Why the Greece Golden Visa matters for African investors

Introduction: an accessible European doorway

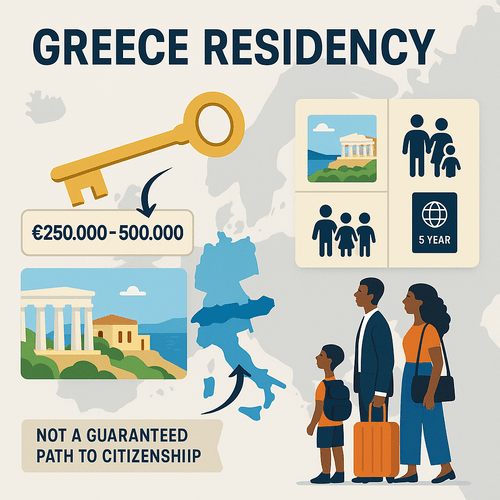

For many English‑speaking African professionals and investors, the Greece Golden Visa has become synonymous with accessible, pragmatic European residency. The programme’s relatively low entry point, straightforward real‑estate focus and family inclusion make it a practical option for those who want EU mobility without immediate relocation. This feature explains eligibility, typical investment routes, realistic costs and timelines, plus risks and practical implications — all rooted in verifiable programme features and industry reporting.

Internal summary: the Greece Golden Visa offers practical EU residency for moderate capital outlay, but it is not a guaranteed ticket to citizenship.

Who qualifies and how the programme works

Eligibility in clear terms

The Greece Golden Visa is aimed at non‑EU nationals who make qualifying investments in Greece. Basic eligibility generally requires:

- A valid passport and clean criminal record

- Proof of lawful funds for the qualifying investment

- Completion of the qualifying transaction and documentation submitted to Greek authorities

Applicants commonly include principal investors, their spouses and dependent children; dependent parents may be eligible in specific circumstances. Applicants do not have to relocate to Greece to secure or renew the permit — a notable advantage for highly mobile professionals.

Internal summary: clear, documentable investment plus routine integrity checks are the foundation of eligibility.

The core investment route: real estate (the dominant option)

Real estate thresholds and structure

Real estate remains the principal qualifying route. As widely reported in official and sector sources, the standard minimum investment in most regions is €250,000. Certain premium zones—central Athens, select islands and tourist hotspots—are associated with a higher threshold, commonly €500,000. Purchases can be single units or aggregated neighbouring units that together meet the threshold.

Transaction and validation steps

Investors must complete purchase contracts, register property titles in the national land registry and document the transfer of funds from abroad. Authorities require notarised contracts and translations where necessary, and they perform routine anti‑money‑laundering (AML) checks. Only fully executed, registered acquisitions form the basis of a successful application.

Inconclusive: occasional proposals to broaden qualifying assets (funds, bonds) appear in debate; as of the latest official guidance, real estate is the primary effective route.

Internal summary: buy and register qualifying property, meet AML checks, and you have the core foundation for application.

Other qualifying options: current picture and uncertainty

Beyond property, public discussion has considered alternative routes such as shareholdings in Greek companies, venture capital participation or designated funds. However, policy and practice remain fluid: many of these alternatives are either limited in scope or officially inconclusive for current, straightforward Golden Visa claims. For investors keen on non‑property routes, up‑to‑date verification with Greek authorities or a specialist adviser is essential.

Internal summary: property is the reliable, well‑established path; other routes require careful, current confirmation.

Residency rights, renewals and the citizenship outlook

Immediate benefits of residency

Holders receive a renewable five‑year residence permit for themselves and qualifying family members. The permit allows unrestricted residence in Greece and visa‑free travel in the Schengen Area for short stays. Permit holders access local services and may live, work or study in Greece without additional work authorisations.

Renewal mechanics and mobility

Renewal is contingent on maintaining the qualifying investment. Critically, there is no strict minimum physical presence required to renew the Golden Visa, making it attractive for investors who do not wish to relocate full‑time.

Citizenship pathway — realistic expectations

The Golden Visa is not automatic citizenship. Naturalisation in Greece typically requires longer residence and integration; official pathways to citizenship usually involve several years of continuous residence and satisfy administrative and language conditions. Investors should view the Greek Golden Visa primarily as a durable residency solution and potential first step, rather than a guaranteed fast track to citizenship.

Internal summary: residency rights are immediate and valuable; citizenship remains a longer, more conditional prospect.

Timelines: from purchase to permit in hand

Typical application timeline

A practical timeline for well‑prepared investors looks like this:

- Property search and acquisition: commonly 4–8 weeks, depending on market and negotiation

- Document collation and contract registration: 2–4 weeks

- Application submission and processing: often 1–3 months after complete submission

Overall, many applicants report an end‑to‑end timeframe of 3–6 months from initial purchase to permit issuance, assuming smooth due diligence and accurate documentation. Complexity in transactions, banking delays or supplemental enquiries can extend this period.

Internal summary: allow three to six months as a practical planning window; budget additional time for contingencies.

Costs: investment plus the full financial picture

Headline investment and additional costs

- Headline property investment: from €250,000 (most regions) to €500,000 (premium zones).

- Non‑investment costs: expect legal fees, notary and translation charges, registration taxes, and due diligence fees. Typical advisory and administrative costs commonly range between €6,000 and €12,000 depending on family size and transaction complexity.

Taxes and ongoing charges

Property transfer tax, municipal levies and annual property taxes apply; maintenance and management costs can be material, particularly for holiday‑rental properties. If you let the property, rental income is taxable in Greece with standard income‑tax rules applying.

Internal summary: factor transaction taxes, professional fees and running costs into your total outlay — the headline property price is only the starting point.

Risks and limitations every investor must weigh

Market and liquidity risks

Greek property markets are varied: prime city apartments and island villas can be liquid and in demand, while peripheral properties may take longer to sell. Do not assume immediate resale or guaranteed capital gain; plan for a medium‑term hold.

Regulatory and policy risk

Programmes evolve. Thresholds, eligible zones and application processes have been adjusted in the past. Investors should expect potential policy shifts and ensure flexibility in their planning.

Compliance and reputational risk

Rigorous source‑of‑fund checks are standard. Weak documentation, complex offshore structures without clear trails, or incomplete legal compliance can delay or jeopardise outcomes. Work with licensed professionals and insist on full transparency.

Internal summary: accept market, policy and compliance risks; mitigate through careful selection, due diligence and professional support.

Practical implications: relocation, asset strategy and lifestyle

Relocation choices and family life

The Greece Golden Visa lets families choose whether to relocate immediately or maintain a primary base elsewhere. For those who do move, Greece offers a high quality of life, good private healthcare, and reputable international schools in urban centres. For those remaining mobile, the Golden Visa preserves EU access without full relocation.

Asset protection and diversification

Real estate denominated in euros can diversify exposure if your assets are concentrated in other currencies. That said, property is illiquid relative to listed investments; balance your portfolio accordingly.

Internal summary: the Visa supports flexible relocation choices and can form part of a measured asset‑diversification strategy.

How to proceed: practical next steps

- Clarify goals: residency only, family mobility, or eventual citizenship?

- Choose target regions and properties with independent valuation.

- Assemble source‑of‑fund evidence and background documentation in advance.

- Engage licensed Greek legal counsel and a specialist migration adviser to manage the application and compliance process.

Callout — quick checklist:

- Confirm current thresholds for your target region

- Prepare notarised, translated documents early

- Use independent valuation and trusted local professionals

Internal summary: early preparation, independent verification and professional support materially reduce delays and risks.

Why Siyah Agents can help

Navigating the Greece Golden Visa effectively requires up‑to‑date regulatory knowledge, local property insight and precise dossier preparation. Siyah Agents provides tailored advisory for English‑speaking African investors: from property vetting to application management and post‑arrival logistics. Their on‑the‑ground relationships and compliance experience help translate opportunity into a clean, efficient outcome — while making clear that no result is guaranteed.

Conclusion: accessible, valuable — but not risk‑free

The Greece Golden Visa stands out for accessibility and a relatively low entry point into EU residency. For many African investors the programme delivers genuine value: EU mobility, family inclusion and optional relocation. That value is contingent on robust due diligence, careful region and property choice, and readiness to accept market and regulatory risk. If you proceed, do so with a disciplined plan and trusted advisers.

If you would like a personalised eligibility review or a step‑by‑step application roadmap, contact Siyah Agents for a confidential consultation tailored to your circumstances and ambitions.

Sources: Official Greek residency‑by‑investment guidance; reputable migration industry reports; Siyah Agents programme and advisory data.