Launch, scale, reside: the Portugal D2 in brief

Introduction: a practical pathway for founders

The Portugal D2 Entrepreneur Visa offers a hands‑on route for non‑EU founders and investors who want to build a business in Portugal and secure EU residency. It suits founders ready to operate locally, contribute economically and meet clear documentation standards. This guide explains who qualifies, what authorities expect, realistic timelines, cost ranges, risks and the practical steps to increase your chance of a successful application. No guarantees are offered; outcomes depend on your plan, compliance and evolving policy.

Who qualifies — the essentials

H3 — Core eligibility

The D2 is aimed at non‑EU nationals intending to establish or invest in a genuine economic activity in Portugal. Authorities generally expect a credible business plan, proof of capacity to fund the venture, and evidence of lawful background and health cover. There is no statutory minimum capital set in the D2 text; applications are assessed on the business’s viability and the applicant’s ability to sustain it (check the Portuguese immigration authority for current guidance).

H3 — Typical applicants

Successful applicants range from tech founders and creative entrepreneurs to service professionals and small‑business owners. Freelancers or consultants may qualify if they can demonstrate sustainable commercial activity and local integration.

Internal summary: the D2 rewards demonstrable economic intent and documentary completeness more than headline capital sums.

What officials look for: business plausibility, not magic numbers

H3 — The business plan: your primary case

A robust business plan is decisive. Immigration officers typically assess market research, realistic revenue and cost projections, operational milestones, and local economic contribution (job creation, exports or skills transfer). Emphasise how your project fits the Portuguese market and how it will be financed.

H3 — Funding and financial readiness (realistic ranges)

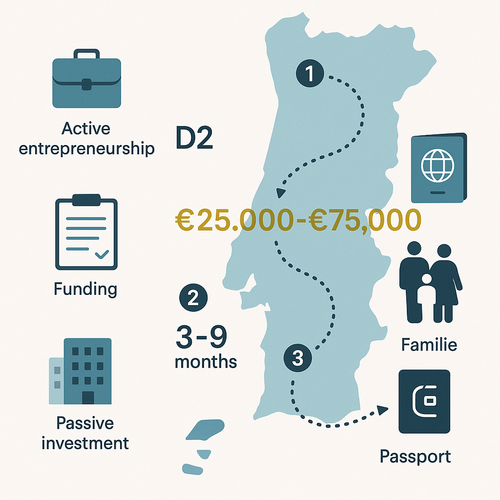

There is no universal minimum, but practical cases show early‑stage service businesses often demonstrate credibility with available working capital in the low tens of thousands of euros; capital‑intensive projects require substantially more. Assume working capital needs of approximately €25,000–€75,000 as a broad planning band, and budget for personal living costs for at least 12 months. Treat these figures as indicative, not prescriptive.

Callout:

- Demonstrate clear funding sources and bank‑level proof of funds — unverified transfers or opaque structures trigger follow‑ups.

The application process: documents and timelines

H3 — Documentation checklist (core items)

- Valid passport and CV

- Detailed business plan and projected accounts

- Proof of funds and source of wealth documentation

- Police clearance and health insurance

- Proof of accommodation in Portugal

H3 — Timelines you should expect

Allow 3–9 months from planning to visa issuance in typical cases. Document preparation: 2–8 weeks. Consular processing and SEF (immigration) stages: often 6–16 weeks, but delays are possible. These ranges reflect common practice; processing speed depends on consular workload and completeness of the dossier.

Internal summary: build a 6‑month window into your launch timeline and prepare for contingency.

Residency rights, family inclusion and onward options

H3 — What residency permits you get

D2 holders receive a residence permit enabling work and business activity in Portugal. Family reunification is typically permitted for spouses/partners and dependent children; evidence requirements for dependants follow standard immigration rules. Residence cards enable Schengen short‑stay travel rights (90 days in 180 days) and, after five years of legal residence, eligibility to apply for permanent residence or citizenship subject to language and legal requirements. Timeframes and conditions can change; remain attentive to official updates.

Costs, compliance and risks to plan for

H3 — Typical cost components

- Company formation and registry: €300–€1,000 plus notary fees

- Legal/accounting and business plan fees: €2,000–€7,000

- Consular and SEF administrative charges: a few hundred euros each

- Living costs for an entrepreneur: budget conservatively for €8,000–€18,000 per person per year depending on lifestyle and family size

These ranges are indicative; actual costs depend on sector, city and family composition.

H3 — Compliance risks and renewal considerations

Residence renewal hinges on continued business activity and meeting immigration conditions. Passive ownership without active operation risks non‑renewal. Authorities will scrutinise employment records, tax filings and local contributions. Non‑compliance can lead to permit refusal or revocation.

Callout:

- Treat compliance as ongoing: tax filings, company accounts and social security duties are essential for permit renewals.

D2 versus the Portugal Golden Visa: which suits you?

H3 — Comparing the routes

The D2 is operationally different from the Portugal Golden Visa. The Golden Visa is investment‑led (property or capital thresholds) and can suit passive investors, while the D2 centres on active entrepreneurship and local business operation. If your goal is to found and run a company, the D2 aligns with that intent; passive investors may prefer the Golden Visa pathway. See the Portugal Golden Visa guidance for direct comparisons.

Internal summary: choose D2 if you intend to build and manage a business; consider the Golden Visa for asset‑based residency.

Practical advice: how to maximise success on D2

H3 — Five practical steps

- Validate market fit locally—engage a Portuguese industry contact or advisor.

- Build conservative, evidence‑backed financial forecasts and stress‑test them.

- Keep clean, traceable proof of funds; avoid complex offshore routing without clear documentation.

- Use local legal and accounting support for company formation and tax registration.

- Plan family documentation early—school applications and health coverage take time.

H3 — When to seek professional help

If you lack local contacts, complex corporate structures, or expect rapid hiring, professional advisers materially reduce risk and timelines. Explore Siyah Agents programmes for structured support and project management.

Key takeaways: realistic, cautious optimism

- The Portugal D2 is a flexible, credible route for entrepreneurs committed to launching and running businesses in Portugal.

- Officials prioritise credible plans and transparent funding over fixed minimums.

- Anticipate 3–9 months to secure residency and budget for legal, operational and living costs accordingly.

Final Callout:

- Start with a focused business plan and a clear funds audit—these two steps explain most successful D2 cases.

Ready to explore the D2? Take the next step

If you are considering Portugal as your launchpad, begin with a tailored review. Book a free assessment to evaluate fit and identify gaps in your dossier and consider a guided pathway through Siyah Agents programmes for end‑to‑end support. No path guarantees approval, but careful preparation, local expertise and disciplined compliance substantially improve your prospects.

Sources: Official Portuguese immigration guidance; verified migration advisories; Siyah Agents internal advisory experience