Launching in Portugal: the D2 advantage

Introduction: why founders choose Portugal

Portugal has become a favoured base for growth‑minded founders: competitive living costs, EU market access and a maturing tech ecosystem make it attractive. For non‑EU entrepreneurs, the D2 visa — Portugal’s entrepreneur route — enables legal residence while you set up and scale a business. This guide explains practical eligibility, entity choices, funding expectations, residency and tax implications, realistic timelines, and the risks to plan for.

Internal summary: D2 rewards credible, well‑funded business plans and ongoing compliance. It is not a shortcut; preparation and local execution matter.

Who qualifies for the D2 visa?

H3 — Core eligibility

The D2 visa targets non‑EU/EEA nationals aiming to found, buy or invest in a Portuguese company. Applications rest on a convincing business plan, demonstrable funds to launch and sustain the enterprise, evidence you will create local economic value, and clean criminal records. Health cover valid in Portugal is also required.

H3 — What authorities expect

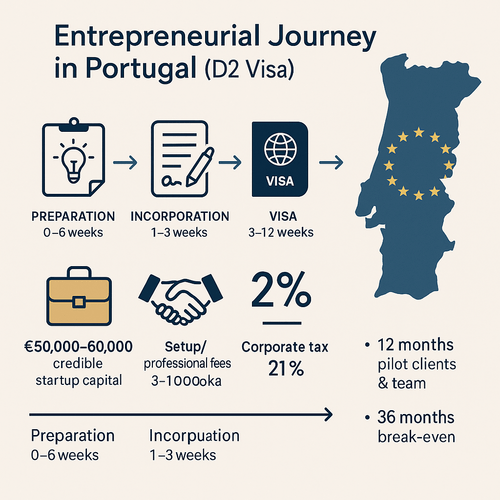

Authorities look for a viable, implementable plan: market research, a clear value proposition, realistic financial projections and, where applicable, evidence of job creation or export potential. There is no fixed minimum investment published; immigration officials assess sufficiency against the plan. Practical advisory practice suggests early‑stage service or digital startups typically show €50,000–€60,000 in available capital as credible, while capital‑intensive projects need more. This range is indicative and not an administrative rule (inconclusive).

Which entity form should you choose?

H3 — Sociedade por Quotas (LDA)

The LDA — a private limited company — is the most common choice for D2 applicants. It provides limited liability, familiar governance and a credible structure for investors. Nominal share capital can be low, but practical credibility often calls for several thousand euros in subscribed capital.

H3 — Sole trader and other options

Sole proprietorships are simpler but expose personal liability and can look less robust for immigration purposes. Joint ventures or branch registrations are possible alternatives, depending on strategy. Choose a structure that aligns with funding, liability and exit plans.

Internal summary: an LDA usually balances credibility, liability protection and administrative ease for founders.

Funding, costs and financial preparation

H3 — How much should you bring?

Beyond operational burn, budget for: company incorporation, legalisation of documents, visa and SEF fees, translation and notarisation, professional services (legal, accounting), and initial living costs. Practical benchmarks: initial setup and professional fees often total €3,000–€10,000, while showing €50,000+ in deployable capital is commonly persuasive for simple startup plans. For manufacturing, exports or hospitality, required capital rises materially.

H3 — Proving funds and source of wealth

Portuguese authorities verify both availability and provenance of funds. Prepare audited accounts, sale contracts, bank histories and legal proof for transfers. Circular or opaque transactions trigger enhanced due diligence. Meticulous source‑of‑fund documentation reduces delay and suspicion.

Callout: build an ‘audit pack’—certified bank statements, sale deeds, shareholder agreements and clear SWIFT traces—to speed checks and reduce follow‑up requests.

Residency rights and compliance obligations

H3 — Residence permits and family rights

Successful D2 applicants receive an initial residency permit (often up to two years) and can apply for renewals (commonly three‑year periods thereafter). The D2 permits family reunification for spouses and minor dependants. Holders enjoy access to local healthcare and may travel within Schengen for short stays, subject to standard rules.

H3 — Maintaining compliance

Key obligations: maintain your business activity, file annual accounts, register and pay taxes, and satisfy SEF on residence renewals. Authorities expect economic activity; prolonged dormancy or failure to file can jeopardise permit renewal.

Internal summary: residency is conditional on active business operation and administrative compliance.

Tax and labour considerations

H3 — Personal and corporate tax landscape

Portugal taxes residents on worldwide income once tax residency criteria (typically 183 days per year or habitual residence) are met. Corporate tax stands at a standard rate (commonly 21%), with local regimes for SMEs and incentives for export, R&D or investment in certain regions. The Non‑Habitual Resident (NHR) regime can offer transitional tax benefits for eligible new residents, but policies change and should be verified.

H3 — Employment and social charges

If you employ staff, expect employer social contributions and payroll obligations. Labour law offers protections for workers; plan for hiring costs, mandatory contributions and HR compliance when budgeting.

Internal summary: tax and payroll costs are real and should be budgeted from day one; specialist tax advice is essential.

Step‑by‑step application timeline

H3 — Practical milestones

- Preparation (0–6 weeks): develop a concise business plan, gather certified documents, obtain criminal records and health cover.

- Company formation (1–3 weeks to incorporate): register the company, obtain tax ID (NIF) and open a bank account.

- Visa application (3–12 weeks): submit to Portuguese consulate or via online channels; timing varies by post.

- Entry and SEF appointment (1–3 months): travel to Portugal, finalise SEF appointment and receive residency card (allow 3–6 months total from initial application as a cautious planning horizon).

These ranges reflect typical practice; specific cases, consular load and extra due diligence can extend each phase.

Risks and common pitfalls for founders

H3 — Practical risks to anticipate

- Underfunding: undercapitalised ventures are the most common cause of permit refusal or non‑renewal.

- Weak documentation: incomplete proof of funds, missing apostilles or inconsistent corporate records trigger delays.

- Market fit and scalability: Portugal’s domestic market is modest; export strategy or pan‑EU ambition increases growth prospects but also complexity.

H3 — Mitigation strategies

- Prepare robust financial models and conservative cash‑flow forecasts.

- Use escrow or staged investments to demonstrate committed capital.

- Engage trusted local accountants and lawyers to ensure filings and payroll are timely.

Internal summary: fund sufficiently, document meticulously and plan for EU market scaling if growth is a priority.

Benchmarks for entrepreneurial success in Portugal

H3 — Realistic early goals

- First 12 months: legal establishment, pilot customers, local team formation and initial revenue generation.

- 18–36 months: reaching break‑even for service businesses; longer for capital‑intensive models.

- 3–5 years: evidence of sustainable operations, hiring and tax filings that support residency renewal and potential naturalisation planning.

H3 — What accelerates success

Export orientation, digital‑first offerings, partnerships with local incubators and participation in EU funding or accelerator programmes often speed scale. Fluency in Portuguese and local networking materially improve client acquisition and supplier terms.

Callout: aim for a clear 12‑month pilot and a 36‑month path to sustainability—then revisit scale and fundraising plans.

Conclusion and next steps: practical support matters

The D2 visa offers a genuine route for entrepreneurs to live and build in Portugal. It requires disciplined planning, credible funding and ongoing compliance rather than optimism alone. If you are preparing a D2 application or refining a Portuguese business plan, consider expert, local guidance to reduce errors and accelerate progress. Siyah Agents provides tailored advisory for founders — from eligibility checks and company setup to tax planning and SEF liaison — helping founders convert ambition into long‑term Portuguese ventures.

If you’d like a confidential discussion about your D2 ambitions and a bespoke project plan, contact Siyah Agents for a personalised assessment and next steps.

Sources: Portuguese immigration official guidance; verified entrepreneurial advisories; Siyah Agents internal case experience.