A strategic response from Africa’s founders

Introduction: the H‑1B fee shock and what it means

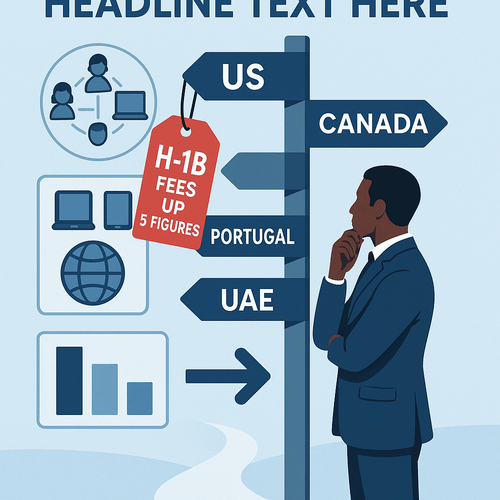

Picture an ambitious African founder mapping a US market entry plan—then add a new policy twist: a substantial H‑1B fee surcharge that can push total employer costs into five figures. The proposed measures discussed in 2023–24 (see USCIS and legislative summaries) introduce surcharges that dramatically raise the cost of sponsoring foreign talent. For many African entrepreneurs, this is not just a budget line: it reshapes hiring strategies, partner selection and market entry timing.

Internal summary: A rising H‑1B cost environment forces African startups to rethink US expansion and talent mobilisation.

What changed: the policy in plain terms

US proposals and rule changes in 2023–24 include additional employer surcharges linked to firm size and H‑1B/L‑1 usage. Reports and official USCIS communications describe an additional fee that applies to employers with larger H‑1B/L‑1 populations — in some scenarios adding tens of thousands of dollars to the total cost per petition (USCIS updates). Exact applicability depends on employer headcount and visa ratios; independent analyses flag scenarios that drive total sponsor costs significantly higher (see sources below).

Key policy nuances:

- The surcharge targets employers who rely heavily on H‑1B or L‑1 workers.

- Small startups with few foreign workers are often outside the high‑surcharge bracket, but partnerships or rapid scaling can change that profile.

- Legal and filing fees remain additional, so total cost exposure is wider than the surcharge alone.

Note: policy texts and final fee amounts change; always consult official USCIS guidance and legal advisors for precise, up‑to‑date obligations.

Immediate impacts on African entrepreneurs and startups

Cost and hiring pressure

For African founders aiming to build US presence—sales offices, R&D or investor relations—the fee hike increases the marginal cost of hiring US‑based or US‑sponsored talent. The effects are real and measurable: fewer sponsored hires, longer recruitment cycles and tighter budgets for growth activities that depend on US teams or specialists.

- Startups may defer hiring US talent, opting instead for remote contractors or local hires.

- Investors scrutinise burn rates and may pressure founders to pivot away from capital‑intensive US expansion.

Strategic friction for scaling

The US is an enormous market, but the fee environment reduces the financial appeal of using H‑1B sponsorship as a rapid scaling lever. Early‑stage African companies typically operate with constrained runway; additional sponsor costs can blunt ambitions to open US offices or absorb US partnerships that require local staff.

Internal summary: Increased sponsor costs raise the bar for US expansion—especially for capital‑sensitive startups.

How African entrepreneurs are responding: practical strategies

Faced with higher costs and greater uncertainty, founders on the continent are adopting varied, pragmatic responses. These are strategic, not reactive—designed to preserve growth while limiting exposure to US policy volatility.

1) Exploring alternative visa and residency pathways

Many entrepreneurs are shifting attention to other destinations with predictable processes and strong startup ecosystems. Notable alternatives include:

- Canada (Global Talent Stream, Start‑up Visa): predictable processing and targeted streams for tech talent; appeals to founders seeking relatively quick access to North American markets (Government of Canada resources; OECD overview).

- Portugal (Residency by Investment / Startup Visa): EU access, growing tech cluster in Lisbon and potential residency benefits for founders and families.

- UAE (Golden Visa and business setup): a hub for Africa–Asia–Europe trade, favourable tax regimes and long‑term residency options.

These routes do not mirror H‑1B in every respect but offer alternative market access, residency and family pathways—often with more transparent cost structures than the uncertain US surcharge environment. Siyah Agents helps African founders map these alternatives and run eligibility assessments: https://siyahagent.com/assessment

2) Embracing remote‑first models and global contracting

Rather than relocating staff, many teams are sharpening remote capabilities:

- Hire skilled contractors in target countries to support US clients without sponsorship.

- Use local employer‑of‑record (EoR) services to engage talent compliantly without costly sponsor commitments.

This reduces upfront migration costs and preserves agility; however, it does not replace the benefits of local presence when in‑person relationships or regulatory footprints are required.

3) Diversifying go‑to‑market strategies

African founders are reworking GTM (go‑to‑market) plans to rely on regional hubs that provide proximity to US markets without the same sponsorship costs—Toronto, Dubai, Lisbon and selected Latin American centres are practical examples. These hubs offer flight connectivity, investor networks and legal regimes friendly to foreign entrepreneurs.

Callout: Policy shocks are catalysts for smarter diversification — not retreat.

Alternative destinations: what founders are weighing and why

Below are succinct comparisons of popular alternatives attracting African entrepreneurs.

Canada: predictable, talent‑focused

- Advantages: Fast processing for skilled streams, clear employer programmes (Global Talent Stream), and established startup support.

- Use case: Founders wanting North American access with lower sponsor volatility.

Portugal: EU gateway and startup ecosystem

- Advantages: Residency pathways, EU market access and growing tech clusters in Lisbon and Porto.

- Use case: Founders seeking long‑term EU footprint and family residency options.

UAE: tax efficiency and geographic hub status

- Advantages: Golden Visa for entrepreneurs, favourable tax regime and strong air connectivity to Africa and Asia.

- Use case: Companies wanting regional headquarters and trade facilitation.

Source note: Each destination has unique eligibility criteria and costs—confirm with official sources and Siyah Agents’ programme advice before applying (https://siyahagent.com/programs)

Policy nuances and the outlook for US visas

Policy watchers note that the surcharge targets firms with heavy visa use; the stated policy intention is to encourage domestic training and employment. However, unintended consequences include shifting hiring to regional neighbours and altering global talent flows. Pending legal or administrative changes could alter fee applicability or thresholds.

Practical steps for founders:

- Review workforce structure and projected visa needs if planning US operations.

- Model total migration costs (surcharges, legal fees, relocation, compliance).

- Maintain relations with US partners but manage expectations and timelines.

Important caveat: Immigration law changes rapidly; use official USCIS sources and regulated counsel for decisions that hinge on fee rules (USCIS.gov).

Case snapshots: how real founders adapt (anonymised examples)

- Tech startup A (early‑stage fintech): pivoted from hiring two US engineers on H‑1Bs to contracting talent in Canada and Portugal while opening a satellite office in Lisbon.

- Marketplace B (growth stage): used an EoR to expand sales capacity in the US without immediate sponsorship, investing saved capital into customer acquisition.

These pragmatic choices reflect trade‑offs: cost savings versus some loss of direct local control.

Checklist: immediate actions for entrepreneurs

- Reassess your US talent dependency and model alternative remote or local contracting.

- Run a cost comparison: US sponsorship (including potential surcharges) vs alternative residency and remote models.

- Engage a regulated advisor for cross‑border tax and compliance planning.

Siyah Agents action: Start with a tailored eligibility assessment to map the most suitable migration and residency routes for you: https://siyahagent.com/assessment

Final thoughts: strategy, not panic

The H‑1B fee changes raise costs and complexity, but they also sharpen strategy. African entrepreneurs are responding with agility—diversifying markets, leaning into remote models and exploring alternative residency routes that offer family stability and investor confidence. Thoughtful, measured action guided by up‑to‑date advice is the prudent path forward.

Ready to adapt your global plan? Siyah Agents offers programme matching and end‑to‑end advisory for entrepreneurs navigating immigration and residency choices: https://siyahagent.com/programs Book an eligibility assessment and discovery call at https://siyahagent.com/assessment

Sources

- USCIS official updates — https://www.uscis.gov/news

- OECD migration policy reports — https://www.oecd.org/migration

- Siyah Agents programme data — https://siyahagent.com/programs

- Immigration consultancy analyses 2024 — https://www.immigrationconsultantreports.com