Policy shifts investors must track

Introduction: why these updates matter now

Golden Visa programmes once offered a predictable pathway to residency for international investors. Recent policy changes—most notably in Portugal—are reshaping that landscape. For English‑speaking African professionals and investors, understanding these reforms is essential: they alter eligibility, increase documentation demands and can affect timing, cost and strategy. This article summarises the key changes, explains their practical impact and sets out how to adapt with confidence.

Internal summary: rules are evolving; prepare documentation, reassess routes and seek up‑to‑date professional advice.

Portugal’s Golden Visa: the headline reforms

What changed and why

Portugal’s Residence Permit for Investment Activity—the Golden Visa—has undergone material reform. Policymakers have tightened the programme to direct investment away from already pressured urban markets and toward projects that deliver broader economic or cultural benefit. The intent is clear: manage local markets, promote regional development and raise transparency.

Practically, the reforms affect three main areas: eligible property locations, investment categories and minimum thresholds. Existing applicants with approvals under prior rules are generally protected from retroactive changes, but new applicants now face a different set of options and costs.

Major, practical updates investors need to know

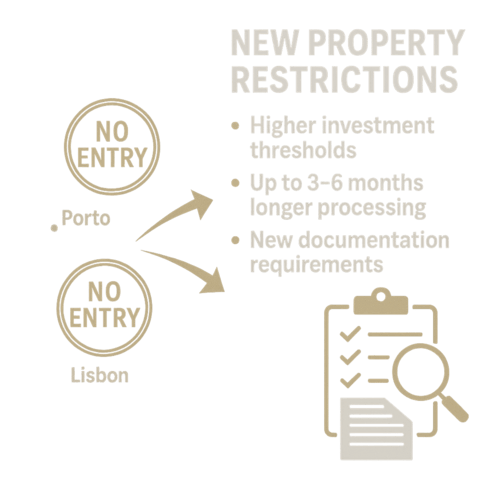

- Residential purchases in central Lisbon, Porto and many coastal tourist hotspots no longer qualify for the property route.

- Capital transfer minimums have been increased for some fund and deposit routes.

- Research, development and cultural investment categories now carry higher minimums, shifting the balance toward larger, impact‑orientated projects.

Internal summary: investors should no longer assume prime urban property will qualify and must verify eligible categories before committing capital.

Broader European trends: higher scrutiny, higher thresholds

Converging policy pressures across programmes

Portugal’s adjustments are part of a wider European pattern. Several countries with investor schemes have increased due diligence standards, raised financial minima, or paused programmes for review. These shifts reflect public concerns about housing pressures, money‑laundering risk and fairness.

Common trends include: stronger source‑of‑fund checks, greater transparency requirements, and a move away from purely property‑centric options toward funds, job‑creation and R&D investments. Programmes that remain open are also likely to raise thresholds or tighten eligibility.

What this means for timing and cost

- Application timelines can extend as authorities process complex vetting.

- Higher thresholds increase initial capital needs—investors should plan for larger outlays and potentially greater legal and advisory fees.

Internal summary: expect longer lead times and higher transaction costs when preparing applications in this new environment.

Implications specifically for African investors

Reassess route suitability and regional strategy

Many African investors targeted Portuguese property for residency benefits and potential returns. With prime urban property largely excluded from Golden Visa eligibility, investors should reassess whether alternative routes—such as regulated fund investments, research partnerships or job‑creation projects—better match their objectives.

Documentation and compliance demands rise

Governments now expect more exhaustive paper trails: certified proof of funds, corporate records, source‑of‑wealth narratives and enhanced background checks. For applicants whose wealth is held through family offices or complex corporate structures, early financial housekeeping is critical.

Callout — immediate actions for African investors:

- Review current holdings against updated eligibility lists.

- Prepare audited financial statements and clear source‑of‑fund evidence.

- Model alternative qualifying routes beyond urban property.

Internal summary: act early to align capital and paperwork with revised programme rules.

Strategic adjustments: how to respond to the new rules

Diversify qualifying strategies

If property in prime urban zones is no longer eligible, consider the following alternatives where available and appropriate: investment funds focused on Portuguese businesses, research & development projects, regional real‑estate in permitted areas, cultural or heritage investments, or direct business creation with job targets. Each option carries distinct implications for liquidity, management and exit strategy.

Revisit investment horizon and liquidity planning

Higher thresholds and longer vetting mean capital may be tied up for longer. Reassess liquidity needs and factor in potential holding periods, compliance costs and tax implications. In many cases, investors will benefit from staged investments or diversifying across more than one qualifying route.

Internal summary: diversify qualifying routes and plan for longer capital commitment horizons.

Compliance best practices: documentation and due diligence

Source‑of‑fund and enhanced vetting

The single most important area of focus is source‑of‑fund documentation. Practically, this means: clean, audited bank statements; sale or transfer agreements; formal valuation documents; and audited corporate accounts where relevant. Where funds flow through multiple vehicles, provide clear, chronological explanations and supporting documents for each transfer.

Work with local counsel and licensed advisers

Regulatory nuance matters: local lawyers, tax advisers and regulated migration specialists help translate official guidance into executable plans. Early engagement reduces the risk of surprises and avoids rushed fixes under time pressure.

Internal summary: invest in documentation and professional partners to smooth the application process.

Risks and realistic expectations: no guarantees, only probabilities

Policy reform creates winners and losers. While some investors will adapt quickly and find new qualifying routes, others may face longer waits or higher cost of entry. Authorities reserve the right to amend schemes further; therefore no outcome is guaranteed. Be prepared for processing delays, enhanced scrutiny and possible changes to exit options or tax treatment.

Callout — risk checklist:

- Expect longer processing times (allow an extra 3–6 months beyond historical averages).

- Budget for increased compliance and advisory fees.

- Avoid last‑minute investments without documented eligibility confirmation.

Internal summary: conservative planning reduces exposure to regulatory shocks.

How to approach timing and decision‑making

Act, but do not rush blindly

If you are mid‑decision, reassess to clarify whether your intended route remains eligible. If you plan to apply, begin documenting and consulting advisers now. Rushed investments without confirmed eligibility commonly result in complications.

Scenario planning is essential

Model at least two scenarios: one where your preferred route remains available and another where thresholds rise further. This approach helps preserve optionality and avoid capital being trapped in ineligible assets.

Internal summary: combine timely action with scenario planning and structured advising.

Why work with Siyah Agents: intelligence, compliance, and execution

Siyah Agents assists African investors through rapid policy shifts. Key services include real‑time programme monitoring, personalised eligibility assessments and end‑to‑end application management with local counsel. Specialists prepare source‑of‑fund documentation, structure investments into qualifying formats, and advise on tax and exit planning—reducing the operational burden on investors.

Final callout: expert guidance shortens timelines and mitigates regulatory risk—book a tailored assessment with Siyah Agents to clarify your options.

Conclusion: adapt decisively, plan conservatively

Golden Visa reforms—Portugal’s among the most significant—signal a new era: greater scrutiny, higher thresholds and a shift away from hot‑market property as the principal qualifying asset. For African investors, the priority is clear: reassess plans, shore up documentation and work with advisors experienced in rapid policy environments. Those who adapt thoughtfully will realise residency and mobility benefits while managing the evolving risks.

If you want help testing scenarios and preparing a compliant application path, book a personalised assessment with Siyah Agents for up‑to‑date guidance and practical execution support.

Sources: Official Portuguese SEF announcements; recent industry migration reports; Siyah Agents programme intelligence.