Choosing between a passport and a place to live

Introduction: a practical decision for African investors

For English‑speaking African professionals and investors, obtaining either a second citizenship or long‑term residency is a strategic move: access new markets, secure family options and diversify assets. Citizenship by Investment (CBI) and Residency by Investment (RBI) share aims but deliver distinct rights, obligations and risks. This guide compares both routes clearly — eligibility, costs, timelines, mobility, tax and succession — so you can choose the pathway that fits your priorities.

Internal summary: CBI buys nationality; RBI buys residence and a pathway. The right choice depends on speed, family strategy, tax planning and risk tolerance.

Eligibility: who typically qualifies

H3 — Financial requirements

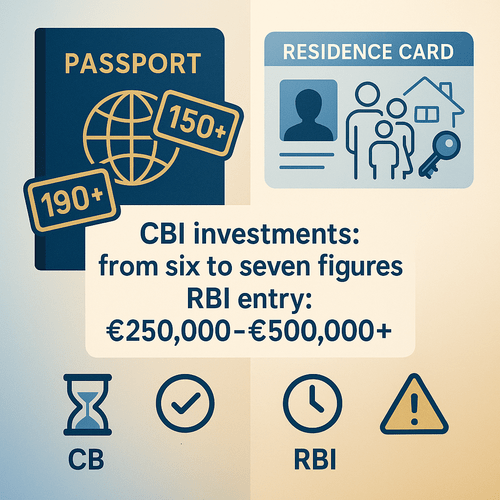

Both CBI and RBI hinge on demonstrable capital. CBI minimums vary widely—from roughly low‑six figures for some Caribbean programmes to seven‑figure investments in higher‑tier schemes. RBI thresholds similarly span a broad range: certain European Golden Visa routes have historically started around €250,000 for qualifying property, with other routes demanding €500,000 or more. These figures are indicative; confirm current official thresholds for each programme before acting.

H3 — Integrity checks and documentation

Robust due diligence is universal. Expect criminal‑record checks, source‑of‑fund verification and identity validation. Failure to provide clear, audited evidence of funds is a leading cause of refusal. Some CBI programmes carry heightened scrutiny due to international oversight; treat documentation as central to success.

Internal summary: you need clean personal records and fully traceable funds; the capital requirement depends on your chosen jurisdiction.

Cost comparison: headline capital and real‑world expenses

H3 — Direct investment and ancillary costs

Headlines tell only part of the story. CBI programmes often advertise a single minimum, but total cost includes family surcharges, due diligence fees and legal expenses. Expect ancillary costs from several thousand to tens of thousands of euros per adult. RBI routes add transaction taxes, property transfer costs, ongoing renewals and local service fees.

H3 — Lifetime and opportunity costs

Consider holding periods, maintenance and opportunity cost of locked capital. Property qualifying for some RBI schemes may require a minimum three‑ to five‑year hold. These factors affect net returns and liquidity.

Callout: budget beyond the headline investment for legal fees, due diligence and running costs.

Internal summary: compare full project‑level costs (investment + fees + maintenance), not just entry minima.

Processing times and practical steps

H3 — Speed to outcome

CBI can be the faster route to a new passport: Caribbean programmes may complete in a few months; some other CBI options also aim for relatively rapid naturalisation. RBI approvals may range from a few months to over a year, depending on the country and complexity of the investment. Transitioning from residency to citizenship typically adds years where naturalisation is required (commonly five years or more in many jurisdictions).

H3 — Procedural differences

CBI often requires proof of investment and completion before nationality is granted. RBI generally issues a residence permit first, with subsequent renewals contingent on maintaining qualifying conditions. Both processes demand careful document preparation and local legal involvement.

Internal summary: choose CBI for speed to nationality where available; choose RBI when you prefer staged integration or EU‑based residence pathways.

Benefits: citizenship rights versus residency freedoms

H3 — What citizenship delivers

Citizenship confers the full legal rights of nationality: a passport (travel privileges depend on the issuing country), political rights where applicable, and permanency of status. Citizenship is often inheritable by children, and in many cases persists irrespective of future residence choices.

H3 — What residency delivers

Residency gives you the legal right to live, work and access local services. RBI is often the first step towards naturalisation, but residency alone does not change your national identity or passport benefits until and unless you naturalise. For mobile professionals the flexibility of residency—sometimes with limited physical‑stay obligations—can be particularly valuable.

Callout: CBI = nationality and permanency; RBI = legal residence and gradual integration.

Internal summary: match the legal status to your strategic need—immediate nationality or progressive presence.

Travel mobility: passports versus residence cards

H3 — Passport power matters

A passport’s visa‑free reach varies dramatically. High‑ranking passports open 150–190+ destinations; others grant access to far fewer. CBI passports differ in quality by issuing country; some deliver extensive mobility, others more limited access.

H3 — Residency‑based mobility

RBI often provides Schengen or regional travel rights if the host is in a zone that confers that benefit, but your original passport still determines wider visa access. Residency can ease short‑term travel within the host region while you retain your original nationality.

Internal summary: if global mobility is the prime objective, compare passport visa access carefully rather than assuming all CBI passports are equal.

Tax and succession: plan early and precisely

H3 — Tax residence and obligations

Tax consequences hinge on where you are tax‑resident, not solely on citizenship. Many investors seek CBI in jurisdictions with favourable tax regimes, but becoming tax resident typically requires physical presence or other ties. RBI may trigger tax residency if you spend substantial time locally; some countries offer favourable newcomer regimes for a limited period. Always obtain cross‑border tax advice before changing residence or nationality.

H3 — Succession and family planning

CBI commonly transfers nationality status to children and sometimes spouses automatically, simplifying cross‑border succession and inheritance planning. RBI extends residence to family members but does not necessarily confer nationality for descendants without further naturalisation steps. Succession planning should consider local inheritance law and potential wealth taxes.

Internal summary: tax residency is driven by presence and ties; succession benefits generally favour immediate citizenship routes. Seek specialist tax and estate counsel.

Risks and programme variability

H3 — Regulatory and political risk

CBI and RBI schemes are policy instruments and can be tightened, suspended, or reformed. Programmes have closed or altered terms in response to public scrutiny or geopolitical pressure. Anticipate regulatory change and model downside scenarios.

H3 — Financial and legal risk

Real estate values can fluctuate; fund routes depend on governance and redemption terms. Legal protections vary by jurisdiction—title clarity, dispute resolution mechanisms and enforcement matter. Inconclusive: exact probabilities of adverse changes differ by country and are time‑sensitive.

Callout: always stress‑test plans for policy change, currency moves and liquidity constraints.

Internal summary: treat investment migration as a strategic, not speculative, allocation—factor in regulatory, liquidity and legal contingencies.

Practical guidance: which path suits which profile?

H3 — Choose CBI if you need:

- Immediate nationality or fast mobility for family

- A passport with specific visa advantages

- A route where residency expectations are impractical for your lifestyle

H3 — Choose RBI if you prefer:

- A staged approach to integration and citizenship

- Asset or business presence in a particular jurisdiction (e.g., EU access)

- Greater flexibility in investment type and portfolio allocation

Internal summary: CBI fits those prioritising nationality and speed; RBI suits investors seeking presence, business access and gradual naturalisation.

Conclusion and call to action: plan with experts

CBI and RBI each provide genuine pathways to international opportunity, but they differ fundamentally in legal outcome, timing and risk profile. The right choice depends on family goals, appetite for regulatory change, tax planning needs and liquidity preferences. For a tailored comparison and confidential assessment of which route matches your objectives, consult Siyah Agents for bespoke advice and scenario modelling.

Ready to evaluate your options? Contact Siyah Agents for a confidential, personalised eligibility review and strategic recommendation.