Introduction: why a deliberate Plan B matters

European residency programmes are among the most effective strategic tools African high‑net‑worth individuals (HNWIs) can use to protect family, preserve capital and sustain business agility in an uncertain world. Whether concerns stem from sudden policy shifts, currency volatility or geopolitical risk, a carefully constructed residency portfolio buys time, options and peace of mind. This guide explains how to build a pragmatic multi‑flag Plan B and how Siyah Agents supports HNWIs through every step.

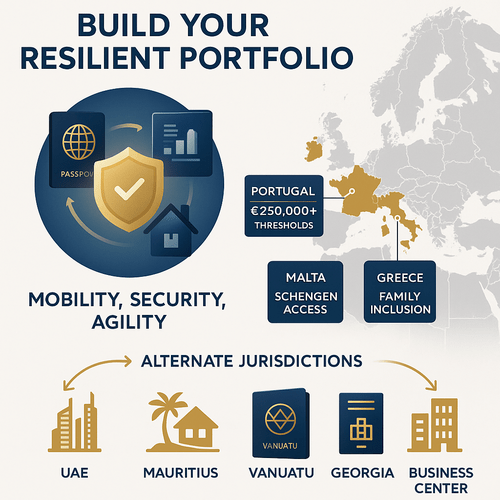

Internal summary: Residency is not an escape — it is a deliberate strategy that converts investment into mobility, legal safeguards and market access.

The case for diversification: why a multi‑flag approach is non‑negotiable

Consolidating wealth or legal status in a single jurisdiction concentrates risk. Regulatory changes, capital controls or unexpected political events can rapidly limit access to assets or travel. The Siyah Multi‑Flag Strategy spreads these risks across complementary jurisdictions and instruments: second citizenships, residency permits, international banking, overseas property and compliant corporate structures.

What the Multi‑Flag Strategy delivers:

- Rapid optionality—move people and capital when needed

- Legal redundancy—separate legal systems protect assets and succession

- Operational agility—business continuity across markets

Callout: Multi‑flag is prudence, not paranoia—evidence from OECD and World Bank reports shows diversified residence and asset allocation among global HNWIs reduces downside exposure during shocks.

Mobility as strategy: the practical benefits of European residency programmes

European residency programmes (Portugal, Malta, Greece and others) often provide Schengen access, simplified travel and family inclusion. For HNWIs these features translate into real advantages: seamless business travel, children’s education access and a secure fallback for family relocation.

Key mobility benefits:

- Schengen travel for business and family movement

- Easier access to education and healthcare

- Reduced friction for opening EU bank accounts and conducting transactions

Internal summary: Mobility reduces friction, turning travel time into productive business time and reducing disruption when local conditions change.

Security and family protection: more than a place to stay

Residency in stable jurisdictions offers legal protections—clear property rights, contract enforcement and regulated financial systems. Most reputable programmes include family members on the main application, enabling continuity for spouses, children and sometimes parents. Access to resident healthcare and educational pathways is a practical benefit that supports long‑term family planning.

Benefits at a glance:

- Family inclusion and continuity of education

- Access to private and public healthcare options

- Stronger courts and enforcement regimes for property and contracts

Comparing leading European pathways (concise, evidence‑based)

Portugal Golden Visa (selected routes)

- Typical routes: targeted real‑estate, capital transfer or qualifying funds.

- Advantages: low physical presence requirements, family inclusion, potential route to permanent residence after five years (SEF).

- Notes: eligible asset classes and thresholds have changed—confirm current SEF guidance.

Malta Permanent Residence Programme (PRP)

- Structure: government contribution, property or rental requirement and donation elements.

- Advantages: robust due diligence, English widely used, Schengen travel subject to rules.

- Notes: Malta applies strict compliance checks; professional advice advised.

Greece Golden Visa

- Investment route: real‑estate purchase (thresholds often from €250,000).

- Advantages: relatively low entry point, quick processing, broad family inclusion.

- Notes: property market dynamics should be assessed for liquidity and location.

Callout: thresholds and eligible assets differ; Siyah Agents confirms current requirements and matches clients to the best route: https://siyahagent.com/programs

Strategic regions beyond Europe: complementary options for multi‑flag portfolios

Mauritius (Africa)

- Residency via property or business investment; strong regional banking and tax planning opportunities.

United Arab Emirates (Middle East)

- Long‑term residency options (Golden Visas) and zero personal income tax in many cases; excellent global connectivity.

Vanuatu (South Pacific)

- Citizenship by donation options offer fast access to alternative passports; mobility and acceptance vary by destination.

Georgia (Eastern Europe)

- Affordable investor/residency routes and an improving business climate — useful for Eurasian market exposure.

Internal summary: Complementary jurisdictions can provide tax, banking or speed advantages that augment EU residency’s travel and institutional benefits. Professional matching is key.

The Siyah Multi‑Flag Strategy: how we design a resilient portfolio

Our process is methodical and compliance‑first:

- Deep eligibility and objectives assessment — family, business, tax baseline.

- Source‑of‑funds review and KYC readiness.

- Bespoke portfolio design — EU residency(s) + complementary jurisdictions + banking and business structures.

- Application delivery and legal coordination.

- Post‑arrival integration: banking, schooling, property management and renewals.

Callout: we prioritise lawful, transparent structures—multi‑flag is about resilience, not avoidance. Start with a confidential Siyah assessment: https://siyahagent.com/assessment

Real‑world examples (anonymised)

- A Nigerian tech founder used Portuguese residency to secure EU mobility for family education while maintaining operations in Lagos and establishing a Mauritius holding company for regional projects.

- A South African entrepreneur combined Greek residency with a UAE commercial base to preserve both lifestyle flexibility and a resilient business hub.

These scenarios show how mixing jurisdictions produces practical options for travel, schooling and business continuity.

Risks, costs and compliance: realistic expectations

Residency and citizenship programmes carry real costs and obligations. Typical considerations include:

- Investment thresholds from ~€250,000 upwards in Europe (varies by country and route).

- Rigorous due diligence and source‑of‑fund checks.

- Potential policy changes that can alter qualifying rules or timelines.

- Ongoing costs: legal fees, taxes, renewals and local compliance.

Mitigation measures: maintain clear documentation, retain contingency capital and use regulated professional advisers. Siyah Agents provides ongoing monitoring and compliance support to clients.

Internal summary: account for upfront and ongoing costs, and plan for regulatory change.

Why choose Siyah Agents: expertise, network and ethical practice

Siyah Agents combines African market insight with global residency and citizenship expertise. Our unique value includes:

- Bespoke multi‑flag programme design tailored to family and business needs.

- Strong partnerships with vetted legal, financial and real‑estate specialists worldwide.

- Rigorous compliance and ethical standards to protect reputation and outcomes.

Callout: partner with advisors who place compliance and long‑term stewardship at the heart of strategy. Learn more: https://siyahagent.com/

Taking action: how to build your Plan B today

- Clarify objectives: mobility, education, tax planning or asset safety.

- Gather documents: certified bank statements, proof of source of funds and IDs.

- Book an eligibility assessment with Siyah Agents: https://siyahagent.com/assessment

- Select a portfolio and begin legal structuring.

Urgency note: windows of opportunity and policy conditions change; early action reduces execution risk.

Conclusion: future‑ready, not fearful

A thoughtful multi‑flag strategy converts uncertainty into optionality. European residency remains central to many HNWIs’ Plan B because of travel access, legal protections and family stability. Complementary jurisdictions add tax, banking and speed advantages—together they form a practical shield for wealth and mobility. Siyah Agents is ready to guide your bespoke strategy—discreetly, legally and effectively.

Start today: assess your options with a confidential Siyah Agents assessment: https://siyahagent.com/assessment Explore curated programmes: https://siyahagent.com/programs For direct advice, contact Siyah Agents: https://siyahagent.com/

No guarantees are offered. Outcomes depend on evolving laws, eligibility and due diligence. Sources include Siyah Agents programme data, OECD, World Bank and Henley Passport Index.