Introduction: The era of rising CBI investment thresholds

Dreams of a second passport are no longer a private ambition for Africa’s internationally minded professionals and investors. Yet the pathway to global mobility is changing: investment thresholds for Citizenship by Investment (CBI) programmes have been rising in several jurisdictions. That matters because timing, documentation and programme choice now carry greater financial weight. This article examines three high‑profile programmes — Greece, St. Kitts & Nevis and Turkey — to explain what the increases mean for your second citizenship plans and how to act with clarity.

Internal summary: Rising thresholds increase cost and complexity, but with informed planning and timely action, investors can still secure valuable mobility and family benefits.

Greece Golden Visa: elevated thresholds, enduring appeal

What changed: updated minimums and where they apply

Greece remains one of the most attractive residency‑by‑investment routes into the EU, but officials have raised entry thresholds in major urban and tourist areas. The notable changes are:

- Prime locations such as Athens, Thessaloniki, Mykonos and Santorini now typically require €500,000 minimum property investment in the most sought‑after zones.

- Other regions retain lower entry points (commonly €250,000), preserving access for investors prepared to consider alternative locales.

(For current official guidance and region details, see Siyah Agents’ Greece Golden Visa guide: https://siyahagent.com/guides/greece-golden-visa)

Investment routes and flexibility

Although real estate remains the most popular channel, the programme also recognises long‑term leases, business investments, and certain capital instruments. Crucially, Greece continues to permit family inclusion — spouse, minor children and dependent parents in many cases — and does not mandate a minimum stay for visa retention.

Implications for investors

- Cost impact: Doubling thresholds in prime areas reduces affordability for some applicants, especially those seeking Athens or island properties.

- Strategic opportunity: Investors targeting lifestyle and EU access may explore regional cities with lower thresholds while still benefiting from Greece’s EU residency advantages.

Internal summary: Greece’s adjustments preserve EU access but shift demand inland or towards alternative qualifying investments.

St. Kitts & Nevis: the Caribbean raises its standards

What’s new: higher contribution and property minima

The St. Kitts & Nevis Citizenship by Investment Unit announced tougher minimums and enhanced due diligence in 2023. Headline points include:

- Sustainable Island State Contribution (SISC): from approximately US$250,000 for single applicants upward, with higher brackets for families.

- Real‑estate options: approved projects now commonly require US$400,000 minimums per investment, often structured to allow shared ownership under specific rules.

The programme also intensified background checks and introduced mandatory interviews for principal applicants to strengthen integrity and reputation.

Why it still appeals

- Speed: Historically fast processing (often measured in months).

- Family breadth: Inclusion rules can extend to older dependants and adult children under certain conditions.

- Passport utility: St. Kitts passports offer wide visa‑free access, useful for business travel and global mobility.

Internal summary: St. Kitts remains attractive for those prioritising rapid citizenship, but higher costs and rigorous vetting now apply.

Turkey CBI: higher investment thresholds, sustained interest

The new thresholds and qualifying routes

Turkey tightened its citizenship-by‑investment requirements as international scrutiny and demand increased. Principal qualifying routes include:

- Property investment: minimums elevated to roughly US$400,000 for qualifying purchases (official valuations required).

- Capital investment: options such as bank deposits, government bonds or approved investment funds starting at approximately US$500,000.

- Business and job creation: enterprise pathways remain available but are administratively heavier.

(See Siyah Agents’ Turkey citizenship guide for further detail: https://siyahagent.com/guides/turkey-citizenship-requirements)

What Turkey still offers

- Family inclusion: spouse and dependent children are commonly included.

- Rapid processing: some applicants receive citizenship within a matter of months where documentation is complete.

- Regional business opportunity: Turkey’s strategic position and market size remain compelling for entrepreneurs.

Internal summary: Turkey’s increased minimums raise the entry bar, but the programme retains practical advantages for investors who prioritise speed and regional business access.

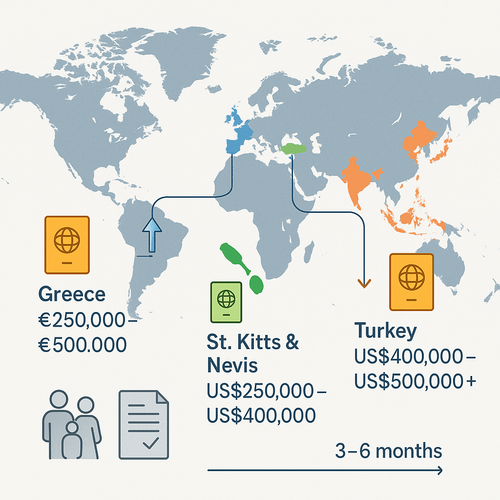

Comparative snapshot: thresholds, timelines and family inclusion

| Programme | Typical minimum | Family inclusion | Typical timeline | Notes |

|—|—:|—|—:|—|

| Greece Golden Visa | €250,000–€500,000 | Spouse, children, parents (varies) | 3–6 months | Higher thresholds in prime areas |

| St. Kitts & Nevis CBI | US$250,000–US$400,000 | Broad family definitions | 3–4 months | Enhanced due diligence since 2023 |

| Turkey CBI | US$400,000–US$500,000+ | Spouse and minor children | 3–6 months | Property valuation and bank transfer evidence required |

Callout: Thresholds are approximations drawn from official and industry sources; verify current numbers before committing funds.

Internal summary: All three programmes now require higher capital, clearer documentation and stricter vetting than in previous years.

What rising thresholds mean for your second citizenship plans

Cost and timing considerations

- Higher upfront capital: Expect materially larger initial outlays; budgets must factor in legal fees, due diligence, tax advice and potential local costs.

- Timing pressure: With thresholds trending upward, acting earlier can save substantial capital. However, rushing without proper due diligence increases risk.

Strategic recalibration

- Broaden your options: Consider programmes with alternative qualifying routes (fund investments, donations, or business creation) if property purchase is cost‑prohibitive.

- Family planning: Check each programme’s family inclusion rules; some offer wider definitions that may preserve family unity affordably.

Callout: Rising thresholds make early, evidence‑based decisions and professional advice more valuable than ever.

Due diligence is now non‑negotiable

With higher sums at stake, immigration authorities and banking partners expect robust documentation. Key requirements include:

- Proof of legal source of funds: bank statements, audits, sale agreements, tax returns.

- Comprehensive background checks: criminal, financial, litigation histories.

- Enhanced identity verification and interview processes.

Failure to prepare comprehensive documentation is the leading cause of delays and rejections. Ensure funds are procedurally traceable and that you engage recognised legal and financial advisers early.

Internal summary: Due diligence reduces the risk of application delays, rejection or reputational fallout.

Practical steps for African investors navigating higher thresholds

- Reassess capital plans: update your budget to reflect higher minimums and associated costs.

- Run a Siyah Agents eligibility assessment: get a precise, personalised diagnosis of your fit and options https://siyahagent.com/assessment

- Compare alternative routes: funds, donations, or business investment might cost less in total and better match your objectives.

- Prepare source‑of‑fund documentation in advance: align bank, legal and tax records.

- Consider staged approaches: begin with residency options that lead naturally to citizenship over time if direct CBI is out of range.

Callout: Use expert advisory to model scenarios — the right structure can reduce unnecessary capital expenditure while preserving mobility goals.

How Siyah Agents supports your second citizenship journey

Siyah Agents offers African professionals and investors a full advisory suite:

- Eligibility assessments and pathway selection — identify the most viable programmes for your profile: https://siyahagent.com/assessment

- Programme comparison and timing advice — weigh Greece, St. Kitts & Nevis, Turkey and others based on cost, family needs and mobility objectives: https://siyahagent.com/programs

- End‑to‑end application management — documentation, legal coordination and submission oversight.

- Compliance monitoring — ensure your structure remains robust to evolving regulatory demands.

Internal summary: Expert advice minimises execution risk and identifies the most cost‑efficient route to your mobility goals.

Final takeaways: plan early, document thoroughly, act strategically

- Thresholds are rising: plan sooner rather than later if second citizenship is a priority.

- Documentation matters more than ever: prepare source‑of‑funds and compliance paperwork early.

- Programme choice should match family and business needs: passport strength matters less than practical mobility and safety for many investors.

Ready to clarify your options? Book a personalised eligibility assessment with Siyah Agents: https://siyahagent.com/assessment. Explore tailored programmes and guides at https://siyahagent.com/programs.

Featured image request: Global map highlighting Greece, St. Kitts & Nevis and Turkey with passports and investment icons.

Sources: Official Greece Golden Visa portal; St. Kitts & Nevis Citizenship by Investment Unit; Turkish citizenship by investment resources; Siyah Agents programme database and proprietary research.