Fast, practical and family‑friendly: a concise briefing

Introduction: why speed matters

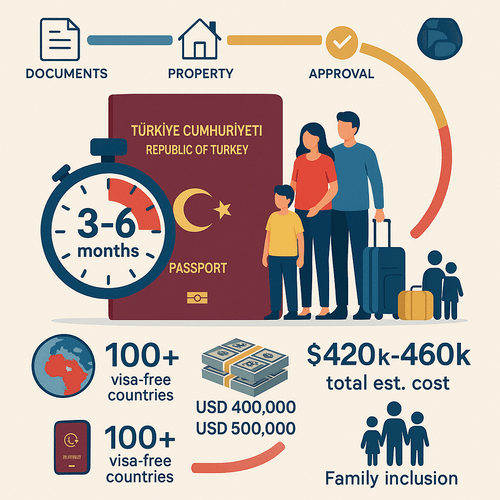

Turkey citizenship by investment is widely discussed because it delivers nationality with unusual speed for a modern programme. For English‑speaking African professionals and investors who prioritise rapid mobility, family inclusion and a practical business foothold between Europe and Asia, Turkey’s CBI can be compelling. This guide explains how it works, who qualifies, expected timelines and costs, and the real risks to weigh—using verifiable programme parameters and conservative ranges.

Internal summary: Turkey’s CBI is typically faster than most alternatives, but success depends on thorough due diligence, clear documentation and prudent risk management.

Eligibility for Turkey citizenship by investment

Who may apply

The programme is open to adult foreign nationals who can make a qualifying investment and demonstrate lawful funds. Authorities carry out criminal‑record and source‑of‑fund checks; adverse findings can halt an application. Family members (spouses and minor children) are routinely included in the principal applicant’s file. Dependent adult relatives normally do not qualify automatically.

Qualifying investment routes (core options)

- Real estate purchase of at least USD 400,000, held for a minimum of three years.

- A capital deposit or equivalent investment commonly cited at USD 500,000 locked in Turkish financial instruments for three years.

- Purchase of certain government bonds or approved corporate investment at similar thresholds.

- Business investment creating jobs (for example, employing a specified minimum number of Turkish workers—criteria and documentation required).

These thresholds have changed in recent years; confirm live official guidance for current figures. Where future adjustments are possible, we mark that as inconclusive.

Internal summary: satisfy the monetary threshold, provide verifiable source‑of‑funds documentation and include your immediate family on the application.

The timeline: realistic expectations (3–6 months)

Stage‑by‑stage timing

- Preparation (1–4 weeks): document gathering, property selection or fund transfer planning, legal due diligence and notarisation.

- Investment execution (days–weeks): bank transfers, title deed registration or bond purchase and legal confirmation.

- Application lodgement and government review (8–16 weeks typical): background checks, verification of investment and official approval.

- Citizenship certificate and passport issuance (days–4 weeks after approval): once cleared, national identity and passport processes proceed rapidly.

Overall, many applicants complete the process within about three to six months from the time of qualifying investment. Delays arise from incomplete dossiers, complex source‑of‑fund trails, or ad hoc administrative revisions. Any promise of fixed, guaranteed timing should be treated sceptically.

Callout — timeline reality:

- Prepare documents thoroughly to reduce risk of delay; rushed submissions are a common cause of longer processing.

Internal summary: plan conservatively for 3–6 months, and budget extra time for unforeseen administrative queries.

Costs: headline amounts and realistic budgets

Headline investments versus total cost

- Real estate route: minimum investment commonly quoted at USD 400,000 (headline). Expect additional transaction taxes, agent commissions, appraisal fees and notary costs (often adding 4–6% to purchase).

- Alternative routes: capital deposit or bonds at roughly USD 500,000 require bank fees and potential currency conversion costs.

Professional and administrative fees

- Government application fees: modest relative to the investment (often under USD 2,000 per family in many cases).

- Legal, advisory and due‑diligence fees: typically USD 5,000–25,000 depending on family size, transaction complexity and the adviser’s service scope.

- Ancillary costs: translations, apostilles and medical checks—allow several hundred to a few thousand dollars.

A reasonable turnkey budget for a nuclear family using the real‑estate route often falls within USD 420,000–USD 460,000 including investments and professional costs, though exact totals depend on property value, location and fee arrangements. Currency movements and local taxes may push final amounts outside this illustrative range.

Internal summary: the headline investment is only part of the financial picture; factor professional fees, taxes and currency risk into your total budget.

Risks and prudent mitigations

Regulatory and policy risk

The Turkish government has revised qualifying thresholds in the past. Changes can occur with limited notice. Treat current thresholds as those in force at time of application but monitor official channels for updates.

Due diligence and rejection risk

Robust source‑of‑fund checks are standard. Weak or poorly documented fund origins, criminal records or prior immigration issues elsewhere can cause rejection. Mitigation: pre‑vetted financial documentation, independent compliance review and transparent ownership structures.

Market, currency and liquidity risks

If you choose the real‑estate route, consider local market liquidity. Niche developments aimed at investor buyers can be harder to resell quickly; expect holding periods. The Turkish lira has experienced volatility; converting local‑currency proceeds back to hard currency carries FX risk. Hedging strategies can help but add cost.

Legal and title risks

Clear title and legal protections vary by location. Insist on independent title searches, escrowed payments and enforceable sale contracts. Use local counsel to confirm regulatory compliance and confirm the investment will meet CBI programme requirements.

Callout — risk checklist:

- Verify live official thresholds before investment.

- Pre‑clear source‑of‑fund documentation.

- Use escrow and independent property valuation.

Internal summary: accept and plan for regulatory shifts, due diligence scrutiny, market liquidity constraints and FX exposure. Professional structuring reduces but does not eliminate risk.

Practical advantages: why investors choose Turkey CBI

Speed and family inclusion

The programme’s speed is its defining advantage. Whole families can receive citizenship together, typically without the prolonged residency requirements other countries impose. That immediacy matters where business timing or family security are priorities.

Strategic location and commercial ties

Turkey sits at a commercial crossroads between Europe, the Middle East and Asia. For investors seeking regional supply‑chain links, export markets or service centres, citizenship offers a practical base and local business ownership rights.

Mobility gains (passport power)

A Turkish passport typically grants visa‑free or visa‑on‑arrival access to over 100 countries—broad, though not on par with top EU passports. This can materially improve travel freedom for many African investors relative to some home passports.

Internal summary: speed, family coverage and strategic geography underpin the programme’s appeal for many investors.

How to approach the process sensibly

Stepwise planning

- Confirm current official thresholds and required documentation.

- Pre‑verify funds with an independent forensic review.

- Choose qualifying investment with liquidity and legal clarity in mind.

- Engage local counsel for title and contractual protections.

Why work with a specialist adviser

A seasoned adviser like Siyah Agents streamlines filings, reduces common documentation errors and coordinates compliance checks with a local network—improving the odds of a smooth, expedient process. Their practical project management includes post‑approval relocation support, which is essential for families moving quickly across borders.

Internal summary: rigorous preparation and expert coordination make fast outcomes achievable—though never guaranteed.

Conclusion and next steps

Turkey citizenship by investment is among the fastest routes to a second passport currently available, typically completed in about three to six months for well‑prepared applicants. That speed, combined with family inclusion and Turkey’s strategic location, explains the programme’s appeal to many African professionals and investors. Yet risks—regulatory, due diligence, market and currency—are real and must be managed with expert support and conservative planning.

If you are considering Turkey’s CBI and want a personalised assessment of eligibility, investment options and realistic timelines, consult Siyah Agents for a tailored advisory review and end‑to‑end project management. For in‑depth programme details and eligibility checks, refer to Siyah Agents’ Turkey citizenship guide: https://siyahagent.com/guides/turkey-citizenship-requirements??utm_source=marc&utm_medium=blog&utm_campaign=turkey-citizenship-by-investment:-the-fastest-route-to-a-new-passport-(3-6-months!)

Sources: Official Turkish government CBI documentation; verified migration industry analyses; Siyah Agents advisory data.