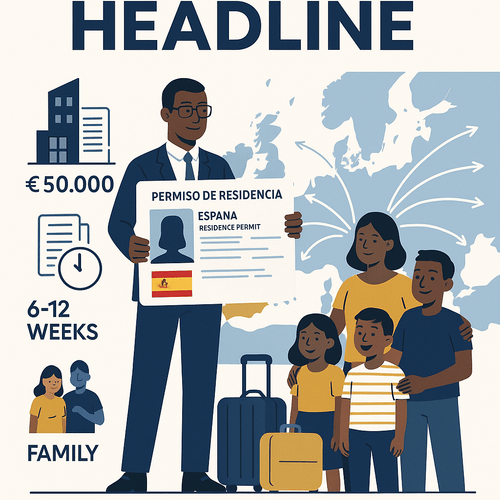

My Spain Golden Visa Journey

Introduction: from uncertainty to a practical European base

I used to plan trips and business meetings around consular calendars. That uncertainty affects decisions, family life and business rhythm. Seeking a more dependable option, I explored Spain’s Golden Visa. This essay is a candid, practical account of that journey—what worked, what surprised me and the hard lessons I learned. It is written for fellow English‑speaking African professionals and investors who value mobility, family security and operational predictability.

Internal summary: the Spain Golden Visa can reduce visa friction when paired with careful planning and compliant investment. It is not a guaranteed shortcut to citizenship.

Why I considered the Spain Golden Visa

H3 — Strategic aims

My priorities were clear: a stable legal base in Europe, Schengen mobility for business travel, school continuity for my children, and a straightforward framework for my family’s residency. Spain’s investor residency scheme appealed because it balances legal clarity with relatively broad family inclusion.

H3 — What the scheme offers

In broad terms, the Golden Visa grants residency in return for qualifying investment. It includes options such as real estate investment, capital placement or business projects. The visa is attractive to busy professionals because it does not force full‑time residence in Spain, while enabling easier travel across the Schengen area.

Callout:

The Golden Visa is a residency tool—helpful for mobility and family stability, but not automatic citizenship.

Eligibility: routes I evaluated

H3 — Investment choices and practical trade‑offs

Spain recognises several qualifying paths. The most common are:

- Real estate: purchases totalling at least €500,000.

- Capital investments: generally €1 million in shares or deposits, or €2 million in government bonds.

- Business projects: investments that generate jobs or economic value, evaluated on a case‑by‑case basis.

I weighed liquidity, management burden and compliance. Real estate felt tangible and offered rental income, but required careful local due diligence. Capital routes demanded larger sums but fewer management headaches. Business projects could be compelling if they created demonstrable jobs or innovation.

H3 — Basic applicant criteria

Applicants must be adults, have clean criminal records, hold private health insurance, and demonstrate the legal provenance of investment funds. Family members—spouse and dependent children—can usually be included, though rules for dependent parents vary and are occasionally updated (inconclusive on parental inclusion).

Preparing the application: documents and advisers

H3 — Document checklist that mattered

The bureaucratic detail is where most delays occur. My core checklist included: passport copies for every dependent, property deeds or investment proofs, bank statements showing transfer histories, police clearance certificates, translated and apostilled documents where required, and private health insurance policies. Keeping originals and certified copies in an indexed ‘audit pack’ paid off whenever authorities asked for clarifications.

H3 — Professional support is not optional

I engaged a local lawyer and a migration specialist. They handled conveyancing, confirmed the investment’s eligibility, and prepared translations and apostilles. Professional oversight cost more up front, but it significantly reduced resubmission risk and administrative back‑and‑forth.

Timelines: realistic expectations

H3 — From submission to residency card

Official processing windows can appear optimistic. In practice, expect: 6–12 weeks from initial consular submission to provisional approval in routine cases; additional weeks for travel, biometrics and local SEF (immigration office) appointments. Delays commonly stem from document queries, local bank procedures or seasonal slowdowns.

H3 — Family synchronisation

Submitting complete documentation for every family member is essential. A missing document for a child can hold up the whole family’s approval, so synchronise timelines tightly.

What changed after approval: practical benefits realised

H3 — Mobility and business flexibility

The residency card reduced visa friction for Schengen travel, which is invaluable when meetings arise at short notice. While it does not replace an EU passport, it streamlined operations and reduced the administrative lead time for business trips.

H3 — Family stability and access to services

My spouse and children gained access to local healthcare and the option of international or local schools. That certainty made long‑term planning (schools, housing, healthcare) far easier.

H3 — Financial and reputational effects

Holding residency improved my standing with European partners and simplified formalities such as opening bank accounts and engaging contractors. It also required more transparent accounting and record‑keeping, which was a salutary discipline for my business.

The real challenges I encountered

H3 — Bureaucracy and document precision

Even small mistakes cost time. I faced a request to reissue a police certificate that had expired by a few days; that added weeks to the process. Institutions in some African countries take longer to produce apostilled documents, so start those steps months ahead.

H3 — Financial flows and compliance

Large international transfers triggered bank compliance reviews and occasional holds. I used escrow arrangements during property purchase to document traceable, auditable transfers—this was important for both conveyancing and immigration checks.

H3 — Market and operational risks

Buying property without independent valuation would have been reckless. I insisted on an independent appraisal and clear title confirmation. Market conditions vary by region; tourist hotspots can be seasonal and less liquid than core city locations.

Lessons and practical advice for prospective applicants

H3 — Start early and expect iterations

Begin document collection at least three months before you intend to apply. Police records, bank attestations and apostilles are time‑consuming.

H3 — Choose investments that match your goals

If you need liquidity, capital investments may suit better than property. If you want rental income and a tangible asset, property can be appropriate—but price, location and title are decisive.

H3 — Use trusted local advisers

A lawyer who understands local property law and a migration adviser who knows SEF processes are crucial. Their fees are an investment in certainty.

Callout:

Treat due diligence as part of the investment cost, not an optional extra.

How Spain compares with alternatives

H3 — Portugal and other options

Portugal’s Golden Visa has attracted many investors—its rules once included lower‑cost property options and a shorter route to potential citizenship in some cases. Recent reforms have narrowed qualifying real‑estate categories, however, and policy can change. Each jurisdiction carries trade‑offs: cost, stay‑requirements, family coverage and citizenship timelines differ. Evaluate options against your family’s priorities and risk tolerance.

Conclusion: from anxiety to operational resilience

Securing Spain’s Golden Visa turned recurrent visa uncertainty into manageable, predictable mobility for my business and family. The process rewarded careful preparation, professional advice and disciplined documentation. It is not a universal solution—investment cost, market dynamics and administrative delays are real—but for those who plan well, the visa can deliver significant practical benefits.

If you’re considering the Spain Golden Visa and want a confidential discussion on strategy and practical next steps, connect with Siyah Agents for tailored guidance. Their advisers can assess fit, map timelines and help you prepare an audit‑ready dossier—so you can move from visa worries to concrete plans.

Sources: Spanish Ministry of Interior guidance; verified migration consultancy reports; investor testimonials.