Golden Visa comparison: Spain as the reference point

Introduction: why this comparison matters

For English‑speaking African professionals and investors, Golden Visas remain a practical route to European residence, market access and family security. Spain, Greece and Portugal each offer residency‑by‑investment options, but their practical implications differ—investment size, permitted assets, residency obligations and the path to citizenship all matter when you plan relocation, asset protection and long‑term strategy. This guide compares the three programmes using Spain as the reference, highlighting verifiable facts and noting where information is inconclusive.

Internal summary: match your priorities—speed, cost, EU access or low entry threshold—to the programme that best fits your life and business needs.

Eligibility: who can apply and basic requirements

Spain (reference)

Spain’s Golden Visa targets non‑EU nationals who make qualifying investments. The most common route is property purchase of at least €500,000 free of liens. Alternatives include €1 million in shares or deposits, or €2 million in Spanish government bonds. Applicants must show a clean criminal record, sufficient financial means, and health insurance. Family inclusion typically covers spouse, dependent children and dependent parents (official Spanish guidelines).

Greece and Portugal—quick comparison

- Greece: entry via property from approximately €250,000 in many regions; criminal‑record and health checks apply. Recent and proposed regional threshold increases (e.g. in Athens) are being phased in—confirm current government guidance (inconclusive on timing).

- Portugal: multiple routes historically—real estate (from c. €500,000), certified investment funds and capital transfers. Post‑reform restrictions have narrowed some property options; other investment channels remain available (verify latest official updates).

Callout — eligibility in brief:

- Spain: higher headline thresholds but multiple asset routes

- Greece: lowest property threshold; changes imminent in some cities

- Portugal: flexible options historically, now more targeted after reforms

Internal summary: Spain is prescriptive on minimums; Greece is cost‑attractive for property buyers; Portugal offers varied routes but requires current verification.

Investment routes: real estate versus financial assets

Spain: asset variety

Spain permits several qualifying investments. Real estate at €500,000 is the most familiar route. Non‑property routes include share purchases, bank deposits or public debt at higher thresholds. Property purchases must be free of encumbrances and held for renewal periods. The asset‑diversity gives investors options for liquidity and risk allocation (Spanish official procedures).

Greece: property‑centred approach

Greece remains largely property‑centric. The low entry price has made Greek coastal and island markets popular with non‑EU buyers. Financial asset routes are less developed than in Spain and Portugal. Investors choosing Greece should consider local market liquidity and seasonal rental dependence.

Portugal: funds and regional focus

Portugal historically allowed diverse investment vehicles—real estate, funds, capital transfers and job creation. Recent reforms now steer property investments away from high‑pressure urban centres; certified fund investments and innovation routes have grown in prominence. Funds offer a less hands‑on alternative to property but require careful vetting of fund strategy and governance.

Internal summary: choose Spain for asset flexibility, Greece for low‑cost property entry, Portugal for fund‑based or targeted regional investments post‑reform.

Residency rights and paths to citizenship

Residency rights common to all three

Golden Visa holders in Spain, Greece and Portugal enjoy legal residence, access to local healthcare (subject to insurance), and the right to travel within the Schengen Area for short stays (90/180 rule applies). Family members included on the principal application generally receive the same residency rights.

Differences in stay requirements and citizenship routes

- Spain: no strict minimum annual stay to maintain the Golden Visa; permanent residency after five years; citizenship typically after ten years of continuous legal residence with integration requirements (language, civic knowledge).

- Greece: minimal stay for visa maintenance; citizenship is possible after seven years of residence, subject to integration and local criteria.

- Portugal: historically awarded citizenship after five years of legal residence with modest physical presence requirements; applicants must meet basic language tests. Recent policy shifts have altered some qualifying investments—confirm latest official guidance.

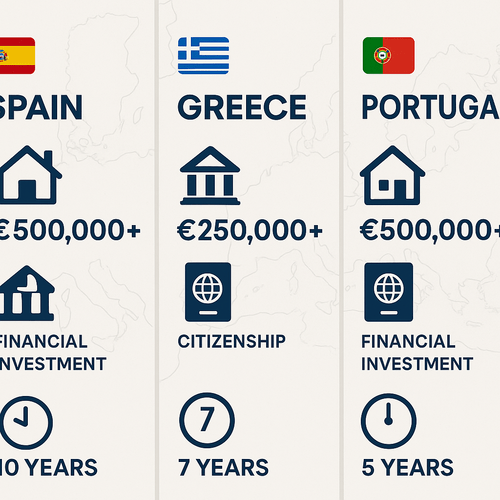

Callout — citizenship timelines at a glance:

- Portugal: shortest route to citizenship in many cases (c. 5 years)

- Greece: mid‑range (c. 7 years)

- Spain: longest (c. 10 years to naturalisation)

Internal summary: Portugal often leads for eventual citizenship speed, Spain and Greece require longer residence and integration.

Processing times, costs and renewal logistics

Processing times (ranges)

- Spain: initial residence permits typically processed in 1–3 months when documentation is complete; renewals follow a two‑year/ five‑year cadence depending on the route.

- Greece: approvals often within 2–3 months for straightforward property cases.

- Portugal: processing has lengthened in recent periods to roughly 6–12+ months, influenced by demand and administrative updates (recent migration reports).

Costs beyond headline investment

- Government and filing fees vary by country and route; legal and due‑diligence costs typically add several thousand euros per applicant. Property transaction taxes and VAT differ—Portugal’s property transaction duties can be significant in premium markets; Spain’s conveyancing and transfer taxes also add materially. Model total transaction costs (purchase price + taxes + legal fees + due diligence) before committing.

Internal summary: Spain and Greece often offer faster permit decisions for simple property cases; Portugal’s administrative backlog can extend timelines. All require robust legal and financial budgeting.

Tax considerations: residence triggers and treaty effects

Tax residency basics

Tax residence generally follows physical presence (commonly 183 days per year) or domicile tests. Golden Visa residency does not always equate to tax residence—unless you choose to live locally or meet the country’s residency tests. Plan carefully to avoid unintended global tax obligations.

Country notes

- Spain: becoming a tax resident (183 days) exposes worldwide income to Spanish tax rates; Spain levies wealth and income taxes that vary by region.

- Greece: similar 183‑day rule applies; specific allowances and reforms may affect high‑net‑worth tax planning (inconclusive on most recent preferential regimes).

- Portugal: offers special regimes (e.g. Non‑Habitual Resident historically) that can be attractive for a limited period—check latest rules as reforms occur.

Double taxation treaties

Each country maintains an extensive network of double taxation treaties that can mitigate double taxation for cross‑border incomes. Always obtain tax advice that considers treaty positions between the investor’s home jurisdiction and the host country.

Internal summary: tax consequences depend on how you use residency—be deliberate about days spent, local ties and reporting obligations.

Practical implications for relocation, asset protection and timing

Relocation and lifestyle

Spain suits investors seeking vibrant urban markets and established expat services. Greece is cost‑efficient for property entry and seasonal lifestyles; Portugal is attractive for EU access and longer‑term settlement ambitions. Consider schooling, healthcare and local language in your relocation planning.

Asset protection and liquidity

Real estate liquidity varies by market: Spain’s major cities and coastal zones tend to be more liquid than smaller Greek islands or peripheral Portuguese regions. Financial asset routes (Spain, Portugal) can offer quicker exits but require sound fund governance.

Timing your strategy

If rapid residency is the priority, Greece or Spain’s property routes often yield quicker administrative turns; for long‑term EU citizenship, Portugal frequently offers the shortest naturalisation timeline—subject to maintaining required residential and integration conditions.

Internal summary: align market liquidity, family priorities and citizenship horizon to choose the right programme.

Final takeaways and next steps

- Spain offers multiple asset routes but requires higher minimums for property; it’s well‑suited to investors wanting asset flexibility and urban markets.

- Greece provides the lowest property threshold and fast permit issuance for many cases, but limited non‑property routes and variable liquidity.

- Portugal combines pathway flexibility and a relatively short route to citizenship, although recent reforms have narrowed some property options and extended processing times.

Callout — decision checklist:

- What is your primary goal: immediate residency, EU citizenship, or asset diversification?

- How much active management do you want (property vs funds)?

- What is your acceptable timeline to citizenship and relocation?

For tailored, up‑to‑date advice that matches your priorities and risk profile, consult Siyah Agents for a personalised assessment and step‑by‑step plan. European Golden Visas remain powerful tools—used well, they expand options; used without strategy, they add cost and complexity.

Sources: Official programme information from Spain, Greece and Portugal; recent migration and investment reports; Siyah Agents advisory data.