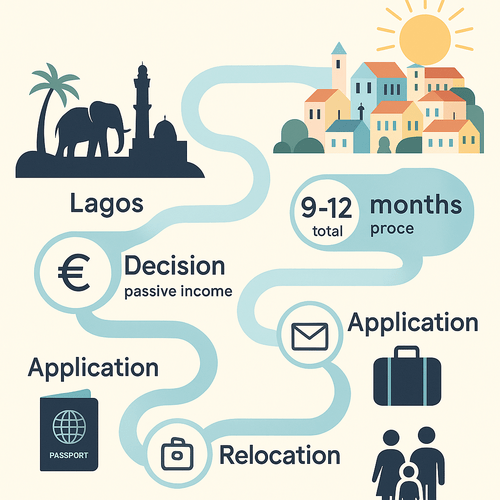

A realistic 12‑month roadmap from Lagos to Lisbon

Introduction: Why the Portugal D7 Visa can change your life

Imagine exchanging Lagos’ intense rhythm for Lisbon’s sunlit squares within 12 months. The Portugal D7 Visa — the passive‑income route — provides a credible path for English‑speaking African professionals, retirees and remote earners to gain EU residency, family stability and long‑term quality‑of‑life benefits. This is a practical, step‑by‑step customer journey: what to do, when, and how you’ll feel at each turning point.

Short takeaway: With verified passive income, meticulous preparation, and the right advisory partner, many applicants move from decision to residence in about a year. Exact timings and requirements vary; verify current rules with specialists.

Why choose the Portugal D7 Visa?

The D7 is attractive because it is income‑based rather than capital‑intensive. Key practical benefits include:

- Schengen mobility: Residency in Portugal opens travel across much of Europe for short stays.

- Family stability: Spouses and dependent children can usually be included on the application.

- Affordable relocation: You can qualify with regular passive income (not necessarily large capital investments).

- High quality of life: Good healthcare, attractive education options, safety and an agreeable cost of living compared with many Western European cities.

This route is especially relevant if your income derives from pensions, rental yields, dividends, or remote work contracts. The D7 Visa thus fits retirees, remote professionals and many passive‑income earners.

Step 1 — Decide and assess readiness (Weeks 0–4)

Bold step: decide why you want EU residency. Your motive (family schooling, healthcare, mobility, lifestyle or diversification) determines timing and document needs.

Next, conduct an eligibility assessment. Siyah Agents’ assessment (https://siyahagent.com/assessment) reviews your income sources, family inclusion needs and potential compliance flags. Typical checkpoints:

- Confirm passive income streams and their stability.

- Check passport validity and basic travel history.

- Identify documents needing apostille, translation or legalization.

Callout — Eligibility quick check: passive income ≈ €820+/month for a single applicant (typical range; check official guidance), more for partners and dependants. Evidence of 6–12 months’ steady receipts strengthens the case.

Step 2 — Plan and gather documents (Weeks 2–12)

Documentation is the backbone of any successful D7 application. Begin early and be rigorous. Your file will typically include:

- Bank statements showing regular passive income (6–12 months).

- Evidence of the income source (pension letters, rental contracts, dividend statements, remote contracts).

- Valid passport and passport‑sized photos.

- Criminal record certificate from current and past residencies.

- Proof of accommodation in Portugal (rental contract or reservation).

- Travel/medical insurance for the initial entry period.

Siyah Agents’ programme guidance (https://siyahagent.com/programs) helps map required documents and arrange certified translations and apostilles. Leaving document collection to the last minute is the most common cause of delay.

Step 3 — Submit your D7 application (Months 3–6)

You apply at the Portuguese consulate or embassy in your country of residence. Typical phases here are:

- Application lodgement: Submit the completed forms and supporting documents.

- Consular interview: Be prepared to explain your income sources and plans in Portugal.

- Decision window: Expect 3–6 months for a consular decision; completeness and clarity reduce follow‑ups.

If approved, the consulate issues a temporary visa that permits entry to Portugal and starts the residency procedure. Siyah Agents manages submissions and liaises with consular teams to reduce administrative friction.

Step 4 — Relocate and register (Months 6–9)

After arrival you must register with Portugal’s immigration service (SEF) to obtain a residence permit. Practical steps include:

- Scheduling a SEF biometric appointment and presenting originals.

- Opening a Portuguese bank account and obtaining a taxpayer number (NIF).

- Securing longer‑term accommodation and enrolling children (if applicable).

Expect the first few weeks to be both energising and administratively busy. Siyah Agents’ relocation support helps with banking, housing searches and school introductions, smoothing the transition so you can focus on settling in.

Step 5 — Settle, enjoy and plan long term (Months 9–12)

With residency in hand, you can enjoy expanded opportunities: European travel for short stays, access to Portugal’s health services, and integration into local life. Consider these priorities:

- Healthcare registration: After obtaining residency, register for access to Portugal’s public health services; private insurance is advisable initially.

- Language and community: Learn Portuguese and join local networks; integration accelerates with language and social ties.

- Financial and tax planning: Understand how residency affects tax status; seek local tax advice.

Emotional checkpoint: The initial months balance exhilaration with small frustrations. Patience, local support and routines (schools, clubs, local services) accelerate the feeling of home.

Documents, timelines and realistic expectations

- Income threshold: Approximately €820+/month for a single applicant; increased amounts for partners and dependants. Verify current thresholds with official Portuguese sources.

- Processing time: 3–6 months at the consulate; additional weeks for SEF and residence card processing. Overall, a 9–12 month timeline is realistic for complete relocation.

Evidence note: Rules and thresholds evolve. All figures here are typical ranges; confirm specifics with Siyah Agents and official government guidance.

Common hurdles and how to handle them

- Incomplete documentation: Use a checklist and expert review to avoid missing apostilles or translations.

- Delays in consular appointments: Book early; consulates have seasonal demand.

- Housing search from abroad: Consider short‑term lets on arrival while searching for longer‑term accommodation.

Siyah Agents’ end‑to‑end assistance anticipates these issues — document checks, appointment booking and local partner introductions minimise unexpected obstacles.

Life after the D7: mobility, family and quality of life

The practical outcomes that make the effort worthwhile include:

- Schengen travel flexibility for short stays across much of Europe.

- Family stability: Spouse and dependent children gain residence rights and access to education.

- Lifestyle improvements: High‑quality healthcare, diverse education options and an attractive work‑life balance.

For many migrants, the real benefit is optionality — the freedom to choose where to live, study and work within the EU‑area.

Internal summary: the 12‑month roadmap at a glance

- Month 0: Decision and eligibility assessment — start with Siyah Agents’ assessment (https://siyahagent.com/assessment).

- Months 1–3: Gather documents, procure translations and apostilles, and prepare the application.

- Months 3–6: Apply at the consulate; attend interview; await decision.

- Months 6–9: Travel to Portugal; register with SEF; arrange banking, housing and schooling.

- Months 9–12: Settle in, register for healthcare, learn the language and build community.

Quick callout: Focus on consistent, well‑authenticated proof of passive income — it’s the single most significant factor in a smooth application.

Take the next step with Siyah Agents

If the Portugal D7 Visa aligns with your goals, start with a confidential eligibility assessment. Siyah Agents offers tailored guidance on documentation, consular strategy and relocation logistics, reducing stress and accelerating outcomes. Begin your transformation:

- Book an eligibility assessment: https://siyahagent.com/assessment

- Explore Siyah Agents’ D7 support programmes: https://siyahagent.com/programs

Ready to make Lisbon home? With the right planning and support, Lagos‑to‑Lisbon in 12 months is achievable, and Siyah Agents can guide every step.

This article provides general information and should not be treated as legal, tax, or medical advice. Verify current rules with official sources and consult qualified professionals for personalised guidance.