A family, a villa, and a new chapter in Europe

Introduction: residency and lifestyle in one package

For many families the idea of EU residency and a seaside holiday home goes hand in hand: mobility for the parents, options for the children, and a comfortable retreat for holidays. This piece tells how one family combined those aims by investing in Greece. It focuses on practical decisions, realistic costs and timelines, and the lessons other families should consider before making a similar move. There are no guarantees with any investment or immigration outcome; ranges and caveats are marked where appropriate.

Why Greece appealed to this family

H3 — Motivations beyond the holiday dream

The family wanted more than an attractive investment. Their priorities were clear: greater freedom of movement within Europe, a safe, affordable place for summer and school holidays, and a tangible asset they could enjoy personally. Greece ticked key boxes: relatively modest property thresholds compared with some European programmes, straightforward family inclusion rules, and a Mediterranean lifestyle that suited their children. Official Greek guidance identifies property investment as a common qualifying route; families should treat thresholds as indicative and confirm current numbers before committing.

Internal summary: Greece offered a balance of lifestyle, cost and residency options that suited a family unwilling to relocate permanently but eager for secure EU access.

How the Greece Golden Visa works (family focus)

H3 — The programme in brief

Greece’s residency‑by‑investment programme grants a renewable five‑year residence permit to investors who make qualifying investments, most commonly in real estate. The programme permits family inclusion—typically spouse and dependent children—on a single application. Many families find this combination attractive because it provides Schengen access without demanding permanent relocation. For an accessible overview, see the Greece Golden Visa guidance.

H3 — Key eligibility points

- Minimum qualifying property investment traditionally starts at around €250,000, though local market conditions and policy discussions can affect available opportunities.

- Clean criminal records, valid health insurance and documentary proof of funds are routinely required.

- Applicants must maintain the qualifying investment for the duration specified by the programme rules.

Note: some regions and high‑demand properties may effectively raise the practical entry price; check current official sources for any recent changes.

The family’s investment journey: step by step

H3 — 1. Clarify objectives and budget

They began by ranking goals: easy Schengen travel, a holiday home that could be let commercially when not in use, and a residence option for children’s education. Their budget allowed for a modest coastal villa plus contingency for taxes and legal fees.

H3 — 2. Shortlist regions and properties

They used market reports and local agent listings to shortlist coastal Peloponnese towns and smaller islands known for family‑friendly communities. Affordability mattered as much as access: proximity to regional airports and healthcare facilities featured in their decision matrix. Working with a bilingual lawyer and a trusted local agent reduced the risk of surprises.

H3 — 3. Due diligence and purchase

Before exchange, they commissioned: title searches, local tax checks, planning‑use confirmations and a property condition survey. These steps uncovered minor zoning issues that were resolved pre‑completion. The purchase price of €270,000 sat above the advertised threshold, but the cottage’s condition and location justified the premium for their lifestyle objectives.

H3 — 4. Application and processing

Their Golden Visa application included proof of funds, notarised purchase contracts, police certificates and health insurance. Processing times vary; theirs completed in about 2–3 months from submission to initial approval—within common published ranges but not guaranteed for all cases. Biometrics and residence card collection followed personal attendance in Greece.

Internal summary: careful shortlisting, professional due diligence and clear objectives shortened the timeline and reduced surprises.

What residency provided the family

H3 — Practical benefits realised

- Schengen mobility: smoother travel across Europe for holidays and business, within the 90‑days‑in‑180‑days Schengen framework.

- Family inclusion: both children were covered under the principal applicant’s permit, easing schooling and extended stays.

- Letting income potential: when not using the property, the family let it short‑term; tax and local regulation compliance were essential.

H3 — Limits and realistic expectations

The Golden Visa does not automatically confer citizenship or an immediate right to work in Greece. Pathways to longer‑term residency or citizenship require sustained presence and compliance with local rules over several years; exact routes and timelines vary and are sometimes subject to policy shifts (inconclusive without case‑specific checks).

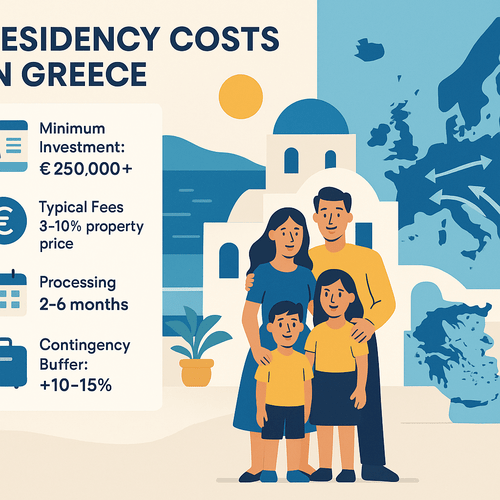

Costs and timelines: planning ranges to budget for

H3 — Typical cost components and ranges

- Property price: from approximately €250,000 upwards depending on location and condition.

- Purchase taxes and fees: typically 3–10% of the property price, plus notary and registration costs.

- Professional fees: expect €3,000–€8,000 for legal, translation and due‑diligence services.

- Visa processing and administrative costs: modest consular and application fees; biometric and residence card costs on arrival.

- Ongoing costs: property maintenance, insurance, utilities and local taxes—budget 1–2% of property value annually for upkeep.

Timelines: property search and due diligence commonly take 1–3 months; purchase completion and administrative registration a further 1–2 months. Golden Visa processing often ranges from 2–6 months but can extend with document queries or busy seasons.

Callout: Always add a contingency buffer (10–15% of purchase price) to account for taxes, unexpected repairs and currency moves.

Lessons learned and practical advice for families

H3 — Focus on clarity, not haste

The Taylors emphasise that in this process patience pays. They avoided rushed offers and insisted on independent surveys and lawyer‑led title checks. For families, the right neighbourhood and access to services often matter more than marginal price differences.

H3 — Tax and rental rules matter

If you plan to let the property, register the rental income correctly and understand Greek tax obligations; non‑compliance can jeopardise residency renewal. Seek country‑specific tax advice to model net returns and compliance obligations.

H3 — Family logistics require lead time

School applications, local healthcare registration and language learning take time. Factor these practicalities into your calendar before committing to a deposit.

Quick comparison: why some families opt for Spain instead

H3 — Spain as an alternative

Spain’s investor route typically starts at higher property minimums—commonly around €500,000—and has its own trade‑offs in residency flexibility and market depth. Families preferring larger urban markets or established expat communities sometimes favour Spain, while those seeking affordability and relaxed coastal life tilt towards Greece. See the Spain Golden Visa guide for up‑to‑date comparisons.

Internal summary: Spain offers scale and infrastructure; Greece can offer value and simplicity for lifestyle buyers.

Final takeaways for families considering Greece

Investing in Greece to secure EU residency and a holiday home can deliver both material and lifestyle rewards—but it requires rigorous planning, honest budgeting and compliance with local rules. Families who succeed tend to combine clear objectives, trusted local advisers and realistic timelines.

If your family is considering a similar path, start with informed advice: review curated options via Siyah Agents programmes and arrange a [free assessment] to evaluate suitability and next steps. Expert guidance turns complexity into a manageable plan—and increases your chance of a smooth, rewarding outcome.

Sources: Official Greek Golden Visa materials; verified migration and real estate advisory reports; Siyah Agents family advisory experience.