Digital banking: a new era for African entrepreneurs abroad

Introduction: the shift that matters

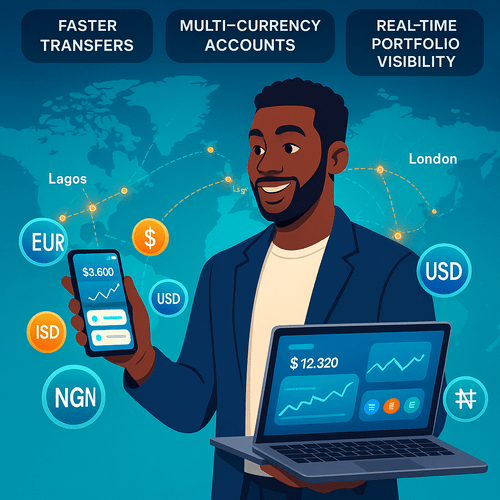

Picture this: an African entrepreneur, laptop open and phone buzzing, sending invoices from Lagos, paying suppliers in Nairobi and accepting investment in London — all before lunch. That scenario is now widespread. Digital banking is more than convenience; it is infrastructure for global enterprise. For English‑speaking African professionals and investors building businesses or managing assets internationally, these platforms unlock speed, transparency and control previously reserved for large institutions.

Internal summary: digital banking gives diaspora founders faster payments, multi‑currency capability and consolidated asset visibility.

What is driving adoption among African entrepreneurs?

Fintech momentum and mobile‑first habits

Africa’s fintech scene has matured rapidly. Mobile‑first services and improved internet access mean entrepreneurs are comfortable with app‑based finance. Reports from industry analysts show strong growth in diaspora usage of digital banking for cross‑border commerce and asset management (see McKinsey, 2023). Siyah Agents’ advisory work confirms clients favour platforms that combine banking with bookkeeping and compliance tools.

Cross‑border business needs

African founders increasingly operate across jurisdictions — customers in Europe, suppliers in Asia, teams in Africa. That complexity demands multi‑currency accounts, fast transfers and reliable reconciliation. Traditional banks often lag on these fronts; digital banks were built for them.

Financial inclusion as a springboard

The continent’s success stories — mobile money, payment APIs and embedded finance — have created familiarity with digital finance. Entrepreneurs now expect the same agility when scaling abroad.

Core features transforming how entrepreneurs bank

Digital banks serving the African diaspora typically offer a powerful set of capabilities:

- Multi‑currency accounts that let you hold, receive and pay in major currencies without constant conversions.

- Fast international payments with transparent fees and real‑time tracking.

- Integrated asset and portfolio dashboards for property, equities and alternative assets.

- APIs and integrations that connect banking to accounting, payroll and ecommerce stacks.

Multi‑currency accounts

Holding multiple currencies in a single account reduces FX friction. Invoice in euros, pay suppliers in naira, and keep reporting in dollars — all from one dashboard. This capability reduces hedging costs and administrative overhead.

Seamless international payments

Digital rails shorten settlement times and typically disclose fees upfront. For entrepreneurs, that means fewer cash‑flow surprises and faster supplier payments.

Portfolio and treasury tools

Leading platforms give entrepreneurs insight into net worth across jurisdictions, performance analytics, and secure document vaults. This centralisation simplifies decisions about capital allocation and tax planning.

Internal summary: these features turn banking into an operational hub rather than a transactional afterthought.

Tangible benefits for African entrepreneurs and investors

Digital banking offers several practical advantages:

- Agility — open and operate accounts remotely, often within days.

- Cost efficiency — competitive FX and lower transfer fees can improve margins.

- Control — consolidated reporting and automation reduce manual reconciliation.

- Compliance‑ready workflows — KYC/AML built into onboarding reduces friction with regulators.

These benefits support business expansion, capital raising and cross‑border payroll, helping entrepreneurs scale with fewer banking bottlenecks.

Risks and how to mitigate them

Digital banking is powerful, but not risk‑free. Entrepreneurs should address three primary concerns.

1. Regulatory complexity

Different countries enforce different rules on onboarding, tax reporting and capital flows. Maintain a compliance checklist for each jurisdiction where you operate. Engage local counsel and accountants early to avoid surprises.

2. Security and fraud

The best platforms deploy multi‑factor authentication, biometrics and real‑time fraud monitoring. But entrepreneurs must adopt robust internal policies: strong passwords, role‑based access, and procedure for incident response.

3. Interoperability and banking cold‑spots

Not every digital bank connects seamlessly with every legacy bank or local payment method. Test critical corridors (for example, NGN–USD, KES–EUR) before committing large volumes, and keep contingency banking relationships.

Callout: most risks are manageable with planning — documentation, cyber hygiene and trusted advisory.

The regulatory landscape and prudential considerations

Regulation is evolving. Expect tighter AML and beneficial‑ownership scrutiny; some jurisdictions now require more documentary evidence for cross‑border transfers and corporate structures. Entrepreneurs should:

- Maintain clear source‑of‑fund records.

- Use regulated platforms and request transparency on custodial arrangements.

- Coordinate tax residency and reporting with a qualified adviser.

If evidence is inconclusive for a specific corridor or product, flag it with your provider and seek bespoke legal advice. Siyah Agents assists clients in mapping those compliance contours and matching suitable banking solutions.

Emerging trends: what to watch next

A few developments will shape the next five years:

- Embedded finance in B2B workflows — invoicing, lending and payments inside business platforms.

- Increased interoperability between digital banks and local payment schemes, improving reach into African markets.

- Expanded treasury services — structured FX, working capital and home‑currency hedging adapted for SME and founder needs.

These trends point to a future where financial operations are deeply integrated with business operations, reducing manual effort and improving capital efficiency.

How Siyah Agents helps entrepreneurs harness digital banking

Digital banking is a tool — extracting maximum value from it requires strategy and local knowledge. Siyah Agents supports African entrepreneurs across the full spectrum: from eligibility assessments to programme matching and ongoing governance. Our services include:

- Eligibility and risk assessment for cross‑border banking and business migration: https://siyahagent.com/assessment

- Tailored programmes for structuring companies, opening fintech‑friendly bank accounts and choosing custodial partners: https://siyahagent.com/programs

- Ongoing advisory on compliance, tax planning and asset protection: https://siyahagent.com/

Internal summary: with Siyah Agents, you combine fintech agility with regulatory safety and strategic oversight.

Practical checklist for entrepreneurs ready to adopt digital banking

- Define your corridors: which currencies and countries are critical?

- Verify platform coverage and test transfers in low value first.

- Prepare KYC and source‑of‑fund documents in advance.

- Adopt strict internal controls for account access and approvals.

- Complement digital banks with a reliable local correspondent bank when needed.

Callout: early testing and proper documentation prevent onboarding delays and operational risk.

Conclusion: act boldly, with counsel

Digital banking is not an optional upgrade — it is core infrastructure for African entrepreneurs operating globally. The right platform reduces friction, saves cost and creates faster, safer routes to scale. But speed must be balanced with governance: regulatory clarity, security and proper structuring matter greatly.

Ready to map your digital banking strategy? Start with Siyah Agents. Book an eligibility assessment and discover fintech‑friendly programmes that match your goals: https://siyahagent.com/assessment Explore our programme options and advisory services at https://siyahagent.com/programs and https://siyahagent.com/

Featured image request: an African entrepreneur using banking apps on multiple devices with a global map in the background.

Sources: McKinsey & Company, Africa Fintech Report 2023; Siyah Agents internal knowledge; World Bank financial inclusion data.