A practical gateway: property investment and European access

Introduction: a smart play for African investors

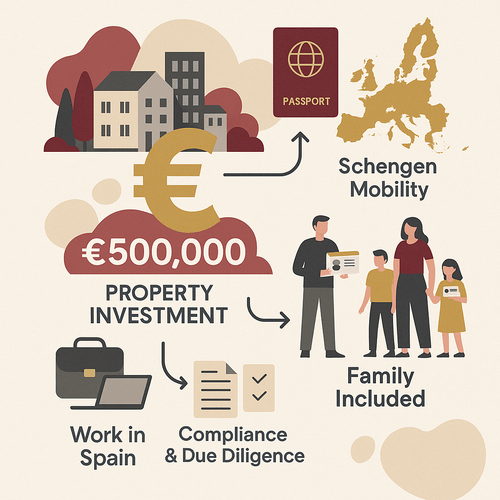

For many English‑speaking African professionals and investors, a well‑chosen property investment can do more than earn rental income — it can open a door to Europe. Spain’s Golden Visa remains a leading residency‑by‑investment route because it balances clear qualifying rules with valuable mobility and professional options. This guide explains how the property route works, what residency and work rights you can expect, the realistic risks, and how to approach the process with confidence.

Internal summary: the Spain Golden Visa converts qualifying property investment into Spanish residence and Schengen mobility; practical work rights are available but require local registration.

How the Spain Golden Visa works: property as a qualifying route

At its core, Spain’s Golden Visa grants residence rights to non‑EU nationals who make qualifying investments. The property route is straightforward in principle: purchase Spanish real estate meeting the programme’s minimum value and demonstrate that the acquisition is free of encumbrances for the qualifying portion.

Key eligibility point

- Minimum qualifying investment: €500,000 in Spanish real estate per principal applicant (the qualifying sum must be unencumbered by loans for the threshold amount).

Qualifying properties

- Residential apartments, villas and townhouses.

- Commercial properties, subject to local planning rules.

- Mixed‑use buildings where permitted by local law.

Joint purchases and financing

Joint purchases are permissible, but only the investor’s share counts towards the €500,000 threshold. Mortgage funding may be used for amounts above the qualifying sum, but the threshold itself must be free of mortgage encumbrance. All purchases must be registered with the Spanish property registry and supported by bank transfers and official deeds.

Internal summary: secure, registered property purchases of €500,000 or more are the clearest path to qualifying under the property option.

Residency rights: living in Spain and Schengen access

Residence permit basics

Successful applicants receive a renewable residence permit that allows them to live in Spain. Initially, an entry visa is issued for the first year; this converts to a residence permit typically valid for two years, renewable thereafter provided the qualifying investment is maintained.

Schengen mobility

One of the Golden Visa’s most practical benefits is enhanced travel across the Schengen Area. Residence in Spain permits visa‑free travel within the Schengen zone for short stays — commonly up to 90 days in any 180‑day period under Schengen rules — offering significant convenience for business and family travel.

Presence requirements and longer‑term rights

The Golden Visa is known for low physical presence obligations compared with typical residency visas, making it attractive to global professionals. However, applicants should note the distinction between:.

- Maintaining the Golden Visa — requires preserving the qualifying investment and complying with renewal procedures.

- Applying for permanent residence — commonly requires a period of legal residence (often five years) and evidence of actual residence; rules and interpretation can vary.

- Applying for Spanish nationality — typically requires longer continuous residence (usually around ten years under Spanish law); outcomes depend on integration, language and legal criteria.

Evidence note: specific timelines and residency conditions are governed by Spanish immigration law and administrative practice; where interpretations vary, treat outcomes as subject to official discretion.

Internal summary: the Spain Golden Visa gives practical residence and Schengen travel, with potential pathways to long‑term rights subject to meeting residence and legal criteria.

Work rights: can you work in Spain with a Golden Visa?

Short answer: yes — with formal registration. The Spain Golden Visa permits holders to live in Spain and engage in economic activity, but working normally requires administrative steps familiar to any foreign national.

Practical realities

- Employment: Golden Visa holders may accept employment in Spain, but must register with social security and obtain the relevant tax and employment registrations. Employers will generally require the holder’s NIE (tax identification) and social security enrolment.

- Self‑employment and entrepreneurship: Investors can establish or manage a business in Spain. Company registration, local tax registration and, where applicable, sector licences are required.

- Remote work: Many Golden Visa holders continue to run businesses or provide services internationally while resident in Spain; remote activity is permissible, but tax residency implications depend on days spent in country and local tax rules.

Callout — work practicalities:

Register with social security and tax authorities before commencing employment.

Legal nuance and compliance

Working in Spain triggers standard employment and tax obligations. Residency via the Golden Visa does not exempt holders from Spanish labour law or tax rules. If you intend to operate a business or be employed locally, secure legal and tax advice early in the process to avoid inadvertent non‑compliance.

Internal summary: Golden Visa holders can work or run businesses in Spain, but must complete local registrations and meet tax obligations.

Family inclusion: expanding the residency ripple effect

One of the Golden Visa’s strongest draws is its family inclusion policy. The principal applicant may apply to include immediate family members on the same application, typically with similar residency rights once approved.

Who is usually included

- Spouse or registered partner.

- Dependent children (commonly under 18; in some cases adult dependants if studying or financially dependent).

- Dependent parents may be included when dependency is demonstrated.

Each family member receives an individual residence card, enabling schooling, health coverage and travel privileges within Schengen. Family circumstances can complicate applications, so prepare relationship and dependency evidence carefully.

Internal summary: one qualifying investment can secure residence for your immediate family, creating practical continuity for education and healthcare.

Risks and realities: what every investor must know

No visa is a guaranteed gateway. Key risks and caveats for African investors:

- Approval is discretionary: Spanish authorities perform checks on applicants’ legal standing, source of funds and security profile. Approval is not automatic.

- Policy change risk: immigration rules, minimum thresholds or renewal policies can change. Recent years have shown that governments periodically review investment immigration schemes.

- Tax implications: living in Spain may create tax residency, with attendant reporting and tax liabilities. Examine your global tax position before moving.

- Investment risk: property value and liquidity can vary by market and location; treat the investment part of the strategy, not merely the immigration outcome.

Callout — mitigations:

Use regulated advisers, secure independent legal and tax counsel, and document source of funds comprehensively.

Internal summary: diligent planning, compliance and professional advice reduce the risk of unwelcome surprises.

Practical steps for African investors considering Spain’s Golden Visa

- Market research: identify locations that match your lifestyle and investment expectations (Madrid, Barcelona, Valencia, Costa del Sol).

- Property due diligence: perform legal title searches, developer vetting and TAPU‑equivalent checks via a local notary or lawyer.

- Funds and documentation: prepare certified bank statements, proof of income, tax returns and source‑of‑fund evidence.

- Plan for tax: assess whether Spanish tax residency rules will apply and the implications for global income.

- Engage specialists early: trusted migration advisers and Spanish legal counsel streamline the trajectory and avoid procedural delays.

Internal summary: investigate thoroughly, prepare documents in advance, and use experienced local advisers to streamline the process.

Conclusion and next steps: preserve mobility, protect family, plan with care

The Spain Golden Visa remains a powerful option for African professionals and investors seeking a European base, Schengen mobility and the ability to work or run businesses in Spain. The property route is clear‑cut, but outcomes depend on compliance, market choice, and evolving policy. For tailored, pragmatic advice and a confidential eligibility review, consult the Spain Golden Visa specialists at Siyah Agents.

Take action: book a personalised assessment with Siyah Agents to map your eligibility and next steps: https://siyahagent.com/assessment

Internal summary: Spain offers practical residency and professional options for investors who plan carefully and act with expert support.

Sources: Spanish immigration guidance; European Commission Schengen rules; Siyah Agents programme data and advisory experience.