Fast‑track or long game: choosing the right investment immigration path

Introduction: the strategic fork in the road

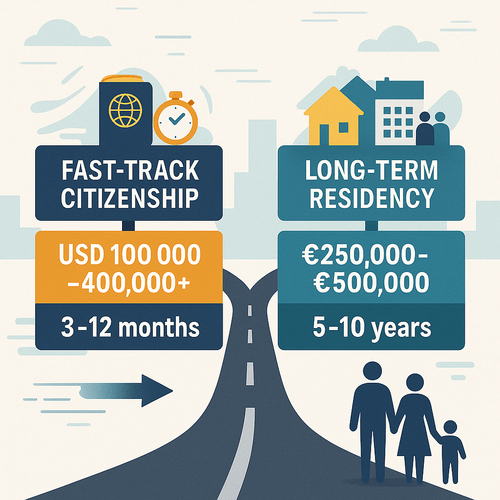

Investment immigration offers two distinct routes: immediate nationality through fast‑track programmes or a gradual path to long‑term residency and, eventually, citizenship. For English‑speaking African professionals and investors the choice is not merely technical — it intersects with family needs, business plans, tax exposures and personal tolerance for regulatory change. This article compares both approaches clearly, presents realistic ranges for costs and timelines, and outlines practical criteria to help you decide. There are no guarantees; treat all figures as indicative and confirm details before you commit capital.

Fast‑track citizenship: speed, simplicity — and concentrated trade‑offs

H3 — What counts as fast‑track?

Fast‑track citizenship (Citizenship by Investment, or CBI) offers a direct route to a passport in a condensed timeframe. Typical features include a single qualifying investment, limited or no residence requirement, and a relatively rapid administrative process — often measured in months rather than years.

H3 — Typical profile and timelines

Fast‑track programmes suit investors who prioritise immediate travel freedom, a second passport for family security, or rapid business mobility. Indicative timelines vary by country: approvals can arrive in roughly 3–12 months in many programmes, though exhaustive due diligence commonly extends that range.

H3 — Typical investment ranges and costs

CBI schemes tend to demand higher upfront capital. Examples widely cited in public guidance show:

- Real‑estate or donation routes from roughly USD 100,000 (Caribbean donor models) to USD 400,000+ (some rapid citizenship options tied to property purchases).

- Higher tier programmes or continental European citizenship fast‑tracks have historically required substantially larger sums (often well into seven figures).

Legal, due‑diligence and advisory fees are additive and frequently range from €10,000–€50,000 or more depending on complexity. Always model total cost, not just headline investment.

H3 — Strengths and limitations

Strengths: speed, immediate passport rights, minimal relocation.

Limitations: expensive, heightened scrutiny of source of funds, and greater exposure to abrupt policy changes or international pressure that can restrict programmes.

Callout:

Fast‑track is about immediacy — but it demands rigorous evidence of funds and tolerance for regulatory shifts.

Internal summary: choose fast‑track when immediate nationality is essential and you can meet elevated capital and compliance requirements.

Long‑term residency routes: the methodical, integrated option

H3 — What long‑term routes deliver

Residency‑by‑Investment (RBI) programmes—often called Golden Visas—grant residency permits in return for qualifying investments (property, business creation, capital transfers). They usually lead to permanent residency or citizenship after sustained residence and integration.

H3 — Timelines and investment ranges

RBI routes commonly require lower headline investment than CBI, at least in certain asset classes. For example, well‑known European programmes have offered qualifying routes from approximately €250,000–€500,000 depending on the asset and location. Pathways to citizenship typically span 5–10 years, contingent on physical presence, language and legal requirements.

H3 — Strengths and limitations

Strengths: staged commitment, potential tax and business planning benefits, easier integration for families, and often lower initial capital outlay.

Limitations: longer wait to full nationality, renewal obligations, and the need to satisfy residence and activity tests (vary by country).

Internal summary: residency routes suit investors prepared to integrate and plan multi‑year horizons for mobility and citizenship.

Comparing thresholds, timelines and real‑world trade‑offs

H3 — Investment and timeline snapshot

- Fast‑track CBI: investment typically ranges from low‑hundreds of thousands (Caribbean) to several hundred thousand USD (property‑based routes); timeline from 3–12 months (subject to due diligence).

- Long‑term RBI: investment bands frequently start around €250,000–€500,000 for certain European options, with residency-to-citizenship horizons of 5+ years.

These are indicative ranges; programmes and thresholds change, and some routes have been tightened or paused in recent years. Always verify the latest official guidance for your target country.

Callout:

Numbers are moving targets. Confirm thresholds and process times with official sources before deciding.

Family inclusion, flexibility and lifestyle implications

H3 — Family coverage and age limits

Both CBI and RBI typically permit spouse and dependent children. Fast‑track citizenship often allows immediate family naturalisation; residency routes commonly extend permits to dependents but may impose age or dependency tests for older children. Clarify inclusion rules early — they vary significantly.

H3 — Physical presence and daily life

Fast‑track schemes frequently require no residence; RBIs often require periodic presence, affecting schooling choices and business commitments. If your plan involves children’s education or gradual relocation, long‑term residency may align better with family needs.

Internal summary: align your family mobility needs to the programme’s residence rules and dependency definitions.

Risks, uncertainty and how to quantify trade‑offs

H3 — Policy risk and reversals

Governments revise programmes. Some fast‑track offers have faced curtailment under international scrutiny; residency routes have been tightened in response to housing concerns. Treat policy risk as a material factor and model contingency scenarios.

H3 — Due diligence and source‑of‑fund scrutiny

All programmes now enforce stringent AML and KYC checks. Difficulties in proving funds provenance are a common cause of delay or refusal. Plan for documentary requirements and possible remediation processes.

H3 — Financial modelling: ranges to consider

- Expect potential property value fluctuations of 10–30% in stressed market scenarios.

- Model additional lifetime costs: legal and advisory fees (€10,000–€50,000+), renewal or holding costs, and tax compliance obligations.

Internal summary: quantify downside scenarios and maintain liquidity for contingencies.

Practical decision framework for African investors

H3 — Questions to guide your strategy

- How urgent is your need for a passport or residency?

- Are you prepared to commit capital now, or prefer staged investments and integration?

- What matters most for your family — schooling, health access, business mobility, or immediate travel freedom?

- What is your tolerance for policy risk and regulatory change?

H3 — A simple decision matrix

- Choose fast‑track if urgency, immediate passport benefits and family security outweigh higher capital and compliance burden.

- Choose long‑term residency if you prioritise integration, lower immediate capital outlay and staged planning toward citizenship.

If you’re uncertain, begin with a professional review. A short eligibility scan can surface key constraints and opportunities; consider a free assessment to map your options.

Practical steps to reduce risk and increase success

- Verify current official thresholds and program status for your target countries.

- Secure transparent, auditable proof of funds.

- Work only with regulated advisers and licensed legal counsel.

- Stress‑test investments for liquidity and downside scenarios.

- Prioritise family inclusion rules if dependants matter.

- Keep reserves for unexpected compliance or tax costs.

Internal summary: diligence, legal support and conservative modelling are the investor’s best defence.

Conclusion: choose with clarity and expert support

Fast‑track and long‑term investment immigration are tools with different strengths. One delivers speed and near‑immediate mobility; the other builds durable, integrated residency with lower immediate capital and more gradual benefits. Neither is inherently superior — the correct choice depends on your timeline, family needs and tolerance for policy and market risk.

For a market overview and curated pathways that match your priorities, review Siyah Agents programmes and arrange a personalised consultation. If Turkey is on your shortlist, review Turkey’s detailed citizenship mechanics before committing capital. Likewise, if Portugal’s residency routes appeal, confirm the latest qualifying investments and rules for the Golden Visa. Start with a focused, confidential consultation via our free assessment to clarify your best path forward.