Finding Peace in Portugal: a D7 retirement testimonial

Introduction: a deliberate fresh start

Retirement can be a chance to reset priorities: quieter days, meaningful routines and a place where money buys calm as well as comfort. For many British and international retirees, Portugal ticks those boxes. The Portugal D7 visa—designed for those with passive income streams—offers a practical route to long‑term residence, and, for a growing number of retirees, a new chapter defined by stability, good healthcare and community. This testimonial distils one couple’s experience and practical lessons for others considering the move.

Internal summary: the D7 can deliver quality of life improvements for prepared retirees; careful planning and realistic expectations are essential.

A personal story: John and Margaret’s transition to tranquillity

John and Margaret were typical of many would‑be retirees: moderate pensions, a small UK property, and a desire to spend later life somewhere sunnier and less expensive. They chose Portugal after visiting friends, sampling local life and assessing healthcare and housing options. Their move was deliberate—timed to coincide with a property purchase and Margaret’s retirement date—and supported throughout by detailed planning.

They describe the first year as “a long‑ish holiday that became home”: paperwork and appointments were inevitable, but the reward was steadier routines, new friendships and the sense that their savings stretched further. Their experience is not universal, but it is instructive.

The Portugal D7 visa: eligibility and practical requirements

H3 — Who the D7 is for

The D7 targets those with stable passive income—pensions, rental income, investment yields or remote work revenues—seeking legal residence in Portugal. It suits retirees who can demonstrate they will not rely on Portuguese social welfare. Applicants must show credible, ongoing income and evidence of accommodation in Portugal.

H3 — Core documentary tests

Typical D7 requirements include:

- Proof of passive or recurring income at a level sufficient to support the applicant and dependants. Many advisors reference a benchmark linked to the Portuguese minimum wage per adult, with additional sums for dependants, but precise thresholds are subject to official guidance and may change (inconclusive).

- Valid passport and clean criminal record certificates.

- Proof of accommodation (rental contract or property deed).

- Health insurance covering the initial stay until Portuguese health registration.

Applications begin at a Portuguese consulate or via the national immigration service. After initial approval, successful applicants receive a short‑term visa to enter Portugal, followed by a residence permit issued locally. Timelines can vary (see later).

Internal summary: D7 requires verifiable passive income, accommodation proof and standard identity/character checks.

Costs and the true cost of living: realistic ranges

H3 — Upfront and application costs

Expect consular and application fees (modest by comparison to investment routes), translation and apostille costs for documents, plus legal or advisory fees if you choose professional help. These upfront costs commonly fall within a few hundred to a few thousand euros depending on services used and family size.

H3 — Ongoing living costs and budgeting

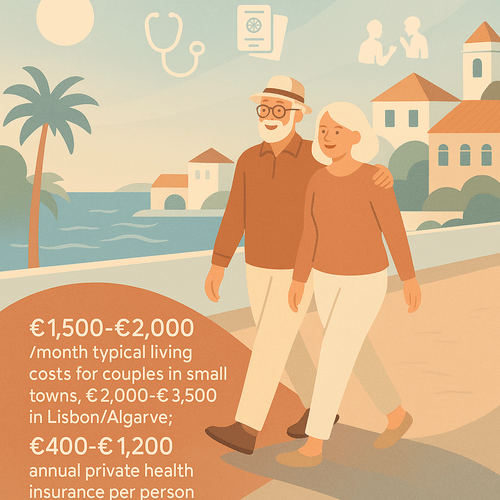

Portugal’s cost of living is lower than UK norms in many respects, but location matters. Typical monthly budgets for retirees: in smaller towns, a couple might comfortably live on €1,500–€2,000 per month including rent; in Lisbon or the Algarve budget from €2,000–€3,500 depending on lifestyle and housing choices. Private health insurance premiums vary by age and cover level—many retirees budget €400–€1,200 per person annually for comprehensive cover (ranges depend on insurer and medical history).

Callout — budgeting tip:

- Plan conservatively: allow for higher living costs in cities and unexpected healthcare or relocation expenses.

Internal summary: D7 applicants should model five‑year household budgets including housing, insurance and contingency funds.

Healthcare and wellbeing: practical expectations for retirees

H3 — Access to Portuguese healthcare

Once legally resident, you can register with Portugal’s public health service (SNS) and access subsidised care. Many retirees combine SNS access with private insurance to shorten waiting times for specialists and maintain continuity of care. Public healthcare quality is broadly high, but waiting times for some services can be longer than in private settings.

H3 — Costs and practicalities

Private insurance premiums are age‑sensitive and reflect pre‑existing conditions. Routine care and prescriptions are generally affordable under the SNS, but budget for private consultations if rapid access is required. English‑speaking practitioners are common in expat hubs, which eases the transition for non‑Portuguese speakers.

Internal summary: register with SNS after receiving residence status and consider private cover for prompt specialist access.

Relocation logistics: moving, housing and settling in

H3 — Practical steps taken by our retirees

John and Margaret bought a long‑term rental while house‑hunting, allowing them to complete the D7 paperwork and local registration before committing to a purchase. They opened a Portuguese bank account, registered with local authorities and arranged for pension transfers to comply with financial evidence requirements. They also joined local groups to ease social integration.

H3 — Common pitfalls to avoid

- Assume document legalisation and certified translations will take extra time.

- Don’t overlook local tax implications—seek early tax advice to understand residency tests and implications for pensions and estates.

- Plan for transport and seasonality—services vary outside major cities.

Internal summary: practical preparation—banking, housing, tax advice and social planning—smooths the first year considerably.

Peace of mind and community: the emotional dividends of the move

H3 — Building a new routine and social life

Retirees commonly cite community as the most valuable outcome—not merely climate or cost. John and Margaret connected with a local walking group, volunteered at a cultural centre and cultivated relationships with neighbours. These routines anchored them and reduced feelings of isolation.

H3 — Purpose and wellbeing

For many, retirement means finding new purpose—mentoring, part‑time volunteering or studio classes. Portugal’s tempo supports a balanced life: cafés, community events and easy access to nature contribute to wellbeing and a slower pace that many retirees prize.

Internal summary: social ties and meaningful activity are central to wellbeing; plan these as deliberately as paperwork.

Risks and realistic expectations: manage with care

H3 — No guarantees and changing rules

Immigration policy evolves. No adviser can guarantee visa approval or precise timelines. Expect variability in processing and be prepared for document queries or additional requirements. If something appears too easy or guaranteed, seek independent verification.

H3 — Financial and personal risks

Currency fluctuation, unexpected healthcare needs and housing market dynamics can affect budgets. Emotional adaptation varies—some retirees find the cultural shift invigorating; others need more time. Maintain contingency funds and an exit plan.

Callout — risk checklist:

- Keep reserves for unexpected medical or administrative costs

- Verify tax residency rules early with a specialist

- Expect and budget for administrative delays

Internal summary: treat the move as a major life decision—plan conservatively and seek professional advice to reduce avoidable risks.

Conclusion and next steps: turning aspiration into action

John and Margaret’s move to Portugal was not frictionless, but it achieved their aim: a calmer life with strong healthcare options, affordable living and a welcoming community. The D7 visa provided the structure to make that transition, but success required careful financial modelling, legal clarity and patient integration.

If a peaceful retirement in Portugal appeals, begin with a confidential eligibility check and a realistic budget. For tailored guidance on the D7 pathway and practical relocation support, consult Siyah Agents for a personalised assessment and step‑by‑step plan. Their experience helping retirees navigate documentation, health registration and local integration can materially shorten the learning curve and reduce avoidable delays.

Ready to explore whether Portugal’s D7 could make your retirement dreams real? Contact Siyah Agents for a confidential D7 eligibility review and practical next steps.

Sources: Official Portuguese immigration guidance; verified cost‑of‑living and healthcare data; Siyah Agents advisory experience.