Mediterranean choices: choosing between Spain and Greece

Introduction: Europe by investment—what investors must know

Golden Visas in Spain and Greece remain prominent routes for investors seeking European residency. Both programmes offer residency rights in the Schengen area (Spain) or Schengen travel access (Greece), but investment thresholds, eligible assets and long‑term outcomes differ materially. This guide focuses on verifiable requirements, realistic timelines, renewal and exit options, and principal risks—so you can choose a route that suits family and portfolio objectives.

Internal summary: Spain offers broader investment routes; Greece typically leads on entry cost (outside major urban zones). Both require careful planning for renewal, tax and eventual citizenship aims.

Spain Golden Visa: investment routes and thresholds

H3 — Core investment categories

Spain’s investor residency framework provides several qualifying routes. The most commonly used are:

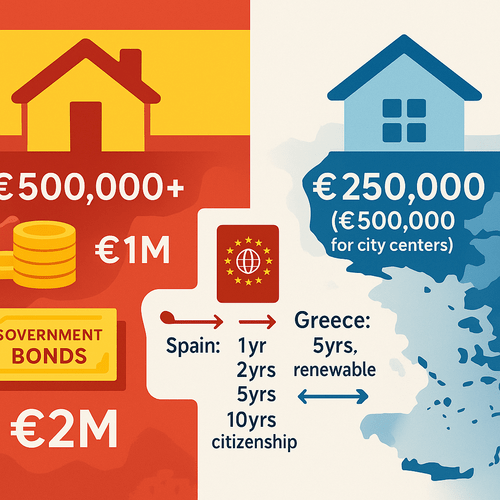

- Real estate acquisition: minimum €500,000 in Spanish property, held free of liens. Multiple properties may be combined to reach the threshold.

- Capital investment: commonly stated minimums are €1 million in Spanish company shares or bank deposits and €2 million in Spanish government bonds.

- Business project: a director‑level or job‑creating investment that the Spanish authorities deem of general interest; criteria are discretionary and assessed case by case (Spanish Ministry of Interior).

H3 — Practical notes on Spanish qualifying investments

- Properties purchased before the scheme’s relevant start date do not qualify; funds must be clear and traceable.

- Joint purchases do not halve thresholds—each investor must meet qualifying sums for separate residency rights.

- Business investments require demonstrable economic impact—job creation, technological value, or regional development.

Callout: Spain’s programme allows diverse capital routes beyond property—but each route brings distinct due diligence and holding‑period expectations.

Greece Golden Visa: investing at a lower entry point (often)

H3 — Property route remains dominant

Greece historically promoted the Golden Visa with a €250,000 minimum property purchase—one of the lowest entry points in Europe. However, recent policy adjustments have raised thresholds in central urban or high‑demand zones to €500,000 in some areas, while the €250,000 floor still applies in many regions (Greek Ministry of Migration). Exact eligible zones have shifted; confirm current maps before committing.

H3 — Alternative routes and current constraints

Greece’s programme is primarily real‑estate driven. Alternative investment channels—certain real estate investment funds or corporate shares—exist but have been subject to legislative review and intermittent suspension. As a result, property remains the principal, most straightforward route for many investors.

Callout: Greece’s lower base threshold is attractive, but city‑centre or island investments may now require higher sums—confirm zone specifics before purchase.

Residency timelines, renewals and compliance

H3 — Spain: residency cadence and renewal

Spain usually issues an initial investor residence permit valid for one year (or short‑term visa to enter followed by card issuance), then renews for two‑year terms, and subsequently for five‑year periods, provided the qualifying investment is maintained. Importantly, Spain historically required only minimal physical presence to renew the Golden Visa, though longer residence is required for permanent residence or naturalisation (continuous residency typically 5 years for permanent residence; 10 years for citizenship, with exceptions).

H3 — Greece: five‑year stability but renewal conditions

Greece grants an initial five‑year residence permit under the Golden Visa scheme, renewable for successive five‑year periods if investment ownership continues. Greece has allowed renewal without strict minimum stay, making it attractive for investors seeking passive residency. Citizenship, however, requires habitual residence (generally 7 years) with substantive presence and integration.

Internal summary: Spain and Greece offer renewal pathways tied to maintained investment, but naturalisation requires sustained physical presence and integration tests.

Exit strategies and routes to citizenship

H3 — Selling the investment and consequences

Selling qualifying assets normally terminates the Golden Visa entitlement. Investors considering sale should plan the timing carefully—especially where family residency or work depends on the permit. Some jurisdictions allow temporary exceptions or grace periods, but this is not universal.

H3 — Citizenship prospects and timelines

- Spain: Permanent residency typically available after 5 years of legal residence; citizenship applications commonly follow after 10 years of residence, with some nationality exceptions reducing this term. Physical presence and tax compliance are critical.

- Greece: Golden Visa holders may seek citizenship after longer periods of habitual residence—often around 7 years—subject to integration and residence requirements. Exact timelines depend on demonstrated habitual residence and compliance.

Callout: Golden Visas are powerful residency tools—but not immediate citizenship tickets. Expect multi‑year commitments if citizenship is the objective.

Risks and practical considerations for investors

H3 — Market liquidity and property risks

Real estate remains the principal route in Greece and a major option in Spain. Liquidity varies: tourist hotspots may offer higher rental yields but face seasonal demand and price cyclicality; peripheral areas may be cheaper but harder to sell. Model exit horizons conservatively—three to seven years or longer depending on location and market conditions.

H3 — Regulatory and political change

Golden Visa frameworks are politically sensitive and have evolved under public and EU scrutiny. Greece’s 2023 changes exemplify rapid reform in response to domestic concerns. Expect potential adjustments to thresholds, eligible zones or programme suspension—monitor official guidance and plan contingency strategies.

H3 — Tax and residency implications

Acquiring residency affects tax residence rules. Both countries assess tax residence primarily on days present and economic ties. Investors must map corporate, personal and wealth tax consequences with a specialist; failure to plan can create unintended tax exposure.

H3 — Compliance and due diligence

Authorities re‑verify source of funds, business provenance and property title on renewal. Independent valuations, escrowed payments and clear audit trails reduce the risk of post‑grant challenges. Use regulated professionals for conveyancing and appraisal to lower legal risk.

Internal summary: weigh market, regulatory and tax risks carefully—and plan exits and tax structure early.

How to choose between Spain and Greece: a pragmatic checklist

- Budget and entry cost: Greece often offers lower entry points in many regions; Spain’s alternatives demand larger capital for non‑property routes.

- Investment diversity: Spain permits more capital‑based routes; Greece is property‑centric.

- Residency lifestyle: Spain offers broader socio‑economic infrastructure; Greece appeals for lower costs and passive residency models.

- Citizenship horizon: Spain’s pathway to citizenship is generally longer (10 years) than Greece’s habitual residence criteria (commonly c.7 years), but both require documented presence for naturalisation.

Internal summary: choose based on capital, desired involvement, family plans and long‑term citizenship goals.

Conclusion and next steps for investors

Spain and Greece both offer compelling Golden Visa options—but the right choice depends on investment appetite, timeline and family objectives. Before committing capital, verify current official thresholds, secure independent valuations, and frame a tax and residency plan with qualified advisers.

For investors seeking personalised analysis, Siyah Agents provides tailored comparisons of Spain and Greece investment routes, diligence support and project management to manage submission, renewal and exit strategies. Contact Siyah Agents for a confidential consultation to map your preferred path and assess risks against your objectives.

Sources: Spanish Ministry of Interior; Greek Ministry of Migration; European migration policy analyses; Siyah Agents advisory materials.