Quick guide: what thresholds and timelines really mean

Introduction: why thresholds and timelines matter now

Investment thresholds and timelines are the two variables that shape your immigration strategy: how much capital you must commit, and how quickly you can expect a visa or passport. For English‑speaking African professionals and investors these factors determine not only cost and speed, but also opportunity cost, tax timing and business planning. This article compares leading Citizenship by Investment (CBI) and Residency by Investment (RBI) programmes, explains practical risks in ranges, and offers actionable steps to choose the right route.

How CBI and RBI programmes differ at a glance

CBI schemes grant citizenship directly (and usually a passport) in return for qualifying investments. RBI schemes grant residence permits which can, after time and conditions, lead to permanent residence or citizenship. The two differ in purpose, cost structure and the obligations they impose: CBI is often faster but costlier; RBI typically requires greater physical presence but can be less capital‑intensive.

Internal summary: pick CBI for speed and immediate nationality; choose RBI for staged settlement and longer‑term integration.

Investment thresholds: ranges you should expect

Thresholds vary widely by jurisdiction and by the type of qualifying investment (donation, real estate, bonds, business):

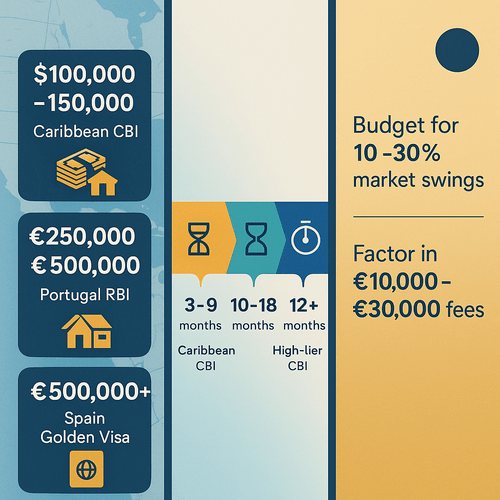

- Caribbean CBI: the most accessible entry point. Typical donation‑based options start around $100,000–$150,000 USD for a single applicant, while real‑estate routes require higher sums.

- European RBI: commonly higher. Portugal’s scheme, historically among the most flexible in Europe, has qualifying routes from approximately €250,000–€500,000 depending on the asset class. The Spain route commonly begins at €500,000 for property‑based qualifications.

- High‑tier CBI (small European states and Pacific programmes): these have demanded between €700,000 and well over €1 million for fast‑track nationality in recent years.

These headline figures exclude professional fees, due diligence, taxes and recurring costs. Expect process fees and legal costs to add a minimum of €10,000–€30,000 for many programmes, and in some European cases significantly more. If a programme looks unusually cheap, probe the fine print: additional charges or future changes often lie beneath the surface.

Callout:

Always model the total cost: capital, transaction taxes, due diligence fees, legal counsel and expected holding period.

Timelines: how fast can you expect decisions?

Processing speeds differ by programme and by applicant profile. Background checks and source‑of‑fund verification increasingly dominate review times. Indicative ranges:

- Caribbean CBI: advertised approvals often claim 3–6 months; pragmatic planning should allow 3–9 months, particularly during peak demand.

- European RBI (Portugal): many applications move through in 10–18 months, though certain routes and local formalities can extend timelines.

- Spain Golden Visa: initial residency permit approvals can be relatively swift (2–4 months) for complete applications; conversion to long‑term residency or citizenship takes years of compliance.

- High‑tier CBI in Europe or elsewhere: parliamentary or ministerial processes mean timelines of 12 months or more in many cases.

Timelines expand when due diligence uncovers complex corporate ownership, when applicants require additional documentation, or where programmes are under policy review. No timeline is guaranteed.

Regional comparisons: what the options look like in practice

H3 — Caribbean: speed and simplicity

Caribbean programmes (Dominica, St Lucia, Grenada, Saint Kitts & Nevis) emphasise speed and a straightforward application model. They suit investors seeking quick mobility enhancement with modest capital. The trade‑off is passport strength: while Caribbean passports afford useful visa‑free access, they do not match EU or top‑tier passports for global reach.

H3 — Europe: residency, integration and asset considerations

European RBIs—such as Portugal’s Golden Visa—combine investment with lifestyle and EU access. Portugal historically offered varied routes (real estate, capital transfers, job creation) often in the €250k–€500k band for certain asset types. Spain’s investor route has been property‑centric at €500k and above. European programmes tend to involve higher legal scrutiny and longer pathways to citizenship, but they confer access to Schengen mobility and EU services. See the Portugal Golden Visa guide for precise route details and recent changes that may affect thresholds.

H3 — High‑tier citizenship schemes

Some small states have offered accelerated citizenship for very high investments—often €700k–€1m+—paired with intensive background checks and parliamentary oversight. These programmes are fewer and subject to intense international scrutiny; expect higher fees and slower, more discretionary decision processes.

Risks, compliance and realistic expectations

No programme is risk‑free. Key risk areas include:

- Regulatory change: governments regularly amend thresholds and qualifying assets. Sudden policy shifts can alter eligibility or increase required capital.

- Due diligence failure: background checks and source‑of‑fund enquiries can delay or deny applications; remediation is costly and time‑consuming.

- Market risk: property bought to qualify may underperform or be illiquid in downturns—plan for potential value declines of 10–30% in stressed scenarios.

Callout:

Budget conservatively: assume 10–30% variation in property values and allow extra months for extended due diligence.

How to choose: pragmatic decision criteria

H3 — Match outcomes to objectives

Define your primary goal first: immediate nationality, EU access, relocation timing, tax planning, or asset diversification. CBI suits those needing nationality and rapid mobility; RBI suits those planning to relocate, integrate and use social or fiscal benefits over time.

H3 — Verify transparency and aftercare

Work only with authorised agents and lawyers. Programmes evolve; choose advisers who provide clear fee breakdowns, post‑approval compliance support and contingency planning. For structured programme options, consider reviewing curated offerings with specialist firms such as Siyah Agents programmes that map options to investor priorities.

H3 — Stress‑test scenarios

Model best, base and adverse cases: FX moves, housing market drops, delayed approvals. Use conservative assumptions for exit timing and cost recovery. If you’re unsure where you fit, start with a [free assessment] to map eligibility and exposure across programmes.

Practical checklist before committing capital

- Define priority outcomes and time horizon.

- Obtain a pre‑eligibility review and compliance check.

- Secure verifiable proof of funds and simplify ownership where possible.

- Choose regulated advisers and demand itemised cost estimates.

- Plan liquidity and exit scenarios for qualifying assets.

- Maintain conservative financial modelling (include fees, taxes, and contingency).

Summary: key takeaways for African investors

- CBI offers speed and direct nationality at higher cost; RBI enables staged settlement and lower upfront capital in some cases.

- Expect Caribbean CBI thresholds from ~$100k–$150k; European residency routes commonly start at €250k and extend to €500k+ depending on route.

- Timelines range from 3–9 months for Caribbean CBI to 10–18 months (or longer) for European RBIs.

- Model risk conservatively: allow for policy change, due diligence friction and market volatility.

Conclusion and next steps: expert advice matters

Choosing between CBI and RBI is a strategic decision that affects your family, taxes and mobility for years. Start by mapping objectives and testing scenarios with experienced advisers. Explore programme options through reputable channels such as Siyah Agents programmes, and book a focused review using their free assessment to clarify which routes fit your capital, timing and family needs.

Sources: Official government CBI/RBI websites; verified migration consultancy reports; Siyah Agents internal advisory research.