Why Turkish residency appeals to African professionals

Introduction: strategic residency at the crossroads of opportunity

For African professionals and investors, Turkey offers an unusually practical route to long‑term residence—and in many cases, a structured pathway to citizenship. Situated between Europe and Asia, Turkey combines rapid processing, multiple qualifying investment routes and family‑inclusive options. This guide explains the investment routes, likely timelines, post‑residency choices and the compliance realities every serious investor must know.

Internal summary: Turkish residency by investment can deliver speed, family coverage and commercial opportunity — but success depends on rigorous due diligence and up‑to‑date advice.

The investment routes: choose the path that fits your objectives

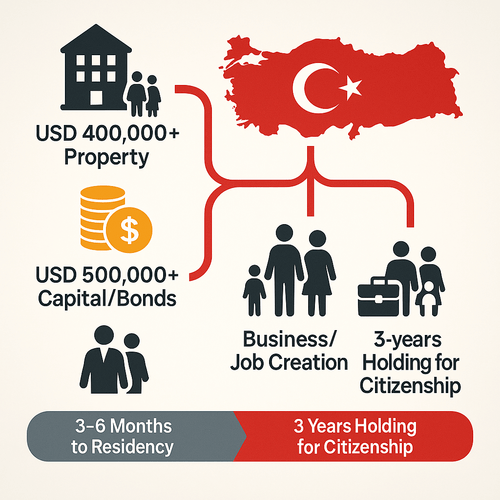

Turkey offers several government‑recognised investment pathways. Each is designed for different investor priorities: property for lifestyle and rental returns; capital and bond options for liquidity; business investment for entrepreneurs.

Property investment (common entry point)

- Typical threshold: approximately USD 400,000, verified by official valuation.

- Assets accepted: residential and certain commercial properties registered in the investor’s name.

- Holding period: generally expected to be maintained for at least three years where citizenship is the objective.

Why many choose property

Property is tangible, often familiar to investors, and can generate rental income while you hold the asset. It also provides visible local ties that may aid integration and local banking relationships.

Capital deposit and government bonds

- Typical thresholds: commonly around USD 500,000 for bank deposits or government bond purchases, held for a specified minimum period.

- Suitability: attractive for investors who prioritise liquidity and financial exposure over property management.

Business investment and job creation

- Routes include: establishing a business that creates local employment (for example, a threshold of job creation or a minimum capital injection—varies by programme) or investing in an existing Turkish company.

- Why consider this: it deepens commercial ties, may offer tax or operational advantages, and supports regional operations.

Callout — choose with clarity:

- Property for lifestyle and income; capital routes for liquidity; business routes for long‑term commercial integration.

Internal summary: align the route with whether you seek fast citizenship, liquidity, or a business base.

Timelines and residency terms: what to expect

Application and processing times

- Preparation: document collection, translations and notarisation may take 2–6 weeks depending on complexity.

- Government processing: when files are complete, investors commonly report residency permit decisions within 3–6 months; processing times vary with seasonal volumes and compliance checks.

Residency permits and renewals

- Initial permit: usually issued for one to two years depending on the route and is renewable while investments are maintained.

- Renewal checks: authorities review continued ownership, investment holding and compliance with Turkish law at renewal.

Practical residency rights

- Rights typically include: the ability to live in Turkey, access local healthcare and primary schooling, and to apply for work permits where applicable. Some investment routes allow direct citizenship applications after meeting holding period conditions.

Internal summary: plan for a multi‑stage process—prepare documents early and expect renewal reviews tied to continued investment.

From residency to citizenship: realistic expectations

Many investors pursue residency as a step towards citizenship. Turkey permits citizenship by investment under specified conditions; applicants should treat this as a regulated process with clear requirements.

Typical path and timing

- Holding period: for most investment routes, investors must maintain the qualifying investment for at least three years before applying for citizenship.

- Processing to citizenship: after the holding period and submission, citizenship decisions often follow within several months, though timelines can extend to a year in individual cases.

Family inclusion

- Common practice: residency and citizenship applications generally include the principal applicant’s spouse and dependent children under 18.

- Extended family: entitlement for older dependants or other relatives is less consistent and may be inconclusive depending on current regulations.

Mobility gains with Turkish citizenship

- Passport benefits: a Turkish passport currently offers visa‑free or visa‑on‑arrival access to a substantial number of countries (reports commonly cite figures around 100+ destinations). Verify the up‑to‑date list before relying on specific visa privileges.

Internal summary: the route to citizenship is achievable for compliant investors, but it requires patience, maintained investment and precise documentation.

Compliance, risk and documentation: non‑negotiables

The integrity of your application rests on compliance. Turkey adheres to international anti‑money‑laundering standards and conducts robust background checks. Investors should treat source‑of‑fund documentation and legal clarity as the project’s foundation.

Source of funds and due diligence

- Provide certified bank statements, sale agreements, audited company accounts or equivalent evidence.

- Legalisation, apostilles and certified translations are often required for foreign documents.

Common pitfalls and delays

- Incomplete source‑of‑fund records, inconsistent ownership documentation, or unclear banking trails are frequent causes of delays or refusals.

- Local administrative variations can add complexity; using accredited local counsel minimises these risks.

Regulatory change and policy risk

- Investment thresholds and qualifying conditions can change. Treat timelines and thresholds as indicative and consult up‑to‑date official guidance when planning.

Callout — compliance checklist:

- Certified proof of funds and audited financials

- Clean criminal records for all principal applicants

- Fully translated and apostilled documents where required

Internal summary: robust documentation and local legal support are essential to reduce risk and achieve timely approvals.

Practical considerations for African investors

Banking and fund transfer logistics

- Use formal banking channels for transfers and retain all transaction records.

- Expect banks to require enhanced due diligence for higher sums.

Property market realities (if using property route)

- Consider location liquidity, developer credentials and rental demand.

- Factor in transaction costs, taxes and potential management fees.

Business planning (if choosing the commercial route)

- Prepare a solid business plan, local market analysis and employment projections to satisfy authorities and banks.

Internal summary: plan cashflow, legal structures and exit options before deploying capital.

Why use a specialist adviser: the Siyah Agents advantage

Navigating Turkish residency demands precise, local knowledge. Siyah Agents provides targeted support for African investors: eligibility assessment, document preparation, local counsel coordination and post‑residency integration advice. Their compliance‑first approach helps anticipate and resolve common issues before they arise.

For up‑to‑date programme details consult the Turkey citizenship guide: https://siyahagent.com/guides/turkey-citizenship-requirements??utm_source=marc&utm_medium=blog&utm_campaign=turkish-residency-by-investment:-your-path-to-long-term-stay-and-eventual-citizenship and book a confidential assessment to evaluate your best route: https://siyahagent.com/assessment

Internal summary: seasoned advisers shorten timelines, reduce risk and help structure investments to support both residency and longer‑term goals.

Conclusion: a route worth planning for, not a shortcut

Turkish residency by investment can be a pragmatic, family‑inclusive route to long‑term residence and, potentially, citizenship. It combines accessible investment options with relatively swift processes, but it is not a guaranteed outcome: compliance, documentation and evolving policy all shape results. For African investors who prepare thoroughly and use experienced advisers, Turkey can be a strategic addition to a global mobility and investment plan.

Ready to explore your pathway? Book a confidential, personalised assessment with Siyah Agents to map the best Turkish residency option for you and your family.