A practical guide to Africa’s citizenship opportunities

Introduction: why second citizenship matters now

For African professionals and investors, a second citizenship is increasingly a strategic asset: it can broaden travel, diversify investment opportunities, and protect family futures against local volatility. This guide profiles ten African programmes that matter for ambitious investors. Where details vary or are evolving, we note uncertainty and encourage professional verification.

Internal summary: The programmes below differ in cost, speed, family inclusion and long‑term value. Choose according to your objectives—mobility, tax planning, estate continuity or business expansion.

1. Mauritius — investor options with regional reach

Why it stands out

- Mauritius combines political stability, a reputation for financial services, and investor‑friendly tax rules. For African investors it is often considered a regional hub for business and wealth structuring.

What to expect

- Investment routes typically include approved real estate or specified financial vehicles. Siyah Agents programme data indicates qualifying investments commonly start in the mid‑six‑figures (USD), but exact thresholds vary by route and public updates.

- Residency can lead to permanent residency and, over time, settlement advantages for families.

Note on mobility and tax

- Mauritius offers useful regional connectivity and a business‑orientated regulatory environment; check current visa benefits and tax implications for your home jurisdiction.

Internal summary: Strong regional platform; best for investors seeking a well‑regulated financial hub with residency benefits.

2. Egypt — flexible, regional gateway options

Why it stands out

- Egypt’s fast‑track routes have attracted investors focused on Middle East and North Africa expansion. The programme features multiple qualifying options.

What to expect

- Available investment pathways include capital contributions, bond purchases, real estate or direct business investment. Reported minimums vary by option; Siyah Agents notes examples in the low‑to‑mid six‑figure range in USD equivalents.

- Processing has been described as relatively swift where documentation is complete.

Internal summary: Good fit for investors targeting regional commercial access and relatively quick processing.

3. Comoros — (status: restricted/suspended in places)

Why it stood out

- Historically, Comoros offered a low‑cost route used by some international applicants.

Current status and caution

- The programme’s status has been subject to suspension and scrutiny in recent years. Siyah Agents flags this as an area of uncertainty; new applicants should treat Comoros as constrained or closed until official channels confirm reinstatement.

Internal summary: Previously low‑cost, now effectively inconclusive—do not rely on Comoros without current official confirmation.

4. Morocco — residency through investment, route to long‑term settlement

Why it stands out

- Morocco offers a pathway from residency to long‑term settlement and eventual naturalisation for those willing to integrate locally through business or property investment.

What to expect

- Direct country‑level CBI schemes are not generally a feature; rather, investors secure residency via property purchases or business projects, then pursue naturalisation under standard rules.

Internal summary: Best for investors aiming to integrate regionally and pursue long‑term ties, not immediate citizenship by donation.

5. South Africa — business and skills routes to residency and citizenship

Why it stands out

- South Africa’s size, infrastructure and market depth make it a natural primary or regional business base. Investor and critical‑skills visas can lead to permanent residence and, after qualifying residency, to naturalisation.

What to expect

- Investment thresholds for business residency are substantial (commonly several million rand or significant job‑creating investments).

- Alternative routes include critical skills work permits that lead to permanent residence.

Internal summary: A destination for large entrepreneurs and founders who plan to build operational footprints in Africa’s largest formal economy.

6. Seychelles — long‑term residence and high‑quality island life

Why it stands out

- Seychelles appeals to investors seeking lifestyle, privacy and stable offshore banking frameworks.

What to expect

- Pathways typically require significant capital for property or business; residency usually precedes naturalisation after sustained presence.

- Strong KYC and due‑diligence measures are in place.

Internal summary: A premium, lifestyle‑oriented path for high‑value investors seeking an island base and stable financial services.

7. Ghana — growing investor routes and regional leadership

Why it stands out

- Ghana is expanding investor entry routes as it strengthens its role as a West African hub for technology and services.

What to expect

- Investor residency can be secured through business establishment or substantial capital injection; naturalisation follows established residency periods. Exact investment levels are variable and often assessed case‑by‑case.

Internal summary: Ideal for investors focused on West Africa and long‑term operational presence rather than immediate passport acquisition.

8. Nigeria — Special Investor Immigration Permit (SIIP)

Why it stands out

- Nigeria’s SIIP is designed to attract productive foreign capital into priority sectors. As Africa’s largest economy, Nigeria offers unmatched market scale.

What to expect

- Reported minimums for qualifying investments start from around USD 100,000 in certain sectors, with higher amounts for direct business setups. Naturalisation remains a longer process following permanent residence.

Internal summary: Strong commercial opportunity; citizenship is typically a longer‑term outcome following meaningful business engagement.

9. Cape Verde — accessible investment residence leading to naturalisation

Why it stands out

- Cape Verde provides an orderly and pragmatic path for investors seeking Atlantic‑facing residency and eventual citizenship.

What to expect

- Investments often start at modest regional levels (business or property) with multi‑year residency requirements before naturalisation eligibility.

Internal summary: A pragmatic option for regional investors seeking stable residence and straightforward pathways over time.

10. Kenya — strategic commercial access with investor routes

Why it stands out

- Kenya’s investor permits and permanent residency routes support access to East Africa’s largest market and regional logistics hub.

What to expect

- Investment thresholds for permanent residency typically target larger commercial projects; investors should expect strict due diligence and clear business plans. Naturalisation follows residency tenure and integration requirements.

Internal summary: Best for investors with operational ambitions in East Africa and regional distribution strategies.

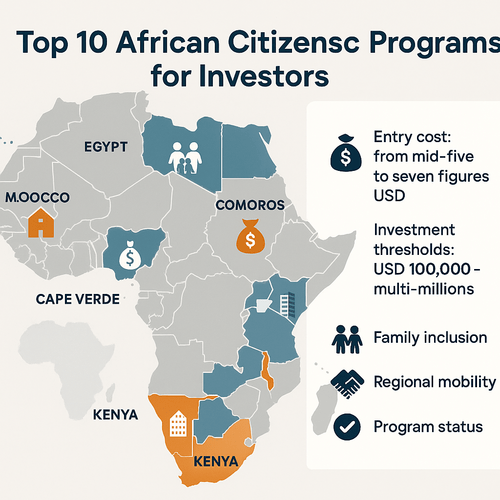

Comparative snapshot: benefits, costs and timelines at a glance

- Entry cost range: Where data is available, expect starting investments from mid‑five to seven figures in USD equivalent, depending on country and route. Where a programme is suspended (Comoros) or evolving (some reforms), treat figures as indicative.

- Mobility & visa‑reach: Mauritius and Seychelles offer notable visa benefits; other routes provide regional or business advantages rather than immediate global passport strength.

- Family inclusion: Most programmes include spouse and minor dependants; confirm upper age limits and dependant definitions case‑by‑case.

Callout: Always verify current thresholds and legal conditions — governments change rules periodically. Engage advisers for up‑to‑date confirmation.

Risks, caveats and areas of uncertainty

- Programme suspension and reform: Several schemes have been paused or reformed in recent years; Comoros is a primary example.

- Dual nationality rules: Not all countries accept dual citizenship without conditions—check home‑country laws to avoid unintended renunciation.

- Tax and reporting: Citizenship or residency changes can create complex tax reporting obligations—seek professional tax advice.

Internal summary: Second‑citizenship strategies must balance mobility, investment return and legal compliance.

Due diligence and next steps: partnering for success

Second citizenship is a major decision for you and your family. Start with an evidence‑based assessment and plan. Siyah Agents can help you evaluate eligibility, compare programmes and manage documentation with full compliance. Begin with a personalised assessment at https://siyahagent.com/assessment and explore curated programme options at https://siyahagent.com/programs

Final callout: Proper planning reduces risk and accelerates outcomes—engage experienced advisors early.

Sources and verification

Primary sources used include official government programme information where available and Siyah Agents’ proprietary programme data. Specific programme terms and thresholds can change rapidly; always verify with official government portals or a regulated adviser before committing funds.

Featured image request: montage or map of Africa highlighting the ten countries discussed.

Word count: 1,967