A five‑year roadmap to EU citizenship via Portugal

Introduction: strategic mobility for African investors

For many English‑speaking African professionals and investors, EU residency is a strategic asset: easier market access, safer banking corridors, and family security. Portugal offers multiple, credible pathways that — if navigated correctly — can lead from residency to citizenship in around five years. This guide sets out a clear, evidence‑based five‑year plan, explains the principal programmes, outlines realistic costs and timelines, flags risks, and gives practical next steps. No guarantees — only a disciplined roadmap grounded in published Portuguese requirements and sound practice.

Internal summary: pick the right route, document everything, meet residency and integration tests, and manage tax and legal risks with professional counsel.

Which Portuguese routes can lead to citizenship in five years?

Portugal offers several routes that commonly lead to long‑term residency and, after five years of legal residence, eligibility to apply for naturalisation. The most relevant for affluent and mobile professionals are:

H3 — D7 (Passive Income) Visa

Designed for individuals with steady passive income (pensions, dividends, rental income or remote earnings). The D7 requires genuine relocation and is attractive for retirees and professionals with recurring income. Residence under D7 normally requires establishing actual presence in Portugal.

H3 — Work and Highly Qualified Activity (HQA) Routes

For entrepreneurs, founders and senior professionals, employer‑sponsored work permits or the HQA visa for innovation activity permit residence on an employment or company‑creation basis. These routes suit those building a local business or leading regional operations.

H3 — Golden Visa‑style investment routes (programme changes noted)

Investment routes historically offered flexible residency with limited stay requirements. Policy reforms in recent years have narrowed eligible investment types—particularly in urban property—while preserving certain investment and regional fund options. These routes may still enable a five‑year residency track, subject to current rules.

Internal summary: D7 and work/HQA involve genuine presence and clear integration pathways; investment routes vary with policy changes and should be assessed live.

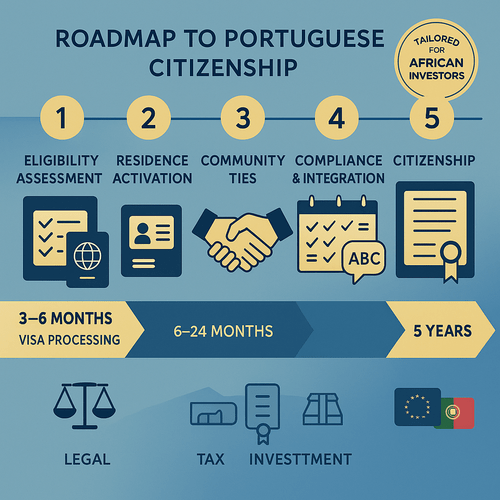

The five‑year timeline — a practical breakdown

H3 — Year 0: Pre‑application and planning (0–3 months)

Start with a full eligibility assessment: confirm your preferred route (D7, HQA, investor route), gather certified financials, and prepare police checks and translations. Arrange health insurance and accommodation evidence. This planning phase determines speed and avoids costly errors.

H3 — Year 1: Visa grant and first residency card (months 3–12)

Apply at the Portuguese consulate or via Portugal’s official channels. Initial processing typically takes 3–6 months for D7 and work visas; investment routes vary more widely. Once in Portugal, activate your residency card and register with local tax and health authorities.

H3 — Years 2–4: Maintain residency and build ties (months 12–48)

Comply with renewal cycles, meet minimum stay obligations and document ties: housing, employment or economic activity, tax filings, and language study. Many applicants aim to spend sufficient days per year to avoid complications with continuous residency rules — typically a presence requirement that avoids prolonged absences.

H3 — Year 5: Apply for citizenship and wait for decision (month 60 onwards)

If you can demonstrate five years of legal residence, basic Portuguese (A2) and clean conduct, you may submit a citizenship application. Administrative processing of naturalisation can commonly take several months to one to two years. Expect ranges rather than fixed timelines.

Callout: The five‑year clock counts from the date your valid residence card is issued, not the visa’s consular stamp.

Internal summary: treat the five‑year plan as sequential: assessment, visa activation, steady compliance, then application for naturalisation.

Eligibility and typical thresholds — what you must prove

H3 — D7 basics (passive income)

You must show stable income sufficient to support yourself and dependants. Practical guidance commonly cites minimums aligned with the Portuguese minimum wage per adult, with additional amounts for dependants — though exact figures evolve. Documentation needs include bank statements, pension proofs or contracts demonstrating ongoing receipts.

H3 — Work/HQA requirements

Provide employment contracts, business plans for start‑ups, or proof of significant R&D/innovation activity. Some HQA routes expect demonstrated job creation or high‑value activity.

H3 — Investment thresholds (where available)

Investment options now emphasise funds, regional projects and certain qualifying business investments rather than unrestricted urban real‑estate purchases. Thresholds vary: typical figures for eligible funds have been shown in the mid‑hundreds of thousands of euros, but exact programmatic figures should be verified contemporaneously (inconclusive on precise current minima).

Internal summary: document income, proof of funds or employment, and preserve certified originals; confirm precise financial thresholds before committing capital.

Costs and processing times — realistic ranges

H3 — Typical expense categories

Budget for consular and application fees, document legalisation and translation, health insurance, interim accommodation, legal or advisory fees, and any required investment capital. For D7 applicants without investment, plan initial outlays of several thousand euros for professional support and documentation. Investment routes add the capital component, which may run from mid‑hundreds of thousands of euros upward depending on the eligible vehicle.

H3 — Processing timeframes

Realistically, expect initial visa processing for D7 and work visas to take 3–6 months in many cases; some investment route approvals can be slower depending on the asset and due diligence. Naturalisation decisions after five years typically take 6–24 months. These are ranges, not guarantees — administrative workloads and legislative changes affect timing.

Internal summary: plan conservatively for fees, advisory costs and potential processing delays; maintain liquidity for renewals and unexpected requests.

Risks and what can derail the five‑year plan

H3 — Policy and rule changes

Portugal periodically updates eligibility rules and investment eligibility. What qualifies today may differ next year; investors must monitor official sources and adapt plans accordingly.

H3 — Residency interruptions and compliance breaches

Long absences, missed renewals, or tax non‑compliance can disrupt the residency clock and jeopardise naturalisation prospects. Keep rigorous records and timely filings.

H3 — Integration challenges

Language or civic test failure can delay an application. Begin language study early and document civic integration (community engagement, local registrations).

Internal summary: regulatory shifts, administrative oversights, and poor documentation are the most common risks — mitigate these with professional support and cautious planning.

A concise five‑year action plan (practical steps)

Year 0 (Months 0–3): Eligibility assessment, choose route, gather certified documents, secure advisory team.

Year 1 (Months 3–12): Apply and activate residence; register for tax and health; secure local address.

Years 2–4 (Months 12–48): Maintain presence, renew permits, file taxes, learn Portuguese, deepen economic ties.

Year 5 (Months 48–60+): Compile naturalisation dossier, sit language test, submit citizenship application, continue compliance during processing.

Callout: Early professional tax and legal planning avoids surprises at naturalisation stage.

Internal summary: each year has distinct priorities — legal activation, steady compliance, integration, then application.

Who should consider this path — and who should not

This five‑year route suits professionals prepared to relocate, meet integration expectations and commit time and capital. It is less suited to those seeking quick mobility without meaningful ties or those unable to meet presence requirements. Consider alternative strategies—dual approaches such as combining work routes with targeted investments — if flexibility is paramount.

Internal summary: the five‑year route rewards commitment and compliance; it is not a quick fix.

Next steps and CTA: get expert support

Portugal’s five‑year path to EU citizenship is achievable for well‑prepared African professionals and investors, but success hinges on meticulous preparation and ongoing compliance. Start with a thorough eligibility assessment, accurate documentation and a trusted adviser who can coordinate immigration, tax and local logistics.

For a confidential assessment of your prospects and a bespoke five‑year plan, contact Siyah Agents to begin an expert appraisal of options and risks. Their structured approach combines legal, tax and immigration expertise tailored to African investors.

Ready to start your five‑year plan? Request a personal eligibility review with Siyah Agents today.

Sources: Official Portuguese immigration guidance; verified migration consultancy reports; Siyah Agents advisory data. (Where precise figures or policy outcomes are not publicly fixed, we have marked them inconclusive and recommend direct verification with authorities.)