Start your week, start your life abroad

The Monday you arrive as an expat matters. For English‑speaking African business leaders and entrepreneurs, those first hours and days set the tone for stability, opportunity and resilience. This practical guide converts that symbolic Monday into an actionable plan: what to register, whom to call, which documents to trust and how to structure your first 90 days for business and family success.

Internal summary: act quickly on registration, documentation and banking; then focus on business setup and community integration.

Arriving with intention: first priorities on day one

Register and secure a local address

Local registration is not optional in many countries. In Turkey, for instance, recording your address with the migration authorities or the population office within the statutory window (often 10–30 days) is required to access services and avoid fines. Keep original tenancy documents, a signed lease and proof of deposit to hand. Make multiple certified copies and store digital backups.

Why this matters

A verified address speeds bank account opening, tax registration and school enrolment. Without it, these processes stall—and so can your business operations. Prioritise this step before non‑urgent matters such as apartment upgrades.

Secure practical, short‑term accommodation wisely

Choose a neighbourhood that balances proximity to business hubs, schools (if relevant) and transport. Short‑term furnished lets let you assess neighbourhoods before committing to a long lease or purchase. Always insist on written contracts and avoid cash‑only arrangements.

Internal summary: early legal address registration and a secure temporary base reduce administrative friction across the board.

Document management: organise before the rush

Create a reliable document system

Buy a quality document wallet and create a secure cloud folder. Categorise documents: identity and visas, financial, property, business, family and healthcare. Label scanned PDFs clearly (e.g. passport‑bio, lease‑signed, tax‑id). Use password‑protected cloud storage and keep hard copies in a fireproof folder.

Essential documents to prioritise

- Passport and visa/residence permit paperwork

- Lease or title deed and landlord ID

- Proof of funds and bank statements

- Birth and marriage certificates (apostilled/translated if required)

- Business incorporation papers and shareholder registers

Callout — document essentials:

- Originals in a secure folder; certified scans in cloud storage

- Apostille and certified translations if your home country requires them

Internal summary: a disciplined document system saves days of lost time and prevents legal complications.

Residency, permits and legal compliance

Understand your visa and permitted activities

Different visa categories allow different activities. A business visa often permits company registration but may not permit employment without a work permit. Confirm permitted activities early and consult local immigration counsel on renewals and upgrades. Turkey’s investment routes—including the Turkey Instant Citizenship programme—have specific compliance criteria that specialists can explain in detail. https://siyahagent.com/guides/turkey-citizenship-requirements

Register with municipal authorities and tax office

Beyond migration offices, many countries require municipal registration for utilities and tax authorities for a tax identification number. Apply promptly to avoid penalties and ensure the legal ability to invoice, hire staff and open certain bank accounts.

Internal summary: match visa activity to business plans and obtain tax IDs promptly to unlock commercial functionality.

Banking and finance: set up before you spend

Opening a local bank account efficiently

Banks demand consistent ID, a tax number, proof of address and, often, an initial deposit. International banks and local banks with English‑speaking branches are easiest for newcomers. Expect account opening to take days to weeks depending on the bank and your documentation.

Currency management and transfers

If you run cross‑border operations, maintain both local and hard‑currency accounts (USD/EUR) where feasible. Compare fees and FX margins; using specialist FX providers for large transfers can materially reduce costs. Where possible, lock in rates for committed outflows to mitigate volatility.

Tax compliance and planning

Understand when you will become a tax resident (often 183 days in a tax year). Consult a cross‑border tax specialist to plan payroll, corporate tax residency and reporting. Ignorance here risks penalties and reputational damage.

Internal summary: establish banking, manage FX exposure and confirm tax residency rules before committing substantial capital.

Business basics: registering and operationalising a company

Choose the right legal structure

Common options include limited companies, branches or representative offices. Your choice affects liability, capital requirements and tax treatment. For quick go‑to market capability, limited companies with a local director (or nominee services) are often efficient—subject to local rules.

Key steps to company formation

- Obtain corporate tax ID and register with the trade registry

- Draft articles of association and appoint authorised signatories

- Open a corporate bank account and deposit required capital

- Register for VAT and social security where relevant

Local partnerships and networking

Local agents, chambers of commerce and industry groups are invaluable for introductions and market intelligence. Early networking shortens procurement cycles and helps source vetted service providers. Seek peers in sector‑specific forums and local entrepreneur groups.

Callout — business starter kit:

- Legal counsel with cross‑border experience

- Local accountant for payroll and VAT setup

- Trusted corporate bank with international reach

Internal summary: structure matters—choose a legal form that fits your growth plan and regulatory comfort.

Living well: schools, healthcare and daily life logistics

Schooling and family services

If you relocate with family, research school calendars, curricula (IB, British, American) and admissions cycles. Start school applications early; popular international schools often require waiting‑list management and early deposits.

Healthcare and insurance

Secure private health insurance promptly; this often expedites local registration and provides immediate cover. Identify English‑speaking clinics and hospital networks near your home and workplace.

Transport and day‑to‑day logistics

Local transport varies. Major cities typically offer metros, trams and ride‑hailing. If you plan to drive, check whether your international licence is accepted or if local conversion is required. Explore domestic SIM plans and broadband providers for business continuity.

Internal summary: healthcare, schooling and transport are practical priorities that affect family wellbeing and business continuity.

Community, culture and wellbeing: build a support system

Overcoming isolation and culture shock

Schedule regular social activity and set up routine family calls back home. Join business clubs, cultural associations or sporting groups to accelerate social integration. Language classes and cultural orientation sessions shorten adjustment periods and reduce miscommunication risks.

Time management and local norms

Understand local working hours and business etiquette. Meeting punctuality, gift‑giving norms or negotiation styles vary—observation and local advice pay off.

Internal summary: active community engagement reduces stress and amplifies business opportunity.

Troubleshooting and early‑stage risk management

Common early pitfalls and how to avoid them

- Missing registration deadlines—track with a simple calendar app and reminders

- Using unvetted service providers—ask for references and check licences

- Poorly documented financial transfers—use bank SWIFT transfers with clear narratives

When to call for professional help

If regulatory ambiguity, complex ownership structures or immigration queries arise, escalate to licensed legal and migration advisers immediately. Specialist advisers reduce delay, prevent fines and safeguard long‑term plans. For a formal evaluation of eligibility and tailored next steps, start with a structured Siyah Agents assessment: https://siyahagent.com/assessment

Internal summary: early escalation to advisors saves time and mitigates regulatory risk.

Internal summary: your 30‑90 day action plan

Weeks 0–2: address registration, secure short‑term accommodation, collate essential documents

Weeks 2–6: open bank accounts, register for tax ID, shortlist corporate structures and legal counsel

Weeks 6–12: register company, hire initial staff or contractors, apply for necessary permits

Weeks 12–90: stabilise operations, enrol family in schools, build networks and refine local strategy

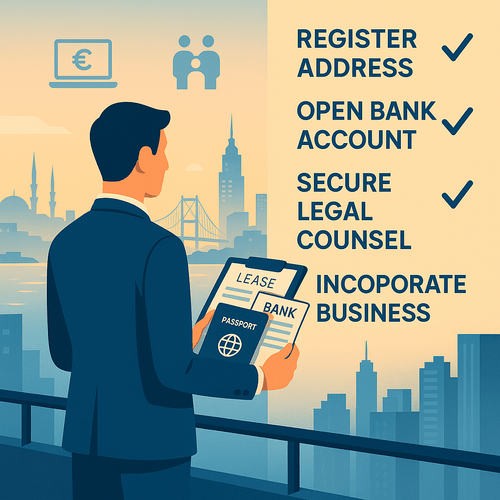

Callout — priority checklist:

- Register address and obtain tax ID

- Open bank account and establish payment channels

- Secure legal counsel and incorporate your entity

Internal summary: this phased approach balances immediate legal‑administrative needs with medium‑term business establishment.

Final notes and a subtle next step

Relocating is strategic, not just logistical. Treat your first Monday abroad as the launch of a new operating rhythm: decisive, documented and delegated. Specialist support reduces friction—particularly for complex investment or citizenship routes such as Turkey Instant Citizenship. https://siyahagent.com/guides/turkey-citizenship-requirements

If you prefer to start with an expert review tailored to your circumstances, consider a personalised Siyah Agents assessment to map eligibility, timelines and costs. https://siyahagent.com/assessment

Featured image request: Urban morning in Istanbul showing an expat arranging documents with the Bosphorus skyline in the background. Alt text: Expat professional preparing documents in Istanbul at dawn.

Sources: Siyah Agents Turkey Instant Citizenship programme; verified expat guides; official government residency regulations; internal advisory data from Siyah Agents.