How to pick a safe, professional adviser

Introduction: why this matters now

Investment immigration promises mobility, market access and family security—yet it also attracts unscrupulous operators. For English‑speaking African professionals and investors, selecting the right firm is not a side task; it is central to protecting capital, reputation and future options. This guide presents practical, evidence‑based steps to spot fraud, verify credentials, and choose a reputable adviser.

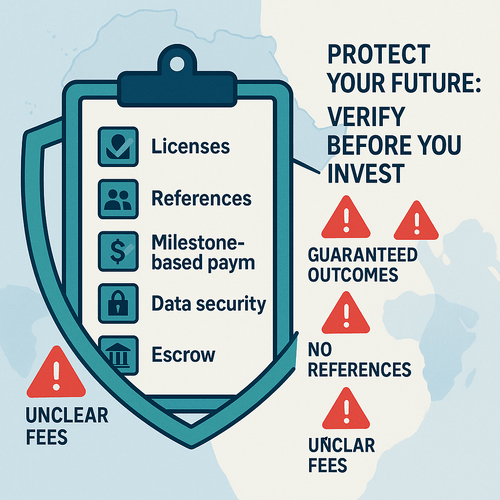

Internal summary: insist on licences, written terms, verified references and transparent fees. Treat due diligence as non‑negotiable.

Recognise the red flags: common scam tactics

Scammers know the language of urgency and exclusivity. Watch for these warning signs:

- Guarantees of citizenship or promises of fixed outcomes and deadlines. No legitimate firm can lawfully guarantee government approvals.

- Pressure to pay large sums upfront or to sign without a clear, written contract. Reputable advisers stage payments against milestones.

- Unusually low fees that are ‘too good to be true’—these often hide hidden charges or insolvency risk.

- Lack of verifiable company details: no business registration number, no physical address, no confirmed licences.

- Refusal to provide client references or to show anonymised case studies that can be independently checked.

If multiple red flags appear, pause and escalate your checks. Regulatory bodies and national immigration portals frequently publish alerts about scams—consult them as part of your verification.

Callout: If a firm promises guaranteed outcomes, treat it as a red flag and walk away.

Do your homework: licensing, credentials and firm history

A stepwise due diligence process reduces risk significantly. Start here.

Verify licences and registrations

Ask for the firm’s licence numbers and cross‑check with the issuing authority. Many countries publish lists of approved migration service providers; where a regulator exists, confirm the adviser’s standing. Licensing alone is not proof of excellence, but absence of licence is a decisive negative.

Check professional qualifications and memberships

Reputable firms list professional affiliations (legal bars, accountancy bodies, immigration associations). Verify membership IDs with the issuing organisations; fraudulent claims are often easy to detect. Memberships matter because they usually require firms to adhere to ethics and complaint procedures.

Examine corporate history and senior team biographies

Trace the firm’s registration history through national corporate registries. Look at the biographies of founders and senior advisers: credible firms show transparent career histories. Short, inconsistent or anonymous leadership records should prompt caution.

Internal summary: insist on verifiable licences, memberships and a clear company record before engaging.

Verify reputation: references, reviews and independent checks

Client feedback and third‑party validation are invaluable. Consider these steps.

Request client references and case studies

Ask for anonymised case examples similar to your circumstances and, if possible, speak to past clients. Reputable firms can provide references or permit you to contact clients directly. If a firm refuses, ask why and treat the explanation carefully.

Use independent review platforms and regulator lists

Scan independent review sites, trade press and regulator complaint databases for any negative patterns. Single negative comments do not prove malpractice; recurring complaints about the same issue are highly significant.

Check media presence and thought leadership

Firms that publish analyses, contribute to conferences, or are cited in credible outlets are often more transparent. Absence of public engagement is not disqualifying, but visible expertise can be a positive signal.

Callout: Triangulate reputation—matching testimonials, independent reviews and regulator records provide robust assurance.

Fee structures: what transparent pricing looks like

A clear fee schedule separates professional advisories from dubious operators. Watch for:

- A written, itemised fee proposal distinguishing professional fees from government, due‑diligence and investment costs.

- Payment schedules tied to milestones (for example: deposit on engagement, fee on application submission, balance on approval).

- Disclosure of ancillary charges: translations, apostilles, medicals and bank fees.

Typical ranges vary by programme and complexity; as a broad orienter, established adviser fees for major CBI/RBI work often fall within a moderate band. Offers far below market norms should be questioned, as should all‑in claims without itemisation. Always request a written engagement letter that sets out deliverables, timelines and refund policies (if any).

Internal summary: insist on itemised, milestone‑based fees and an engagement letter before paying substantial sums.

Contracts and consumer protections: read the small print

Contracts are the practical foundation of a safe transaction. Before signing:

- Ensure the engagement agreement names the services, outcomes that are advisory (not guaranteed), payment terms and data protection measures.

- Confirm the governing law and dispute resolution forum; international disputes can be costly and slow, so clarity matters.

- Ask whether funds will be held in escrow or client accounts until key milestones are met. Escrow arrangements materially reduce financial risk.

If a firm resists formal contracting or uses vague terms, consider that a serious warning sign.

Operational checks: staff, data security and post‑approval support

A reputable firm displays operational competence beyond salesmanship. Key aspects to verify:

- Adequate staffing with qualified specialists (lawyers, tax advisers, compliance officers).

- Data‑security policies for handling sensitive personal documents—ask how they store and transmit files.

- Post‑approval services: relocation assistance, bank introductions and ongoing compliance support; these indicate a long‑term client relationship model rather than a transactional mindset.

Internal summary: operational robustness reduces execution risk and improves your overall outcome.

Practical red‑flag checklist to use in meetings

- Do they provide a written engagement letter?

- Can they show current licences and membership numbers?

- Will they share verifiable client references?

- Are fees itemised with a clear payment schedule?

- Do they offer escrow or secure payment arrangements?

- How do they protect your personal data?

If the answer to two or more of these is negative or evasive, pause and seek alternatives.

Callout: Use the checklist at your first meeting—if a firm cannot satisfy basic checks, do not proceed.

Why ongoing support and honesty matter

Investment immigration is not a one‑off transaction. Regulations change, banks adapt policies and tax positions evolve. Reputable advisers provide ongoing updates and compliance support, and they make realistic assessments of risks and timelines. Firms that overpromise and underdeliver often disappear once fees are paid; ethical firms remain partners.

Financial and reputational stakes are high—choose a firm with verifiable continuity and a clear aftercare offering.

Choosing Siyah Agents with confidence

Siyah Agents exemplify the attributes described above: transparent fee disclosure, verifiable licences and a documented track record serving African investors. Their process emphasises pre‑engagement due diligence, milestone‑based billing and secure handling of client documentation. They do not promise guaranteed outcomes; instead, they offer evidence‑based advice and end‑to‑end support.

For professionals ready to move forward, start with an eligibility review, request a written engagement proposal and insist on escrowed payments for major transfers. These steps protect your capital and reputation.

Conclusion: protect your capital, protect your future

Selecting a reputable investment immigration firm requires patience, verification and controlled scepticism. By following the checks in this guide—spotting red flags, verifying licences and insisting on transparent contracts—you preserve both your wealth and your peace of mind.

For trusted, transparent, and client‑centred advisory, consider engaging Siyah Agents for a confidential eligibility review and a secure application pathway. Take the first step with robust due diligence; your future deserves no less.