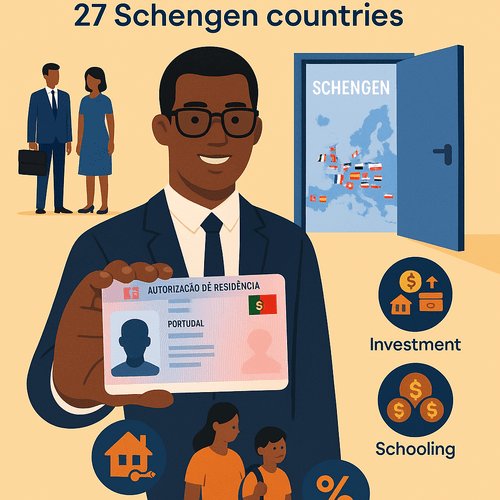

Portugal residency: Schengen freedom and strategic advantage

Introduction: a European base with practical upside

For English‑speaking African professionals and investors, Portuguese residency is a strategic gateway: it combines visa‑free travel across much of Europe with clear residency routes, attractive lifestyle, and business opportunities. This guide explains what Schengen freedom really delivers, the main residency pathways, tax and residency implications, lifestyle and commercial advantages, and practical next steps. Where facts vary, we flag them as inconclusive.

Internal summary: Portuguese residency offers Schengen mobility, several official routes to live in Portugal, and a credible pathway to permanent residence and citizenship — but careful planning and compliance are essential.

Schengen advantages: mobility that matters

The headline benefit of Portuguese residency is access to the Schengen Area — 27 European countries that operate a border‑free zone for short stays. As a legal resident of Portugal you can travel across Schengen for short business trips and family visits without applying for separate short‑stay visas, subject to the 90/180‑day rule that governs Schengen travel.

Why this matters for business leaders

- Immediate executive mobility for meetings, due diligence and investor roadshows across major European markets.

- Fewer consular delays and reduced administrative friction for frequent travel.

- Simplified logistics for family travel, education scouting and relocation planning.

Internal summary: Schengen travel reduces time‑costs and enables swift, flexible engagement across Europe — an everyday operational advantage for international executives.

Official routes to Portuguese residency: pick according to purpose

Portugal offers several formal pathways to residency that suit different investor profiles. The two most widely used are the Golden Visa (investment) and the D7 (passive income) visa. Employment, start‑up and family reunification routes are also available.

Golden Visa (residency by investment)

The Golden Visa historically permitted residency in return for qualifying investments such as regulated funds, capital transfers or real‑estate purchases. It appealed because minimal physical presence in Portugal was required and it provided a clear path to longer‑term status. Recent reforms have narrowed some property options and emphasise investments that deliver economic benefit.

D7 Visa (passive income)

The D7 is aimed at those with a stable income stream — pensions, dividends, remote earnings or rental income. It requires proof of sufficient recurring income to support yourself in Portugal and is suited to professionals or retirees who intend genuine residence.

Other routes

- Employment and highly skilled worker visas for sponsored professionals.

- Start‑up visa for founders in innovation sectors.

- Family reunification for close relatives of residents or citizens.

Callout — which route fits you?

- Choose the Golden Visa if minimal presence and investment structuring suit your goals.

- Choose the D7 if you have steady passive income and plan to live in Portugal.

Internal summary: match the route to your time horizon and whether you prioritise investment returns or genuine residence.

Investment options and financial thresholds: ranges and notes

Thresholds and eligible assets change periodically; treat the figures below as indicative and confirm current rules with official guidance or a qualified adviser.

- Investment funds / capital transfer: regulated fund subscriptions or capital transfers are common Golden Visa routes, often quoted around EUR 500,000 as a rule of thumb for qualifying fund investments.

- Real‑estate: previous minimums for property were commonly EUR 500,000 (with reductions for urban rehabilitation projects). Policy adjustments have restricted prime urban acquisitions in recent reforms — consult up‑to‑date official guidance.

- Business creation: qualifying entrepreneurial investments typically require capital injection and local job creation (for example creating at least ten local jobs in some schemes).

Inconclusive elements: the precise treatment of certain property classes and urban areas has been revised; investors must verify current eligibility before committing capital.

Internal summary: investment thresholds are aligned to delivering economic benefit; confirm exact figures and eligible instruments prior to investment.

Tax and residency implications: plan with professionals

Portugal’s tax environment has features that attract global talent, but outcomes depend on residency status, treaties and individual circumstances. Two points merit particular attention.

Non‑Habitual Resident (NHR) regime (overview)

NHR historically offered beneficial tax treatment to eligible new residents, including reduced tax rates on certain Portuguese‑source incomes and exemptions or lower taxation of some foreign‑source incomes for a limited period. Recent policy adjustments (post‑2022) have affected some NHR benefits; whether specific advantages apply depends on current law and treaty positions. Inconclusive: check latest tax guidance.

Tax residence and reporting

- Becoming tax resident in Portugal usually follows spending 183 days in a calendar year in Portugal or establishing a habitual residence.

- Tax residency brings obligations to report worldwide income and to understand interactions with home‑country tax rules.

- Portugal has no general wealth tax and inheritance treatment is comparatively favourable for immediate family, though other taxes and reporting duties remain.

Callout — tax essentials:

- Don’t assume automatic tax benefits; obtain bespoke tax advice.

- Residency decisions affect reporting and potential exposure to Portuguese tax regimes.

Internal summary: tax planning is central — work with tax advisers who understand cross‑border rules and bilateral treaties.

Lifestyle and business environment: quality and connectivity

Portugal combines an attractive quality of life with growing business opportunity — a key reason it attracts globally mobile executives.

Lifestyle perks

- Mild climate, safety, good healthcare and an increasingly international education offering.

- English widely used in professional and urban contexts, easing integration for English‑speaking Africans.

Business environment

- Rapidly growing tech and start‑up ecosystem, investor incentives and government support for foreign direct investment.

- Strategic location with direct air links to Europe, Africa and the Americas — useful for pan‑continental business networks.

Internal summary: Portugal offers an executive‑friendly mix of lifestyle and practical infrastructure for business.

Pathway to permanence: long‑term residence and citizenship

Portuguese residency can be a stepping stone to permanent status and citizenship, subject to meeting legal requirements. Typical milestones are:

- Permanent residence: often available after five years of legal residence, subject to conditions.

- Citizenship: generally requires a period of legal residence (commonly five years), demonstration of sufficient ties and basic Portuguese language ability, along with clean criminal records.

Note: processes and criteria are administered by Portuguese authorities and can change; outcomes are not guaranteed.

Internal summary: Portuguese residency provides credible long‑term options but necessitates compliance with residence and integration requirements.

Risks, compliance and due diligence: essential precautions

While Portugal is reputable and relatively stable, investors must prepare for evolving policy and stringent checks. Key risks:

- Regulatory changes: eligibility and thresholds can be revised, particularly for investment‑linked routes.

- Source‑of‑fund scrutiny: expect thorough documentation to satisfy anti‑money‑laundering standards.

- Tax exposure: residency may alter your global tax position; disregard at your peril.

Callout — practical safeguards:

- Engage regulated migration advisers and local legal counsel.

- Compile certified proof of funds and tax compliance documents before applying.

- Factor in legal, notary and administrative costs in your budget.

Internal summary: due diligence and credible local partners are non‑negotiable for a smooth application.

Concrete next steps for African professionals and investors

- Clarify objectives: mobility, family relocation, tax planning, business expansion or a mix.

- Choose the most suitable route: Golden Visa for investment flexibility, D7 for passive income residency, or employment/start‑up visas for operational movers.

- Prepare documentation: passports, certified financials, criminal records, proof of accommodation and health cover.

- Engage advisers: obtain a tailored eligibility assessment and a plan that addresses tax, legal and immigration dimensions.

Action: book a personalised assessment with Siyah Agents to identify the route best aligned to your priorities.

Conclusion: Schengen freedom is a start — plan for permanence

Portuguese residency delivers immediate Schengen mobility and a supportive environment for family life and business growth. It also offers structured paths to long‑term residence and citizenship for those who prepare properly. For English‑speaking African professionals and investors, Portugal is a pragmatic European base — provided you act with due diligence and expert support.

Ready to explore? Start with a confidential, personalised assessment to map your residency options and required documentation.

Sources: Portuguese SEF official guidance; European Commission Schengen documentation; Siyah Agents programme insights and advisory experience.