Cutting through red tape: a practical guide

Introduction: why professional support matters

For English‑speaking African professionals and investors, bureaucracy is often the largest obstacle between intention and outcome. Complex residency, citizenship and investment applications demand exact documents, up‑to‑date legal knowledge and precise timing. Left unattended, small errors can cause significant delays or refusals. This article explains how Siyah Agents streamlines those processes—reducing risk, saving time and helping clients make informed choices—while making clear that no adviser can guarantee governmental approval.

Internal summary: prepare thoroughly, use bespoke process management and expect ranges in timelines and costs.

The common bureaucratic barriers applicants face

Even experienced investors find application processes frustrating. Typical hurdles include rapidly changing rules, inconsistent consular guidance, demanding proof‑of‑funds requirements and complex notarisation or apostille needs. For African clients, additional friction can come from document authentication backlogs, varying reliability of local records and stricter scrutiny in some jurisdictions. These complications increase the likelihood of requests for supplemental evidence, longer processing times and higher advisory costs.

What compounds these issues is simple: authorities expect a spotless audit trail. Missing originals, inconsistent translations or unverified corporate structures are frequent causes of delay.

Callout: Small omissions in paperwork often cause the largest delays—attention to detail is non‑negotiable.

Internal summary: expect detailed document checks and heightened scrutiny; plan accordingly.

Siyah Agents’ method: expertise, process and project management

Siyah Agents approaches complex applications as project work. The firm combines legal and regulatory expertise with disciplined process design: an initial eligibility assessment, a bespoke compliance roadmap, document assembly and an audit‑grade pre‑submission review. Advisors coordinate translations, notarisation, bank confirmations and escrow arrangements, reducing the risk that an authority will return an incomplete file.

Personalisation matters: the firm assigns a dedicated case manager to each client, ensuring a consistent point of contact who coordinates deadlines, flags risks and manages follow‑up queries. That continuity shortens response times and, in many cases, avoids costly resubmissions.

Internal summary: thorough project management and a single point of accountability materially improve administrative efficiency.

A step‑by‑step operational workflow that reduces friction

H3 — 1. Eligibility and vulnerability assessment

Every case begins with an eligibility check and a risk map. Advisors identify documentary weak points—such as gaps in banking history, complex offshore ownership or potential PEP status—and set out mitigation steps. This upfront clarity prevents surprises during later stages.

H3 — 2. Audit‑grade document assembly

Siyah Agents prepares an indexed, annotated dossier: certified copies, translations, apostilles and original bank traces. Documents are collected in a standardised folder, each item checked against government checklists to reduce the likelihood of follow‑up requests.

H3 — 3. Compliance and escrow safeguards

For investment routes, the firm recommends escrowed transactions and independent appraisal reports to protect clients and make investment records auditable. Escrow reduces settlement risk and signals good governance to authorities.

H3 — 4. Submission and authority liaison

Siyah Agents submits files through authorised channels and monitors progress. When authorities request clarifications, the case manager coordinates rapid responses, often cutting weeks from the typical response window.

Internal summary: structured phases—assessment, assembly, safeguards, submission—limit errors and create auditable records.

Risk management: what can be mitigated and what cannot

No professional can guarantee a government decision. Siyah Agents is explicit about residual risks: sudden policy changes, political developments, or discretionary re‑assessments by authorities can affect outcomes. What advisers can control—and materially improve—are: the accuracy of documentation, legal structuring, and the speed of responses to official queries.

Typical mitigations include independent valuations for property, forensic proof of funds, and pre‑emptive tax and AML reviews. Data shows professionally prepared applications tend to avoid the most common administrative rejections—though precise rejection‑rate reductions vary by programme and are, for many jurisdictions, inconclusive.

Callout: Expect better odds with rigorous preparation—but never a guaranteed result.

Internal summary: advisors reduce avoidable risks; uncontrollable policy or discretion risks remain.

Practical examples: how process saves time and cost (anonymised)

H3 — Streamlining a residency application for a family

A family based in Lagos needed verified housing proof, notarised documents and bank attestations. Early project scoping revealed missing apostilles and a landlord reference. Siyah Agents coordinated local notary work, expedited apostilles and provided a checklist that cleared the file for submission. The authority issued the first‑instance residency card within the lower end of the typical processing range.

H3 — Protecting investor capital on a property route

An investor preparing a property purchase required clear title and independent valuation. Siyah Agents arranged escrow, an independent valuer and a staged payment plan. That structure satisfied the issuing authority’s transparency checks and reduced the risk of contested valuations later.

Internal summary: proactive coordination and escrow reduce both time to decision and downstream disputes.

Realistic timelines and cost ranges to expect

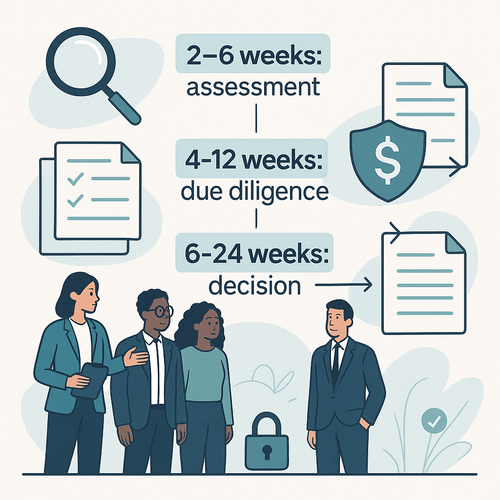

Processing times and costs vary by country, visa category and the applicant’s background. As a general guide:

- Initial eligibility assessment and document assembly: 2–6 weeks.

- Full due diligence (including third‑party verifications): 4–12 weeks.

- Submission to decision: commonly 6–24 weeks, with complex cases extending to several months longer.

Advisory fees, third‑party due diligence and document legalisation typically range from several thousand to tens of thousands of pounds depending on complexity. Siyah Agents provides itemised estimates after an initial assessment so clients can budget realistically.

Internal summary: budget time and money conservatively; expect variability and plan contingency funds.

Choosing the right advisor: red flags and due diligence tips

Select an adviser who demonstrates transparency: clear engagement letters, itemised fees, documented compliance procedures and professional indemnity insurance. Red flags include demands for full payment upfront, vague deliverables or pressure to bypass formal channels. Verify advisers’ professional memberships and insist on written milestone plans.

Internal summary: insist on written terms, staged fees and verifiable professional credentials.

Conclusion and call to action

Complex applications need not be immobilising. For African professionals and investors, the difference between delay and progress often comes down to preparation, process and a trusted partner who manages details relentlessly. Siyah Agents combines legal insight, project‑management discipline and local networks to simplify complex submissions while making clients aware of residual risks.

If you are preparing a residency, citizenship or investment application and need support to reduce avoidable risk and accelerate your timeline, contact Siyah Agents for a confidential assessment and a clear, itemised plan of action.

Take the next step: request a confidential eligibility review and project plan from Siyah Agents today.