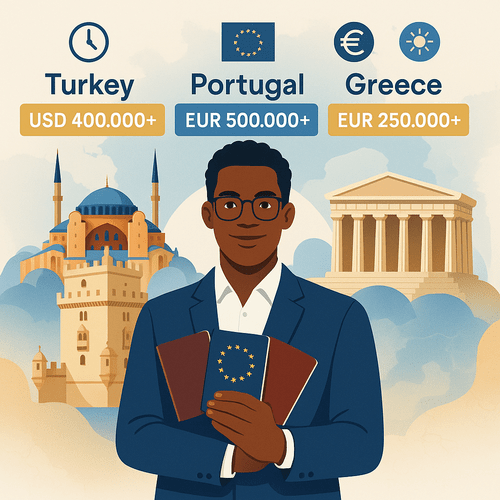

Saturday Spotlight: The Hottest Second Citizenship Programmes for 2025

Introduction: why this matters now

On a quiet Saturday in 2025, the decisions you make about mobility and residence can determine how freely you work, travel and protect your family. For Africa’s high‑net‑worth individuals (HNWIs) the right second citizenship or residency path is strategic capital: it opens markets, reduces friction for travel, and provides contingency when markets or politics shift. This Saturday Spotlight examines three of 2025’s hottest options — Turkey, Portugal and Greece — and shows how to evaluate them with clarity.

Internal summary: these programmes vary by speed, cost and long‑term value. Choose to match your priorities: rapid citizenship, EU access, or low investment thresholds.

Turkey Citizenship by Investment: speed and pragmatism

Why it’s popular

Turkey remains a top pick for investors who want relatively rapid citizenship with practical business advantages. The programme’s multiple qualifying routes and comparatively fast processing are attractive to business owners who value speed and family inclusion.

What qualifies (2025 guidance)

- Residential or commercial property purchases with an official value generally from USD 400,000 (verify exact current thresholds).

- Capital investment options such as bank deposits or government bond purchases at higher thresholds.

- Job creation or business investment alternatives, subject to local employment criteria.

Practical benefits

- Citizenship can be achieved in months when documentation is complete.

- Immediate family inclusion typically covers spouse and children.

- Access to a large market and strategic location between Europe and Asia.

Considerations and compliance

- Property must be properly appraised, purchased via bank transfer and registered in TAPU.

- Due diligence and source‑of‑fund checks are strict; work with licensed advisers.

For current detail, consult Siyah Agents’ Turkish citizenship guide: Turkish citizenship by investment

Internal summary: Turkey suits investors prioritising speed and a strategic business base, but confirm current thresholds and compliance steps before committing funds.

Portugal Golden Visa: EU access and long‑term residency

Why it stands out

Portugal’s Golden Visa has been a perennial favourite for investors seeking EU residency, family rights and a clear pathway to permanent residence or citizenship after five years. Recent regulatory updates have refined eligible investment types, so up‑to‑date advice is essential.

Core routes and features

- Qualifying investments can include capital transfer to funds, certain real‑estate purchases and company creation; thresholds commonly start around EUR 500,000 for real estate and selected fund investments (confirm current limits).

- Minimal physical presence requirements (often measured in days per year) make the route accessible for busy global professionals.

- Family reunification is included for spouses, dependent children and, in some circumstances, dependent parents.

Why HNWIs consider Portugal

- Residency grants Schengen travel rights and a straightforward path to EU citizenship after meeting residency and integration requirements.

- High quality of life, attractive climate and robust private healthcare and education options.

Practical notes

- Portugal is tightening transparency and compliance; ensure funds meet authorised fund criteria and that property purchases fall within approved categories.

Explore Portugal Golden Visa options with Siyah Agents: Portugal Golden Visa

Internal summary: Portugal is ideal if EU access and long‑term residence are top priorities; it requires patient planning and careful compliance.

Greece Golden Visa: competitive thresholds, Mediterranean appeal

Why it appeals

Greece offers some of the EU’s most competitive property thresholds, especially outside capital hotspots. Its Golden Visa is attractive for investors seeking European residence with relatively modest capital outlay compared with many other EU options.

Key features (2025 snapshot)

- Minimum qualifying real‑estate investment often starts from EUR 250,000 in approved areas; certain districts may require higher sums.

- Residency is renewable while the investment is maintained; family members — including children and dependent parents in many cases — can be included.

- No strict minimum stay is required, offering flexibility to international businesspeople.

Strategic advantages

- Schengen access for travel and business in Europe.

- Attractive lifestyle options, strong rental markets in many islands and urban centres.

Practical cautions

- Market selection matters: research location liquidity and regulatory requirements thoroughly.

Find detailed programme guidance at Siyah Agents: Greece Golden Visa

Internal summary: Greece offers cost‑efficient EU residency for those focused on European mobility with lower initial capital than some peers.

Head‑to‑Head: comparing Turkey, Portugal and Greece

Below is a concise comparison to help you weigh purpose, cost and timing. Figures are indicative and should be verified via official sources before investment.

- Turkey CBI — typical qualifying investment: from around USD 400,000 (property) or higher for capital routes. Citizenship in months; family included.

- Portugal Golden Visa — typical qualifying investments: from around EUR 500,000 for property or authorised funds; residency quickly granted, citizenship eligibility after five years.

- Greece Golden Visa — typical qualifying investment: from around EUR 250,000 in many regions; renewable residency while investment held.

Callout:

- Choose Turkey for speed and a non‑EU passport with broad regional reach.

- Choose Portugal for EU residency, Schengen access, and a path to citizenship.

- Choose Greece for lower capital entry points to EU residency and Mediterranean lifestyle.

Internal summary: each programme serves different strategic aims — match route to your priorities.

What to check before you invest: a practical checklist

- Confirm current minimums and eligible asset classes with official sources.

- Prepare audited proof of funds, bank statements and tax records.

- Verify title and developer credentials for property purchases; insist on TAPU review in Turkey.

- Budget for legal fees, notary costs, translation and ongoing compliance expenses.

Quick readiness list:

- Certified bank statements

- Clean criminal record checks

- Tax and corporate documentation

Internal summary: thorough preparation reduces delays and refusal risk.

How Siyah Agents supports African HNWIs

Siyah Agents works with clients across the continent to assess eligibility, compare programmes and manage applications end‑to‑end. Our services include: personalised eligibility assessment, programme matching, document preparation and local counsel coordination.

Start your tailored assessment today at Siyah Agents assessment flow: Siyah Agents Assessment Flow

Callout:

- A bespoke assessment avoids costly missteps and aligns pathway choice to your family and business priorities.

Internal summary: expert guidance shortens timelines and improves approval odds.

Conclusion: pick a programme that serves your purpose

Saturday’s quiet offers an ideal moment to think strategically. The hottest second citizenship routes in 2025 each deliver different advantages: rapid access with Turkey, EU entry and long‑term mobility with Portugal, and cost‑efficient EU residency with Greece. Your objective — speed, EU access, or capital efficiency — should guide the choice. Wherever you start, rigorous due diligence and the right adviser make the difference.

Ready to begin? Take a confidential eligibility assessment with Siyah Agents to identify the best pathway for you: Siyah Agents assessment flow: https://siyahagent.com/assessment

Featured image request: A confident African investor holding passports with Turkey, Portugal and Greece landmarks in the background.

Sources: Siyah Agents Supabase data; recent Brave research; official programme pages for Turkey, Portugal and Greece.