Real estate or alternatives: choosing the best Turkish CBI route

Introduction: the choice that shapes your future

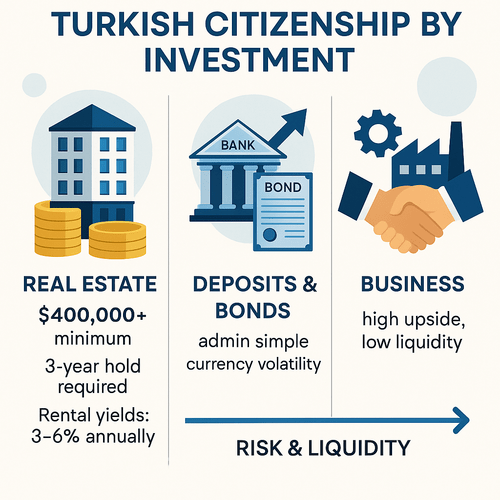

Turkey’s Citizenship by Investment (CBI) programme offers a compelling gateway to a new nationality — but the investment route you choose affects liquidity, risk, timeline and ongoing obligations. This guide compares the property route with alternative options (capital deposits, government bonds and business investment), focusing on what matters to investors: returns, lock‑up, compliance and exit strategy.

Internal summary: real estate gives a tangible asset; alternatives trade liquidity, yield and complexity. Match the route to your risk appetite and timeline.

How the Turkish CBI options work: a quick overview

Turkey’s CBI requires a qualifying investment and a three‑year holding period under current rules. Common accepted routes include:

- Property purchase (residential or commercial) at or above the qualifying threshold.

- Capital deposit in Turkish banks for a specified minimum.

- Purchase of government bonds.

- Direct business investment or job‑creating ventures.

Note: thresholds and technical criteria are subject to government review; consult official Turkish policy documents for the latest rules. Where data varies across sources we mark it inconclusive.

Internal summary: all routes demand documented funds and a minimum holding period — compliance is non‑negotiable.

The real estate route: tangible, familiar, but less liquid

Why investors choose property

Property is the default for many applicants because it is tangible, widely understood and can be used personally or let for income. For many, the psychological comfort of bricks and mortar matters: a house can be visited, improved and managed locally.

Typical investment and transactional costs

- Minimum outlay: commonly cited around USD 400,000 (confirm with official sources).

- Additional costs: taxes, notary fees, agent commissions and transfer charges typically add 4–15% to total outlay depending on region and deal structure.

Liquidity and exit considerations

- Lock‑up: property must generally be held for three years to satisfy CBI conditions, restricting early exit.

- Resale: market demand varies by location — prime Istanbul and coastal resorts attract buyers but can be sensitive to currency movements and buyer sentiment.

- Yield: gross rental yields in Turkish cities often range from approximately 3–6% annually (inconclusive across districts and timeframes).

Risks specific to real estate

- Exchange rate volatility can erode foreign investor returns when repatriating proceeds.

- Local regulatory changes and stamp taxes may affect transaction economics.

- Market liquidity for high‑end or niche properties can be limited.

Callout — real estate in brief: Tangible and familiar, but expect a three‑year hold, transaction costs and variable resale liquidity.

Internal summary: property suits investors who value a physical asset and can accept medium‑term illiquidity.

Capital deposits and government bonds: lower complexity, currency risk

Capital deposit route

- Structure: place a defined minimum (commonly reported higher than the property threshold) in a Turkish bank term deposit for the programme’s required period.

- Pros: administratively straightforward; no property management.

- Cons: funds are locked; returns reflect local interest rates and may not keep pace with inflation or currency depreciation.

Government bonds

- Structure: purchase designated sovereign bonds that meet qualifying criteria and hold them for the required period.

- Pros: relatively secure from credit risk compared to corporate routes; predictable coupon income.

- Cons: subject to sovereign and currency risk; availability and eligibility may vary.

Liquidity and returns

- Both routes are illiquid during the lock‑up, after which redemption is typically straightforward.

- Real yields may be negative in real‑terms if inflation and exchange rates move unfavourably.

Callout — cash and bonds: administratively simple, but exposed to lira volatility and limited upside beyond fixed returns.

Internal summary: these options suit investors prioritising simplicity over capital appreciation.

Business investment: higher involvement, potentially higher upside

Nature of business routes

- Direct investment: equity injection into a Turkish company, meeting minimum capital or job creation thresholds.

- Job creation: some pathways accept investments that demonstrably create local employment (for example, hiring specified numbers of employees).

Benefits and burdens

- Upside: potential for superior returns and meaningful local engagement.

- Complexity: company formation, licensing, local partnerships and operational risk.

- Liquidity: often low; exit depends on corporate sale or buy‑out terms.

Suitability

Business routes favour investors with operational appetite and local networks. They also better support a case for active residency and genuine economic contribution.

Internal summary: choose business investment if you seek active involvement and accept higher operational risk and lower liquidity.

Comparative snapshot: liquidity, risk and return

- Liquidity: deposits/bonds (post lock‑up) > real estate (market dependent) > business (least liquid).

- Risk: bonds/deposits (sovereign/currency) < real estate (market and regulatory) < business (operational).

- Return potential: deposits/bonds (modest, predictable) < real estate (capital appreciation possible) < business (highest variance).

Inconclusive: exact yield figures and market behaviour vary by timeframe and sub‑market; treat quoted ranges as indicative rather than prescriptive.

Internal summary: your tolerance for illiquidity and operational involvement should guide the choice.

Practical considerations: timelines, paperwork and compliance

Timelines to citizenship and process steps

- Typical processing: investors commonly report citizenship timelines from several months to under a year once documentation and qualifying investment are in order (official Turkish CBI guidance).

- Paperwork: rigorous source‑of‑fund proofs, notarised transactions, legal translations and land registry entries for property.

Due diligence and AML checks

All routes require robust anti‑money‑laundering checks and clean criminal records. Complex corporate structures or offshore flows invite closer scrutiny and may lengthen processing.

Internal summary: meticulous documentation accelerates approval and mitigates requests for supplementary evidence.

Currency, tax and cross‑border planning

- Currency risk: investments denominated in Turkish lira expose investors to depreciation risk; hedging strategies or holding some assets in hard currency may be prudent.

- Tax: becoming a Turkish tax resident carries obligations on worldwide income. Plan structures in consultation with tax advisers to manage double taxation and filing requirements.

Internal summary: factor exchange‑rate exposure and tax residency into both investment selection and exit planning.

Risk checklist: what to confirm before committing

- Current official qualifying thresholds and any pending policy reviews.

- Clear, audited evidence of lawful funds and ownership chains.

- Detailed exit strategy and realistic liquidity expectations.

- Local legal counsel and reliable market data for property or business sectors.

Callout — non‑negotiables: Confirm thresholds, document sources of funds, and secure expert local counsel before any transfer.

Internal summary: due diligence and local partners are essential to reduce regulatory and commercial risk.

Why use specialist advisers: the Siyah Agents difference

Siyah Agents provides tailored, end‑to‑end support for Turkish CBI clients: eligibility assessment, investment structuring, dossier preparation and liaison with local authorities. Their in‑country expertise helps match investor goals to the most appropriate route and reduces avoidable delays. Consult Siyah Agents about your options and to receive a bespoke plan aligned with your liquidity profile and long‑term ambitions — including the Turkey citizenship programme details for qualifying routes.

Conclusion: choose the route that fits your capital plan and life goals

There is no universal ‘best’ Turkish CBI option. Real estate offers a physical asset and familiar logic; deposits and bonds offer administrative simplicity but currency exposure; business investment delivers the highest upside—and the highest demands on time and expertise. Define your liquidity needs, appetite for operational involvement and tolerance for currency risk, then match the route accordingly.

For tailored, up‑to‑date guidance on Turkish CBI options and to evaluate which route best serves your investment and residency objectives, contact Siyah Agents for a confidential assessment.

Sources: Official Turkish CBI policy documents; recent Turkish real estate market analyses; Siyah Agents programme data and investor experience reports.