A practical compass for global citizens

Introduction: why high‑net‑worth individuals consider second passports

For affluent professionals and investors in Turkey, Portugal and Greece, a second passport is strategic capital: it broadens mobility, opens business doors, and offers family security. This guide explains the tangible benefits, typical costs, and critical considerations so you can decide with clarity. All claims are grounded in verifiable programme features; where evidence varies, we flag it as inconclusive.

Internal summary: weigh mobility gains against cost, compliance and long‑term obligations.

Core benefits of a second passport

Enhanced global mobility and convenience

The headline advantage is travel freedom. Strong passports reduce visa friction, shorten travel planning and accelerate dealmaking. For HNWIs who travel frequently for business, smoother entry to markets translates into time saved and faster opportunity capture. Mobility indices demonstrate large differences in visa‑free access by nationality; compare prospective passport rankings before committing.

Family security and opportunity

Second citizenship often permits family inclusion—spouses, dependent children and, in some programmes, parents. This access can secure education choices, healthcare options and contingency relocation plans that protect family wellbeing across generations.

Business and investment flexibility

Alternative nationality can simplify company formation, cross‑border banking and property acquisition in chosen jurisdictions. For investors based in Turkey, Portugal or Greece, a second passport in a complementary jurisdiction can open free‑movement markets or reduce administrative friction in target countries.

Internal summary: mobility, family protection and business agility are the main strategic returns on a second passport.

Understanding the costs: investment thresholds and ancillary fees

Second passport programmes demand substantial capital and professional costs. Below are typical ranges; confirm exact figures in each jurisdiction before proceeding.

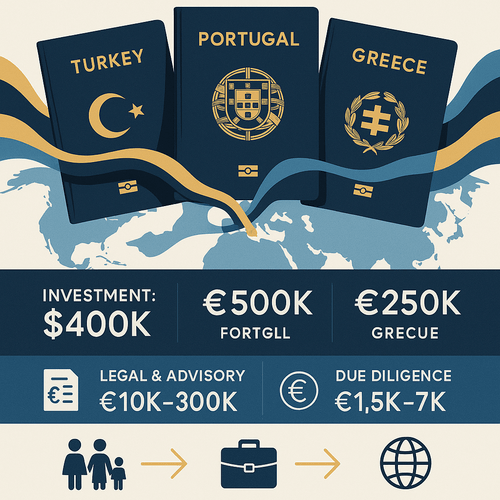

Direct investment or minimums

- Turkey: Citizenship by investment via real estate commonly cites a minimum around USD 400,000 (verify current official guidance).

- Portugal: Golden Visa minimums vary by route—examples include from approximately €280,000 for rehabilitation projects to €500,000 for many real‑estate routes (post‑reform thresholds are evolving).

- Greece: Residency by investment often starts with property purchases from roughly €250,000, though naturalisation timelines and conditions differ.

Inconclusive: governments periodically adjust thresholds and eligible asset classes; always confirm up‑to‑date official requirements.

Professional, administrative and compliance fees

- Legal and advisory fees commonly range from €10,000–€30,000 depending on complexity and family size.

- Due diligence and background checks are typically €1,500–€7,000 per adult.

- Translation, notary and registration charges add several hundred to a few thousand euros.

Ongoing financial commitments

Expect holding costs—property taxes, maintenance and possible residency renewal fees. Factor these into a five‑year cash flow model before committing capital.

Internal summary: total cost equals headline investment plus professional, compliance and ongoing running costs—model the full five‑year expense.

Eligibility, timelines and residency requirements

Typical timelines to residency or citizenship

- Turkey: Investment routes can lead to citizenship relatively quickly—often within months after qualifying investment and compliance checks (verify with latest official timetables).

- Portugal: Golden Visa grants residence rights which may lead to citizenship after around five years subject to residence and integration requirements.

- Greece: Residency is obtainable through investment; citizenship requires longer residence and integration, often several years.

Inconclusive: processing durations vary by individual circumstances and administrative backlogs; treat time estimates as ranges, not guarantees.

Physical presence and integration tests

Some programmes impose minimal stay requirements (Portugal has historically low physical presence for Golden Visa renewal, though rules have evolved); other naturalisation paths demand sustained residence and basic language competence. Confirm obligations before choosing a pathway.

Internal summary: time to citizenship differs sharply—Turkey often fastest, Portugal intermediate, Greece longer—subject to policy updates and personal compliance.

Legal, tax and operational considerations

Tax residency and reporting

A second passport does not automatically change tax residence. Tax residence typically follows days‑present, domicile and economic ties. Before changing residency or shifting assets, consult international tax specialists to understand implications and treaty relief.

Due diligence and source‑of‑fund requirements

Robust AML and proof‑of‑fund checks are standard. Prepare audited financials, sale agreements or corporate records to document legitimate wealth. Complex ownership structures invite deeper scrutiny and possible delays.

Operational steps: what the process usually involves

- Pre‑qualification and eligibility checks.

- Document assembly: IDs, criminal records, proof of investment funds.

- Making the qualifying investment and registering it correctly (title deeds, fund allocations, etc.).

- Submission, government review, and follow‑up due diligence.

Internal summary: rigorous paperwork and transparent funding sources are essential to avoid costly delays.

Comparative spotlight: Turkey, Portugal and Greece

Turkey — speed and direct citizenship routes

Turkey’s programme is notable for direct citizenship via specified investments, often leading to faster outcomes than many EU routes. It is attractive where speed and a clear nationality outcome matter most. Verify current qualifying mechanisms and any policy shifts before transacting.

Portugal — EU access with flexible options

Portugal’s Golden Visa (subject to recent reforms) historically offered multiple qualifying routes and eventual access to the EU. It is appealing for investors prioritising mobility across Schengen and longer‑term settlement options, albeit at higher overall cost.

Greece — lower entry thresholds, longer path to citizenship

Greece provides comparatively accessible residency via property investment, with modest minimums in many locations. Citizenship typically requires longer residence and integration. Greece can suit those seeking residence with lower initial capital.

Internal summary: choose Turkey for speed, Portugal for EU mobility, and Greece for lower initial capital and residence flexibility—subject to up‑to‑date policy checks.

Risks and key disclosures: no guarantees, prepare for change

- Policy risk: Governments revise programme terms—thresholds, eligible assets and family inclusion can change with limited notice.

- Reputational and legal risk: Some investor programmes attract scrutiny; choose reputable jurisdictions and document every step.

- Liquidity risk: Property and other qualifying assets can be illiquid; assess exit timelines and market demand before committing.

Callout — risk checklist:

- Confirm current official rules before any transfer.

- Prepare clear, auditable source‑of‑fund documentation.

- Model worst‑case timelines and exit scenarios.

Internal summary: prudent planning and conservative assumptions reduce exposure to regulatory and market shifts.

Practical next steps: how to decide and proceed

- Define primary goals: mobility, family security, tax planning or investment returns.

- Budget comprehensively for investment and associated professional costs.

- Run residency and tax simulations with qualified advisers.

- Shortlist jurisdictions aligned to your objectives and verify live policy details.

If you seek expert, tailored support, begin with a professional eligibility assessment and document review to identify the route that fits your profile and risk appetite.

Conclusion and call to action: informed action matters

Second passports offer strategic advantages for HNWIs—but only when chosen and executed with precision. They deliver mobility, family protection and business flexibility, yet demand substantial investment, strict compliance and ongoing awareness of policy change. For a personalised assessment and step‑by‑step support based on current rules and market realities, consult Siyah Agents for professional guidance tailored to your situation.

Sources: Official programme information from Turkish, Portuguese and Greek authorities; reputable migration and investment reports; Siyah Agents advisory data.