Are you ready to take your business and family global?

Introduction: the strategic case for global residency

Global residency is no longer an exotic privilege — it is a strategic tool for African business leaders and entrepreneurs who want market access, operational resilience and family security. This guide explains who typically qualifies for residency and citizenship programmes, the common eligibility tests, realistic costs and timelines, and practical next steps so you can decide whether to pursue a pathway and how to prepare.

Internal summary: identify your objectives, confirm available capital and documentation, and use expert assessment to match programmes to your needs.

What do we mean by ‘global residency’?

Residency means legally living in another country. Programmes vary: some grant temporary residency, others long‑term settlement, and a few lead to citizenship. The most relevant types for high‑net‑worth professionals are:

- Residency by investment (Golden Visas) — typically real estate, funds or job creation.

- Citizenship by investment (CBI) — direct nationality after qualifying investment.

- Entrepreneur and start‑up visas — for founders who establish local businesses and jobs.

Each route trades capital, time or economic contribution for legal rights to live, work and access services in a new jurisdiction. The practical differences — physical‑stay requirements, family inclusion, and tax consequences — determine which route fits your life.

Internal summary: residency routes vary by investment type, stay rules and long‑term intent.

Who typically qualifies? Core eligibility pillars

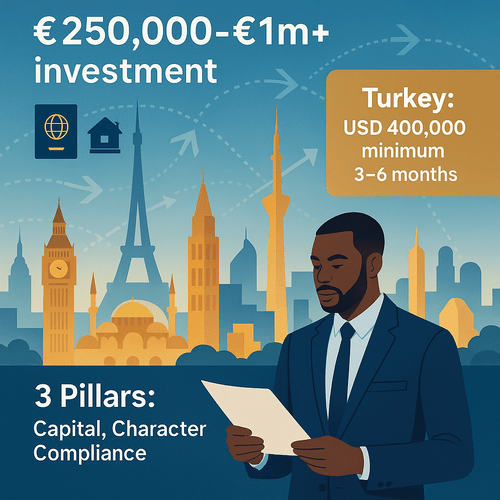

Eligibility is usually assessed across three pillars: capital, character and compliance. Meeting all three does not guarantee approval, but failing any one is likely to rule you out.

1. Capital: minimum investment thresholds and liquidity

Most programmes require a measurable financial commitment. Examples drawn from verified programme information include:

- Property routes: minimums vary widely — typical European Golden Visa entry points range from €250,000 to €500,000, while some CBI routes start at USD 100,000+ depending on jurisdiction and route.

- Fund or bond routes: some states accept certified investment funds or government bonds with thresholds commonly from €250,000 upwards.

- Business routes: may require a startup capital injection or demonstrable job creation, often starting at €100,000+ or a specified number of local hires.

These figures are indicative; confirm exact thresholds with official sources for each country and programme, as governments revise minima.

2. Character: background checks and due diligence

Rigorous vetting is standard. Authorities will check criminal records, immigration history and reputational risks. Expect thorough source‑of‑fund verification — banks, sale agreements and audited accounts are commonly required. Poorly documented funds or adverse legal records significantly reduce approval chances.

3. Compliance: administrative and residency obligations

Some schemes demand minimal physical presence (a few days per year), others require substantive residence and integration for naturalisation. Tax residency rules are separate and generally follow days‑present or centre‑of‑life tests. Be clear on both the immigration and tax obligations before you commit.

Internal summary: you need documented capital, a clean personal record and the willingness to meet administrative and tax requirements.

Spotlight: Turkey Instant Citizenship — a practical example

Turkey’s citizenship-by-investment programme is often referenced for its speed and accessibility for investors. Verified programme features include:

- Minimum property investment: historically set around USD 400,000 for qualifying real estate; alternative routes include specified bank deposits, government bonds or capital investment.

- Family inclusion: spouse and dependent children are usually eligible when included in the application.

- Physical presence: most applicants are not required to live permanently in Turkey to qualify or retain citizenship.

Processing times vary, but many applicants complete the scheme in about 3–6 months from investment to naturalisation, subject to due diligence and documentation completeness. For precise programme steps and current thresholds consult the official guide: https://siyahagent.com/guides/turkey-citizenship-requirements

Callout — Turkey in brief:

- Typical threshold: USD 400,000 (property route)

- Timeline: commonly 3–6 months

- Residency: no strict stay requirement

Internal summary: Turkey can be a pragmatic option for investors prioritising speed and family inclusion, but confirm the latest official terms before committing.

Comparing costs, timelines and flexibility across routes

When evaluating programmes, consider not only headline investments but ancillary fees, compliance costs and opportunity cost of capital. A high‑level comparison:

- Cost range: from €250,000 (some European Golden Visa property minimums) to €1m+ for certain fund or CBI routes.

- Time to status: immediate residence can be weeks to months; naturalisation typically takes years for most residency routes (Portugal circa five years; other EU states longer).

Flexibility differs. Property routes can be attractive for investors who want a tangible asset but often carry a holding period (commonly three to five years). Fund routes provide more liquidity but require trusted fund governance. Business routes offer upside but demand operational involvement and carry higher execution risk.

Internal summary: weigh investment size, liquidity and your appetite for operational involvement when choosing a route.

Legal, tax and practical risks — what to watch for

No pathway is without risk. Key considerations include:

- Policy risk: governments may raise thresholds, change eligible assets, or tighten scrutiny with little notice.

- Financial risk: real estate markets and currency movements affect the real value of your investment.

- Legal risk: incomplete documentation, unclear ownership structures or tax non‑compliance can lead to rejection.

Always model conservative scenarios: assume longer processing in busy periods; budget for professional fees (legal, tax, translation, due diligence) which often add €10,000–€30,000 depending on family size and complexity; and plan for a holding period before you access capital.

Internal summary: plan for regulatory change, FX volatility and due diligence costs; avoid over‑leverage.

Practical steps to assess your eligibility and proceed

Follow a systematic approach to reduce delays and improve odds of a successful application.

-

Clarify objectives: mobility, business expansion, family security or citizenship.

-

Financial readiness: confirm clean, documented funds and liquidity for the minimum investment plus fees.

-

Preliminary screening: obtain a confidential assessment to check basic eligibility and likely programme matches. Start with a structured review such as https://siyahagent.com/assessment

-

Select candidate programmes and verify the current official requirements and timelines. A programmes overview can help you compare options: https://siyahagent.com/programs

-

Prepare documentation: apostilled identity documents, audited financials, notarised property contracts or investment confirmations and criminal background checks.

-

Engage advisers: qualified immigration lawyers, tax consultants and reputable local agents reduce the risk of errors and speed processing.

Callout — documentation checklist:

- Passport and national ID

- Certified proof of funds and source documents

- Criminal record certificates and translations

- Investment agreements or property contracts

Internal summary: a staged, documented approach and a professional assessment materially improve your readiness and timing.

Is global residency right for you? An honest framework to decide

Ask yourself:

- Do you need rapid mobility for business or family safety?

- Can you commit the required capital without jeopardising operational liquidity?

- Are you prepared to meet compliance and potential tax reporting obligations?

If you answer yes to these and have clean documentation, you likely have a pathway worth exploring. If not, refinancing, family planning or staged investments may be necessary first steps.

Internal summary: eligibility is as much about readiness and intentions as it is about capital.

Conclusion and clear next step: use expert assessment

Qualifying for global residency is achievable for many African business leaders, but the path requires preparation, verified funds, clean legal standing and strategic clarity. Begin with a confidential, professional eligibility check to identify the strongest programmes for your profile. For a tailored, confidential assessment and programme comparison, start here: https://siyahagent.com/assessment and review available routes at https://siyahagent.com/programs

Featured image request: Urban skyline with international business hubs and global travel symbols. Alt text: African business leader exploring global residency opportunities.

Sources: Official immigration and government programme pages; verified investment migration reports; Siyah Agents programme data.