Introduction

Residency by investment remains one of the clearest ways for high‑net‑worth individuals to secure global mobility, lifestyle options and business flexibility. For English‑speaking African professionals and investors, the UAE, Portugal and Malta each present compelling — yet materially different — routes. This guide compares the three programmes side‑by‑side so you can match objectives, costs and risks to your family and investment strategy. All figures should be verified with official sources; regulations and thresholds change frequently.

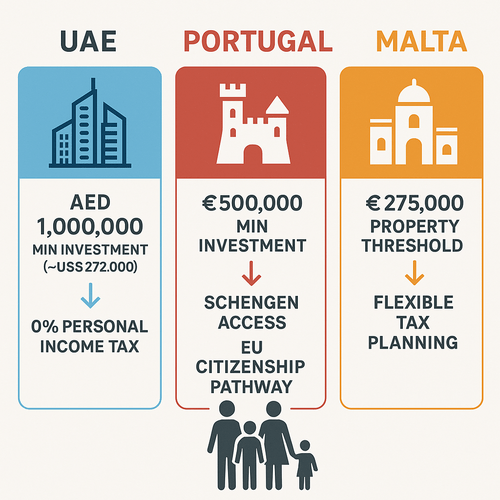

Quick snapshot: What each programme offers

- UAE Golden Visa — long‑term residency in a tax‑friendly, high‑growth Gulf economy, focused on property, business and specialised talent (Government.ae).

- Portugal Golden Visa — European residency with Schengen access and a pathway to citizenship after meeting criteria; historically property‑led (SEF Portugal).

- Malta Global Residence — Mediterranean residency with flexible property options and favourable tax planning possibilities (MaltaResidence.com).

Internal summary: UAE excels on business and tax neutrality; Portugal on EU access and family mobility; Malta on compact EU living and tax structuring.

Programme overviews: the essentials

UAE Golden Visa

The UAE Golden Visa provides multi‑year residency (typically five or ten years depending on the route) for investors, entrepreneurs and certain skilled categories. It emphasises business creation, talent retention and property ownership. The UAE offers a tax‑neutral personal income environment and world‑class infrastructure. According to official UAE guidance, qualifying investments commonly start at AED 1 million in property or equivalent business capital.

Portugal Golden Visa

Portugal’s Golden Visa historically allowed residency for non‑EU investors who made qualifying investments — most commonly real estate. The standard real‑estate route has typically required a minimum investment of €500,000, though reduced thresholds apply to rehabilitation projects or low‑density areas. The scheme is valued for Schengen access and the possibility (subject to meeting residency, language and legal criteria) of applying for Portuguese citizenship after a period. Portugal’s rules have recently evolved; check SEF for current specifics.

Malta Global Residence Programme

Malta provides a residency pathway for third‑country nationals who meet minimum property investment or rental requirements and other fiscal conditions. Typical entry points include property purchase starting around €275,000 (regional variations apply) or long‑term rental with specified annual commitments. Malta emphasises English language use, EU links and competitive tax planning options.

Eligibility: who can apply and what you must show

Core applicant criteria (common across programmes)

- Clean criminal record and comprehensive background checks.

- Proof of legitimate source of funds (bank statements, sale deeds, business accounts).

- Minimum age and capacity to hold property or capital.

- Medical and insurance requirements vary by jurisdiction.

Family inclusion

- UAE: Spouses, dependent children and, in some cases, parents may be included depending on the visa category.

- Portugal: Spouse and dependent children are generally eligible; other dependants may be considered in specific circumstances.

- Malta: Family units (spouse, children and dependent parents) may be included; age cut‑offs and dependency tests apply.

Callout — Practical tip: Early, professional due diligence on source‑of‑fund documentation saves weeks of rework. Siyah Agents’ eligibility assessment can flag issues before you commit: https://siyahagent.com/assessment.

Costs compared: minimum investments, fees and ongoing charges

Costs vary significantly by programme and chosen route. Below are typical entry levels and principal ongoing costs; all figures are indicative and subject to change. Verify with legal counsel and official portals.

- UAE

- Minimum investment: commonly AED 1,000,000 (approx. US$272,000) in qualifying property or business capital (official thresholds vary by emirate and route).

- Fees: government application fees, due‑diligence costs, legal and agent fees.

- Ongoing: property maintenance, utilities, renewal administrative costs; personal taxation is generally nil on income.

- Portugal

- Minimum investment: typically from €500,000 for standard property routes; alternative qualifying options have different thresholds (e.g. reduced amounts for urban rehabilitation or low‑density locations).

- Fees: government application charges, legal fees, property taxes, and renewal costs.

- Ongoing: property upkeep, local taxes, potential tax obligations depending on domicile/residency status.

- Malta

- Minimum investment: property purchase thresholds from around €275,000 (regional variance) or rental options with specified annual commitments.

- Fees: application and admin fees, legal and agent costs, and administrative taxes.

- Ongoing: annual tax obligations (minimum taxable thresholds may apply), property costs, and health insurance.

Internal summary: UAE often demands significant capital but benefits from a low‑tax environment; Portugal requires substantial real‑estate commitment but gives EU access; Malta offers lower property thresholds but with annual tax and administrative expectations.

Lifestyle benefits: how life changes on the ground

UAE: fast, modern, tax‑efficient

- Living standard: High‑end services, modern healthcare and international schools.

- Mobility: Excellent flight connectivity to Africa, Europe and Asia; note the UAE is not in Schengen.

- Tax: No personal income tax (subject to certain exceptions); attractive corporate and wealth structures.

Portugal: relaxed European living

- Living standard: Mediterranean lifestyle, good public healthcare, varied schooling options and a reputation for safety.

- Mobility: Schengen access enables travel across much of the EU.

- Path to citizenship: Possibility of citizenship after meeting residence and legal requirements (check current rules).

Malta: compact and convenient EU base

- Living standard: English widely used; Mediterranean climate and close European ties.

- Mobility: EU access depending on route; efficient connections within Europe.

- Tax: Flexible regimes exist for international residents but require careful planning.

Callout — Family considerations: If EU mobility and education are top priorities, Portugal and Malta may offer clearer long‑term benefits. For immediate tax relief and business access to Middle Eastern markets, the UAE can be compelling.

Risks and practical challenges

- Regulatory change: Programmes are subject to political change. Portugal has revised Golden Visa rules in recent years; similar shifts are possible elsewhere.

- Liquidity and exit: Property markets can be illiquid; weigh holding horizons and exit strategies.

- Compliance scrutiny: Enhanced source‑of‑fund checks and anti‑money‑laundering measures have tightened approval processes.

- Lifestyle fit: High living costs in the UAE and concentrated markets in Malta may not suit every family.

Practical mitigation: Commission market research and legal tax advice before investing; use trusted advisers to manage compliance risk. Siyah Agents’ programmes deliver end‑to‑end handling to reduce operational friction: https://siyahagent.com/programs

Decision framework: choose by priority

- Choose UAE if immediate tax efficiency, high‑quality infrastructure and proximity to African and Asian markets matter most.

- Choose Portugal if EU membership pathways, Schengen mobility and family education options are your priorities.

- Choose Malta if you value a compact EU base, English language convenience and flexible tax planning.

Final internal summary

- UAE: Strong on tax, speed and business environment; less direct EU mobility.

- Portugal: Best for EU access and long‑term family mobility; higher investment thresholds and regulatory evolution to monitor.

- Malta: Attractive EU option with lower property thresholds and tax planning possibilities; smaller market.

Call to action — where Siyah Agents helps you next

Choosing a residency by investment programme is a strategic decision. Siyah Agents offers: a tailored eligibility assessment (https://siyahagent.com/assessment) programme matching and end‑to‑end application support (https://siyahagent.com/programs), plus ongoing advisory (https://siyahagent.com/) Begin with a confidential assessment to identify the right jurisdiction for your profile.

Start today: Book an assessment with Siyah Agents to clarify eligibility, pathways and timelines: https://siyahagent.com/assessment.

This guide is informational and should not be treated as legal, tax or financial advice. Confirm current requirements with official government sources and specialist advisers.