Ten‑Year Outlook: Global mobility at a crossroads

Executive summary

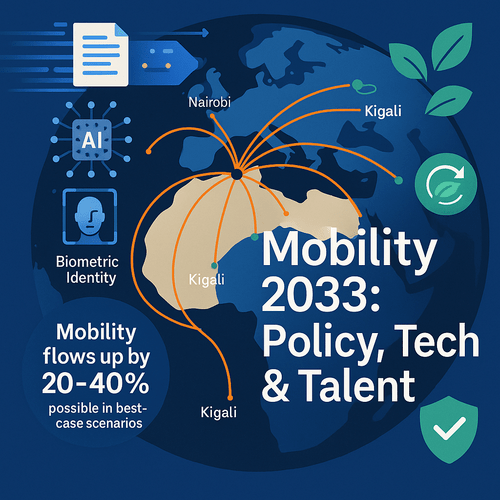

The global mobility industry will be reshaped over the next decade by policy shifts, technological advances, changing talent patterns, sustainability pressures and denser public–private ecosystems. For English‑speaking African professionals and investors, this means more differentiated pathways to residency and work, faster digitally enabled processes, stronger compliance expectations and fresh opportunities in regional hubs. This briefing outlines credible scenarios, practical implications and what to do next.

Internal summary: anticipate faster, digital first mobility services; expect stricter due diligence; position for Africa’s talent renaissance while planning for policy and tech risk.

Policy dynamics: regulation, residency and scrutiny

H2 — Where policy is heading

Governments will balance attraction of investment and talent with security and public accountability. Recent analyses from the International Organization for Migration (IOM) and consulting firms show two durable tendencies: liberalisation in targeted visa classes (digital nomad, start‑up visas) and simultaneous tightening of due diligence for investment routes. In short: more openings, but higher checks.

H3 — Residency by investment: evolution not extinction

Residency‑by‑investment (RBI) programmes will persist but become more outcome‑oriented. Expect host states to demand clearer economic benefit—job creation, innovation or regional development—rather than passive capital alone. Some jurisdictions may raise thresholds; others will diversify qualifying assets (funds, R&D, green projects). Where evidence is incomplete on the precise threshold shifts, mark policy movement as inconclusive and treat forecasts as scenario ranges.

Callout:

- Policy trend: targeted liberalisation of skills visas, increased scrutiny for investment routes.

Internal summary: regulatory change will reward transparency and demonstrable impact.

Technology and data: faster, smarter, riskier

H2 — Automation, AI and identity

Technology will underpin next‑generation mobility. AI‑assisted application processing, automated document verification and data‑driven risk scoring are already reducing friction in visa systems. Industry studies suggest AI can materially shorten adjudication times for routine cases, while keeping higher‑risk files for manual review. Blockchain pilots for portable identity credentials are advancing in pilot projects, especially for professional qualifications and educational credentials.

H3 — The double‑edged sword of data reliance

Greater automation delivers speed, but it increases reliance on data integrity and cyber resilience. Privacy and cross‑border data sharing will require legal harmonisation; until then, fragmentation is likely. Evidence about large‑scale, reliable cross‑jurisdiction identity networks remains inconclusive—adoption will be uneven across regions.

Callout:

- Tech upside: faster processing and better risk detection.

- Tech caveat: privacy, cyber risk and uneven adoption.

Internal summary: tech will accelerate mobility, but effective use depends on secure, interoperable data systems.

Talent mobility and ecosystems: Africa’s emerging role

H2 — From brain drain to brain circulation

Africa’s narrative is shifting from one‑way emigration to bi‑directional talent flows. IOM and sector research point to growing return migration and intra‑African mobility as diaspora professionals repatriate skills and invest in local hubs. Nairobi, Lagos and Kigali exemplify rapid ecosystem growth, attracting both regional and international talent.

H3 — Remote work and distributed teams

Remote work is here to stay in a hybrid form. Employers will increasingly hire across borders while relying on local residency options for critical staff requiring physical presence. Some African jurisdictions are already piloting remote‑worker incentives; this trend may expand, providing revenue for local services and new markets for mobility providers. However, infrastructure constraints (broadband, reliable electricity) remain a practical blocker in parts of the continent.

Internal summary: talent mobility will favour regions that combine human capital with reliable digital and physical infrastructure.

Sustainability and responsible mobility

H2 — Environmental impact and corporate responsibility

Sustainability will become a standard lens for mobility programmes. Airlines, employers and advisory firms face pressure to reduce travel‑related emissions; expect more carbon‑aware relocation packages and standards for sustainable relocation. While industry roadmaps aim for net‑zero aviation by mid‑century, credible near‑term reductions will depend on technology adoption and policy incentives. The evidence for rapid decarbonisation is mixed and partly inconclusive; plan for progressive, not instantaneous, change.

H3 — Social impact and inclusion

Responsible mobility increasingly means ensuring local benefit: skills transfer, employment and inclusive procurement. Mobility programmes that tie investor benefits to local development—training, local hiring or community projects—will gain political and social legitimacy.

Internal summary: sustainability and inclusion will be defining features of credible mobility offerings.

Risks and uncertainties: what can derail expectations

H2 — Geopolitical and economic shocks

Mobility strategies are exposed to geopolitical shocks—sanctions, border closures and pandemic‑style disruptions. Scenario planning is essential: build contingency options (dual residency, regional hubs) and avoid overreliance on a single jurisdiction.

H3 — Data security, governance and trust

As identity and credential systems digitise, the risk of data breaches and trust erosion rises. Regulators may clamp down, increasing compliance costs and complexity. Evidence on long‑term systemic resilience is inconclusive; prudent actors will budget for enhanced cybersecurity and legal review.

Internal summary: resilience and contingency planning must be core to mobility strategy.

Plausible scenarios for 2033

H2 — Three credible futures (ranges)

- Optimistic integration: interoperable digital identity frameworks and robust public–private partnerships reduce friction; mobility expands by 20–40% in legal flows, with African hubs capturing new tech and talent investment (inconclusive on precise percentages; scenario based on trend extrapolation).

- Fragmented patchwork: jurisdictions adopt divergent standards, increasing administrative complexity—mobility grows modestly, but costs and compliance burdens rise.

- Restrictive recalibration: a series of shocks prompts tightened borders and higher thresholds for investor programmes; mobility benefits narrow and emphasise high‑value skills only.

Internal summary: plan for multiple futures; prioritise adaptability and regulatory intelligence.

What this means for African professionals and investors

H2 — Practical actions to prepare

- Build graceful redundancy: diversify residency options and avoid concentration in one jurisdiction.

- Invest in digital credentials and document readiness: authenticated qualifications and auditable fund trails will speed approvals.

- Prioritise partnerships: local partners and mobility experts reduce friction and surface emergent risks early.

Callout:

- Start now: prepare documents, clarify objectives and budget for compliance and cyber resilience.

Internal summary: readiness equals opportunity—early movers who pair compliance with strategic investment will gain the most.

Conclusion: stay strategic, stay nimble

The next decade presents both opportunity and complexity. Policy, technology and sustainability will shape mobility in ways that advantage the prepared and penalise the complacent. For African professionals and investors who want to secure mobility, capitalise on talent flows and engage responsibly, the time to prepare is now. Siyah Agents offers strategic advisory and scenario planning that translates industry shifts into personal opportunity—contact them for tailored guidance.

Sources: IOM migration reports; McKinsey global mobility analyses; industry studies on AI and identity; Siyah Agents proprietary market intelligence. (Where precise numeric projections are not public, we mark projections as scenario‑based and inconclusive.)