algarve are famed hotspots, Alentejo stands apart with its expansive landscapes and emerging market appeal. The key question is not why Alentejo, but why haven’t more investors turned their attention here sooner?

Alentejo: Portugal’s Expansive and Underappreciated Gem

Covering nearly one-third of Portugal’s landmass but housing less than 8% of its population, the Alentejo region stretches from the outskirts of Lisbon to the borders near the Algarve. This sparse population density safeguards vast unspoiled countryside, heritage towns like Évora and Monsaraz, and a timeless lifestyle that balances nature with culture.

Known as Portugal’s ‘breadbasket,’ Alentejo thrives on agriculture and viticulture, with tourism growing as a critical economic pillar. The appeal lies in its affordability and sustainability; its proximity to Spain and UNESCO heritage sites further enhance its profile as a haven for those seeking calm away from urban intensity.

Portugal Property Market Alentejo: Growth with Room to Expand

While property prices in Lisbon and Porto have surged, Alentejo’s market remains comparatively affordable. Since 2021, residential properties have appreciated between 6% to 10% annually depending on the subregion, yet prices per square metre are up to 35% lower than in Portugal’s coastal cities (economic analyses; Siyah Agents internal data).

The commercial sector, focused on rural tourism and boutique hospitality, is also gaining momentum. Increased demand from international buyers — notably from North America, Northern Europe, and the Middle East — is evident, with rental yields ranging from 4% to 7%, outperforming many established Western European markets.

Key Insight

Alentejo’s property prices remain up to 35% lower than Lisbon and Porto, with rental yields reaching 7% (economic analyses; Siyah Agents internal data).

Investment Opportunities: From Countryside Charm to Urban Renewal

Residential Properties: Value and Space Combined

Foreign investors are drawn to Alentejo’s spacious countryside estates and charming restored village homes. Unlike crowded coastal zones, Alentejo offers generous plot sizes and heritage architecture at accessible prices — from renovation projects under €150,000 to luxury farmhouses above €1 million. Demand is growing for family homes near towns such as Évora and Beja, intended as retreats or high-end holiday rentals.

Commercial and Hospitality Ventures: Harnessing Rural Tourism

The region’s growing reputation as a wine tourism destination drives investment in vineyards, olive groves, and boutique hotels. Properties around Alqueva Lake and coastal areas show early signs of gentrification, offering opportunities before prices surge.

Urban Regeneration: Historic Towns in Transition

Historic centres like Évora and Elvas provide prospects for urban regeneration, supported by incentives to refurbish vacant buildings. These projects span co-living, retail, and hospitality sectors, laying foundations for capital growth and community revitalisation.

- Investment avenues include countryside estates, wine tourism projects, boutique hospitality, and urban regeneration — all at attractive entry points.

Why Investors Choose Alentejo: Distinct Advantages

Affordability and Stability

Alentejo offers unparalleled affordability; sprawling land parcels can be acquired for a fraction of the price of Lisbon properties. Lower entry costs reduce capital exposure while enhancing resilience against market fluctuations (economic analyses).

Quality of Life: Safety and Sustainability

With some of Portugal’s lowest crime rates and excellent air quality, Alentejo epitomises “slow living” and eco-friendly tourism. It appeals to wellness-focused buyers and families seeking sustainable lifestyles.

Diversify Your Portfolio

For investors exposed to urban markets like Lisbon and the Algarve, Alentejo presents non-correlated assets that balance urban volatility with rural stability.

Key Insight

Alentejo provides affordable entry and unique diversification for international investors (economic analyses).

Risks and Considerations: A Balanced Perspective

Every investment demands clear-eyed evaluation. Key risks include:

- Liquidity limitations: Lower transaction volumes mean assets may take longer to sell compared to big cities.

- Regulatory nuances: Varying rural planning regulations necessitate thorough due diligence.

- Development challenges: Infrastructure improvements, including broadband, are uneven, potentially delaying operations in less accessible areas.

- Tourism volatility: Visitor flows are seasonal and sensitive to international trends.

Where data gaps exist — such as detailed commercial rental metrics or climate impact studies — investors should adopt a case-by-case approach.

- Key Risks:

- Less liquidity than Lisbon or Porto

- Incomplete infrastructure in rural zones

- Complex regulatory environment

Navigating Residency: Visa Pathways for Alentejo Investors

Portugal is renowned for investor-friendly visa schemes. Two prominent options relevant to Alentejo include:

Portugal Golden Visa

Though Lisbon and coastal areas have tightened eligibility for residential investments, Alentejo remains open for qualifying projects such as tourism development and urban regeneration. These offer routes to EU residency through approved investment schemes. Explore the trusted Portugal Golden Visa for detailed guidance.

Portugal D2 Entrepreneur Visa

Entrepreneurs planning to launch tourism, agricultural, or tech businesses can benefit from the flexible Portugal D2 Entrepreneur Visa. It supports non-EU nationals who aim to generate local economic impact and establish long-term residency.

Summary: Strategic Advice for Savvy Investors

- Alentejo’s affordability and lifestyle appeal are driving growing international interest, yet it remains undervalued.

- Consider risks like liquidity, regulatory complexity, and patchy infrastructure when forming investment strategies.

- Leverage visa programs tied to property and business investments to facilitate residency.

- Begin with hands-on research or a tailored free assessment to align your goals with market realities.

Strategic Insight

Early entrants to Alentejo stand to acquire valuable assets ahead of broader market recognition — success depends on informed, region-specific diligence (Siyah Agents internal data).

Conclusion: Confidently Enter Portugal’s Next Real Estate Frontier

Alentejo represents more than a property investment; it offers a lifestyle transformation. For US and expatriate investors, its blend of affordability, safety, and growth potential is unmatched in Western Europe. However, success demands a strategic approach combining local knowledge with international standards.

To navigate Alentejo’s nuanced market, trust in evidence and expert guidance. Siyah Agents pairs market-leading insights with practical intelligence through Siyah Agents programmes designed to help investors minimise risk and maximise opportunity.

Take the next step: access a free assessment, explore the Portugal Golden Visa and Portugal D2 Entrepreneur Visa routes, and discover why Alentejo is an emerging must-watch in European real estate.

Sources: Verified Portuguese real estate market reports; economic analyses; Siyah Agents internal data.