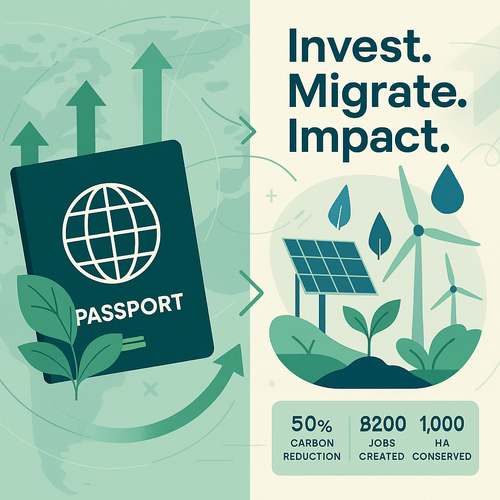

Sustainable investment immigration: purposeful capital, practical residence

Introduction: the new frontier for impact and mobility

Sustainable investment immigration is the practice of using capital to obtain residency or citizenship while directing funds into environmentally and socially positive projects. For English‑speaking African professionals and investors, this approach links global mobility with measurable climate and community benefits — and positions capital to work harder, both financially and ethically. This guide explains how to align immigration strategies with green initiatives, what to look for in ESG‑centred programmes, and practical steps to proceed with rigour.

Internal summary: Align projects with verified ESG criteria, prioritise measurable climate outcomes and choose advisers who verify impact.

What sustainable investment immigration means in practice

Sustainable investment immigration blends two goals: moving capital across borders for residency or citizenship, and investing in projects that advance environmental, social and governance (ESG) objectives. Rather than buying a passport as an end in itself, the investor channels funds into renewables, conservation, sustainable agriculture, or climate‑resilient infrastructure that a host country recognises as delivering public benefit.

This model is gaining traction as governments seek private finance for green transitions. For African investors it offers a way to pursue global mobility while supporting projects that address local and global climate risks.

Internal summary: The clearest programmes tie immigration eligibility directly to projects with demonstrable environmental impact, not merely to the size of the investment.

The green investment universe: where capital meets climate action

Investors should seek projects that meet established green criteria. Common categories include renewable energy, energy storage, sustainable transport, water and sanitation, ecological restoration, and climate‑smart agriculture. Each category demands different technical and reporting standards; these differences matter when programmes require verifiable impact.

Key green criteria to assess:

- Measurable carbon‑reduction or adaptation outcomes.

- Third‑party certifications or standards (where applicable).

- Local community benefits and social safeguards.

Callout — green due diligence essentials: Demand verifiable metrics, independent audits and clear governance arrangements before committing funds.

Internal summary: not all ‘green’ labels are equivalent; insist on transparent verification.

ESG integration: what programmes and projects should demonstrate

ESG considerations are central to sustainable investment immigration. At minimum, eligible projects should demonstrate:

- Environmental integrity: quantified reductions in emissions, improved efficiency or verified biodiversity outcomes.

- Social value: local employment, community engagement and fair labour practices.

- Governance and transparency: anti‑corruption measures, audited accounts and independent oversight.

Where these elements are present, investments are more likely to deliver both impact and resilience to policy shifts. Where evidence is thin, treat the green claim as inconclusive and demand further proof.

Internal summary: robust ESG frameworks reduce reputational and regulatory risk while improving long‑term project viability.

Programmes and jurisdictions: practical reality check

Several jurisdictions have begun to welcome climate‑aligned investments as qualifying routes for residency or citizenship. The landscape is diverse: some programmes explicitly list renewable projects or conservation as eligible, while others accept sustainable funds on a case‑by‑case basis.

Because rules evolve, investors must verify current public guidance and request documented evidence of how a given project meets the host country’s qualifying criteria. If a programme lacks detailed, auditable standards for green investments, class the sustainability claim as inconclusive until proven otherwise.

Callout — jurisdiction checklist:

- Confirm eligible project types and the exact qualifying mechanism.

- Demand clarity on required impact reporting and holding periods.

Internal summary: the most credible options publish clear, auditable criteria and independent verification requirements.

Benefits of aligning immigration capital with green opportunities

- Reputation and market positioning. Investing in sustainability strengthens an investor’s ESG credentials, opening doors to impact partners, concessional finance and institutional co‑investors.

- Risk mitigation. Climate‑aware portfolios can reduce exposure to stranded‑asset risk and regulatory transition shocks.

- Measurable social return. Projects that create local employment and resilience can deliver tangible community benefits alongside financial returns.

Evidence suggests that well‑selected green assets can offer competitive returns over suitable horizons; however, outcomes vary by sector and project structure, so present returns as ranges rather than certainties.

Internal summary: impact‑aligned capital can combine civic benefit with prudent portfolio diversification when chosen judiciously.

Practical challenges: measurement, liquidity and policy change

Sustainable investment immigration brings distinct challenges. Measuring environmental outcomes is technically demanding and often requires third‑party verification. Liquidity can be limited in infrastructure or conservation projects, and exit strategies may be longer than for traditional real estate investments. Finally, immigration policy and green criteria may shift with political priorities, so investors must build flexibility into their plans.

Inconclusive: long‑run return comparisons between green immigration projects and traditional investment routes depend heavily on project selection and local market dynamics.

Internal summary: expect longer due diligence cycles, specialised advisors, and tailored exit planning for green deals.

How to evaluate a sustainable investment immigration opportunity (practical steps)

- Demand third‑party verification: seek projects with credible standards and independent audits.

- Verify residency linkage: confirm that the host country explicitly accepts the project type for immigration purposes.

- Insist on measurable impact metrics: carbon reductions, megawatts installed, hectares conserved or jobs created.

- Plan for liquidity: understand holding periods, potential buy‑back clauses and secondary market prospects.

- Assess legal and tax implications: cross‑border structures must be designed for both immigration and fiscal efficiency.

Callout — due diligence checklist:

- Independent impact verification

- Clear residency eligibility paperwork

- Defined exit and liquidity plan

Internal summary: meticulous verification and legal clarity reduce the risk of surprises and preserve both impact and capital.

A framework for African investors: aligning intent, impact and immigration

Step 1: define your objectives — mobility, return, impact or legacy.

Step 2: shortlist jurisdictions whose immigration programmes recognise green projects.

Step 3: engage technical advisers early (environmental engineers, ESG auditors, legal counsel).

Step 4: structure investments into verifiable vehicles—certified funds, green bonds or accredited projects.

Step 5: monitor performance and compliance through independent reporting.

Internal summary: a disciplined framework turns ambition into credible, documentable outcomes.

Working with advisers: practical advice and next steps

Sustainable investment immigration requires interdisciplinary expertise: immigration law, project finance, ESG assurance and tax planning all matter. Choose advisers with demonstrable experience in green finance and immigration to avoid costly misalignments.

Siyah Agents offers tailored guidance combining programme selection, ESG screening and compliance oversight to help investors align mobility goals with measurable climate outcomes. Begin with a focused eligibility assessment and an impact verification plan.

Internal summary: multidisciplinary advice is essential to align residence outcomes with authentic sustainability.

Conclusion: invest with purpose, migrate with confidence

Sustainable investment immigration represents a compelling evolution in how ambitious African investors think about capital mobility. When executed with rigorous due diligence and credible impact measurement, it can deliver mobility, community benefit and participation in the global green transition. The path requires patience, specialised advisers and a commitment to transparency. If you are ready to explore strategies that align your mobility goals with verified climate impact, speak with Siyah Agents for a personalised assessment and actionable plan.

Key takeaways:

- Insist on measurable ESG criteria and independent verification.

- Prioritise jurisdictions with clear, auditable green eligibility rules.

- Engage multidisciplinary advisers early to structure viable, impactful investments.

Call to action: Book a personalised assessment with Siyah Agents to identify sustainable immigration routes that match your objectives and values.

Sources: Government programme notices on green investment, international ESG standards, investment migration reports and Siyah Agents advisory data.